The effect of parent job loss on health insurance coverage of children

advertisement

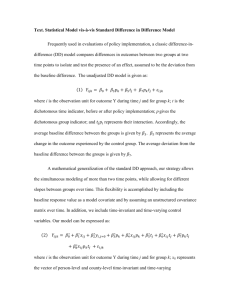

The effect of parent job loss on health insurance coverage of children Susan Busch Partha Deb William Gallo Yale University Background • The U.S. economy lost 2.6 million jobs in 2008, with at least another 1.5 million in 2009 • Most displaced workers spend some time unemployed – reduced income – severance of non-pecuniary benefits (e.g., health insurance) • Adults often lose health insurance coverage as a result of job loss (Gruber, 1997 etc.) Background: children’s coverage • Little information on the effects of parent job loss on children’s coverage • Children may: – Lose employer sponsored insurance (ESI) – Lose coverage through private individual market (if premiums become unaffordable) – Gain ESI coverage through spouse – Enroll in public insurance programs, which are now available at higher income levels • Job loss is a trigger event for changes in children’s health insurance coverage (Czajka and Olsen, 2000) – Does not distinguish voluntary from involuntary job changes Objective • To examine changes in the insurance status of children whose parents experience involuntary job loss • We examine both: – For those children insured at time of job loss, may lose coverage – For those children uninsured at time of job loss, may fail to gain coverage Data: Medical Expenditure Panel Survey • • • • • Nationally representative household survey 2.5 year panel survey (5 waves) Approximately 18,000 individuals each cohort We consider two panels (2004-2006) Includes monthly information on insurance coverage • The subsample we consider are children less than 19 years of age with at least one employed parent at baseline Study Design • Exploit the longitudinal nature of the MEPS, and examine changes in insurance status for children post parent job loss • Our outcomes of interest are coverage 6 and 12 months post job loss • Transitions in and out of coverage may occur in the absence of job loss • Children with parents employed at baseline with no job loss are used as a comparison group – We randomly assign a ‘job loss’ date to children in comparison group • Adjust for weighting and complex sampling structure of MEPS • Use logistic regression to predict insurance coverage Measures • Involuntary Job loss. Self-report of loss of main job due to plant closing, business sale or layoff (measured at each wave) – Parent must be employed at baseline (wave 1) – We consider job losses between waves 1 and 3 to ensure sufficient follow-up – Precise date of job loss known – In some analyses we consider only individuals who lost their job due to plant closing or business sale (reduces concerns about selection) • Insurance status. Private, public and uninsured • Control variables. Job tenure (# years), age, self reported health status; cohort/panel; single parent; five income categories Any insurance coverage (adjusted), all children (N=7241) Baseline Month Month 6 12 (%) (%) (%) Children experiencing parent job loss Children not experiencing parent job loss 90 81 84 89 89*** 88* Any Insurance coverage (adjusted), children insured at baseline Baseline (%) Month 6 (%) Month 12 (%) Job loss 100 87.9 88.8 No job loss 100 97.0*** 94.9*** Job loss 100 88.7 86.7 No job loss 100 98.1*** 96.8*** Job loss 100 87.3 90.8 No job loss 100 94.4* 90.7 Children Insured at Baseline Privately insured at baseline Publicly insured at baseline Any Insurance, Children Uninsured at Baseline (%) Month 6 (%) Month 12 (%) Job loss 0 29.6 39.7 No job loss 0 24.0 35.3 Baseline Children Uninsured at Baseline Results • Among children who were insured in the month of job loss, significantly fewer are insured six months later (88 versus 97 %) • We find no significant change in public coverage rates in either group at 12 months; entire decline is for private insurance • Among children who were not insured in the month of job loss, children in job loss group may be more likely to gain coverage • Robust to limiting to just business sold or plant closings Limitations • We have a relatively small sample of job losers, so it is difficult to do sub-analyses • Would like to follow children for longer than 12 months • Differences in labor market may affect estimate (especially to the extent it takes longer to regain employment) • Do not know the effects this uninsurance has on children or their families Discussion • COBRA health benefit provisions and the nongroup market are unaffordable to many families. • Administrative mechanisms related to unemployment insurance may be used to extend coverage to job losers – The efficiency of extending coverage through an existing infrastructure may make the idea more attractive to policymakers • Because the risk of job loss is greatest during economic downturns there is presently a window of opportunity to increase public support for legislation that includes this population as part of a broader reform proposal Conclusion/Future Work • By adding additional MEPS cohorts, we hope to examine the specific types of coverage lost/gained • Additional analyses will examine whether these effects result in declines in health status and the receipt of necessary care Rates of private and public coverage (adjusted) Baseline (%) Month 6 (%) Month 12 (%) 61 58 45 58*** 47 57*** 25 26 23 25 25 25 Privately insured Job loss No job loss Publicly insured Job loss No job loss