Medical Expenditure Burdens: The Impact of Tax Subsidies, Within-Year Expenditure

Medical Expenditure Burdens: The Impact of Tax Subsidies, Within-Year Expenditure

Concentration, and More

Thomas M. Selden

Division of Modeling & Simulation

Center for Financing, Access and Cost Trends

Why Study Burdens?

Most families healthy in given year

Illness, however, is a fact of life

Medical bills pour in just when families must grapple with illness, seeking care, care-giving, and possibility reduced earnings

Accurate burden measurement a key ingredient for sound public policy

Data

Medical Expenditure Panel Survey (03&04)

<65 population

– Medicare Part D

Conventional 20% Burden Measures

(OOP Care + OOP Prem > .2*Y Disp )

25

20

15

20.9

10

7.3

5

0

Poverty Level

*Essentially same as Banthin&Bernard (JAMA 06)

All

0-100

100-200

200-300

300-400

400-600

>600

Annual 20% Burdens vs. Self-Reported

“Bill Problems”

Adults Age 19-64 in 2003

50

45

40

35

30

25

20

15

10

5

0

MEPS

>20% Burden

Commonwealth

Fund

"Bill Problems"

“Bill Problem” Responses Might

Reflect Lower Thresholds

30

25

20

15

10

5

0

50

45

40

35

>40%

>15%

>5/10%

MEPS

>20%

>10%

>5%

"Bill Problem"

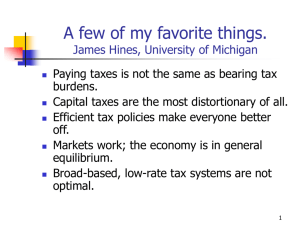

3 Refinements

Impact of tax subsidies

Intra-year burdens

Burden of uncompensated care

None previously studied

Impact of Tax Subsidy

Summary

Tax subsidies modestly reduce burdens

– Especially subsidies for premiums

Lowers burden prevalence (7.3% to 6.2%)

Little benefit for poor

The Impact of Within-Year Expenditure

Concentration

Within-Year Family Expenditure

Concentration

50

40

30

20

10

0

1 2 3 4 5 6 7 8 9 10 11 12

Ranked Months

Total Out-of-Pocket

Note: Families with zero expenditures excluded

Peak Month as Percentage of Annual

Total, by Poverty and Expenditure

70

60

50

40

30

20

10

0

<1

00

10

0-2

00

20

0-3

00

30

0-4

00

40

0-6

00

>6

00

Poverty Level

Total Out-of-Pocket

70

60

50

40

30

20

10

0

<1

K

1K

-5

K

5K

-1

0K

Total Expenditure

Total Out-of-Pocket

>1

0K

Intra-year Burdens?

Precautionary savings are low

– 24% of bottom quintile have assets no liquid

– Median among those with assets=$600

Earnings down when expenditures spike

– Expenditure spikes play larger role

Within-Year Burdens (20%)

25

20

15

10

5

0

50

45

40

35

30

15.5

6.3

25.7

A ll

36.3

42.7

20.5

1.1

0-1

00

10

0-2

00

20

0-3

00

30

0-4

00

40

0-6

00

>6

00

Annual Quarterly Monthly

Burden of Uncompensated Care

Uncompensated Care

CWF “bill problem” includes inability to pay

UC can indeed be burdensome

– Medical debt

–

–

–

–

Credit problems

Access problems

Stigma

All ignored by conventional burden analyses

Not observed, but…

– WTP (avoid UC burden) < UC

Bounding 20% Annual Burdens for Uncompensated Care

30

25

20

15

10

5

0

ALL

Upper Bound

Lower Bound

Monthly Burdens (20%)

60

50

40

30

20

10

0

ALL

Upper Bound

Lower Bound

UC Conclusions

Modest increase in prevalence

– Families “pay until it hurts”

Concentrated among poor

Importance of measuring medical debt

Monthly UC-adjusted burdens approach

“bill problem” frequency

– 29% versus 32% among adults in 2003

Conclusions

Tax subsidies modestly reduce burdens

– Mostly among middle income

Narrowing “budget window” increases burden prevalence, especially among poor

UC modestly increases burden prevalence, again mostly among poor

Refinements greatly increase regressivity

Type of Service Distribution in

High-Burden Month

100%

80%

60%

40%

20%

0%

A

LL

<1

00

10

0-2

00

20

0-3

00

30

0-4

40

00

0-6

00

>6

00

*Conditional on having 20% burden

HOSP

ER

AMB&OTH

DENT

RX

PREMIUM