Health Insurance Markets & Managed Care

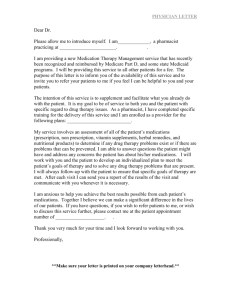

advertisement