Impact of Prescription Drug Coverage on Medicare Program Expenditures:

advertisement

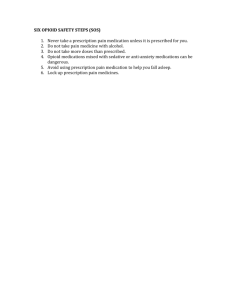

Impact of Prescription Drug Coverage on Medicare Program Expenditures: Will Part D Produce Savings in Part A and Part B? Bruce Stuart, PhD* Becky Briesacher, PhD,**, Jalpa Doshi, PhD,*** Marian Wrobel, PhD,**** Fatima Baysac, MHS* (* University of Maryland Baltimore, **UMASS, ***University of Pennsylvania, ****Abt Associates) AcademyHealth San Diego, June 7, 2004 The Belief “Drug coverage under Medicare will allow seniors to replace more expensive surgeries and hospitalizations with less expensive prescription medicine.” President George W. Bush upon signing the Medicare Modernization Act, December 8, 2003 Why it Matters • Prescription drug expenditure trends – Drugs represent the fastest growing service segment in the past half decade and for the next decade to come – Potential for significant cost offsets puts this trend in a much more favorable light • Cost offsets as a marker for real improvements in health – If drug coverage improves medical management then the impact should be reflected in savings elsewhere in the system • Stand-along drug plans under Part D – Medicare plans have financial incentives to keeps drug costs low – Tracking cost offsets is a way to monitor unintended consequences of plan behavior The Theory • Prescription drugs are normal goods… – As price goes down demand goes up – Insurance lowers price so quantity demanded should rise • As the price of a substitute goes down… – Quantity demanded goes down – If drugs substitute for hospitalization, then prescription coverage should reduce Medicare Part A spending • As the price of a complement goes down… – Quantity demanded goes up – If physician services are a complement for prescription drugs, then prescription coverage should increase spending for Part B The Evidence • Clinical trials – Comparing new drugs to placebo on utilization end points – 1000s of published studies – Evidence of savings commonplace • Natural experiments – Track health care spending following changes in drug coverage – Studies limited mainly to small changes in copays, mostly for poverty populations • Non-experimental observational designs – Lichtenberg’s analyses of new versus old drugs – Gillman et al. study of the Vermont pharmacy assistance program Lessons from the Evidence • Clinical trials – Limited to new products tested on nonelderly populations with short observation periods – High internal validity/low generalizability • Natural experiments – No “experiment” comparable to Medicare Part D (or any other comprehensive drug plan)/poor generalizability – Difficulty in finding appropriate control populations • Non-experimental observational designs – Poorly matched controls – Selection bias • Conclusion from the evidence – The only way to adequately test the cost-offset hypothesis is through large-scale population-based observational studies using appropriate matched populations with and without drug coverage that demonstrably control for selection bias Testing the Cost Offset Hypothesis • Data – MCBS 1999 and 2000 • Sample – 2-year panel of 3,365 beneficiaries (2,603 with and 762 without prescription coverage) – Inclusion criteria: continuous Part A and B coverage, continuous Medicare supplement, and continuous (or no) drug benefits – Exclusions: LTC facility residents, M+C enrollees, decedents, • Dependent variables – Annual 2000 expenditures for drugs, Medicare inpatient hospital, physician services, all Part A and B combined Testing the Cost Offset Hypothesis • Explanatory variables – Prescription coverage status (continuous from any source or none) – Age, gender, SSDI disability status – Predicted Medicare spending in 2000 based on DCG/HCC values generated from 1999 claims data • Statistical Procedures – Propensity score weighted comparison of mean spending levels between those with and without prescription coverage – GLM regression with gamma distribution and log link – Sensitivity tests for excluded populations • Test for Selection – Durbin-Wu-Hausman specification test for omitted variables Study Findings • Sample composition – Substantial differences between population samples with and with prescription benefits (shows need to control for selection) • Differences in annual spending – Insured sample had higher spending in all categories – After propensity weighting, only drug spending was found to be significantly higher among insured beneficiaries (same for regression analysis) • Test for selection and sensitivity to sample restrictions – Negative DWH finding when DCG/HCC variable in the models – Sensitivity tests confirm general findings for excluded populations Study Findings Annual expenditures (2000) Prescription drugs Sample with drug coverage $2,074 Sample without drug coverage $1,068 Inpatient hospital $2,099 $1,835 Physician services $1,537 $1,243 All Part A and B $4,952 $3,899 Study Findings: Adjusted versus Unadjusted Differences (*=p<.05) Annual expenditures (2000) % difference for sample with coverage (unadjusted) % difference for sample with coverage (propensity adjusted) Prescription drugs 94%* 66%* Inpatient hospital 14% -14% Physician services 24%* 8% All Part A and B 27% -2% Implications for Policy • No evidence for cost offsets to prescription coverage – Failure to find savings associated with relatively generous coverage (about 70% of drug costs paid by 3rd parties for our sample) means that the much less generous Part D benefit is unlikely to generate savings in Parts A and B • Study limitations – Usual caveats on drawing causal inferences from observational designs – Propensity weighting equates samples on all matching variables but restricts generalizability to those in the middle of the propensity range – Heterogeneity in drug coverage limits generalizability to specific types of coverage • Future work – Focus on medication-sensitive diseases (diabetes, hypertension, heart disease, mental illness, and chronic lung disease) – Focus on drug benefits designs with medication management programs