Medicare & Medicare Prescription Drugs

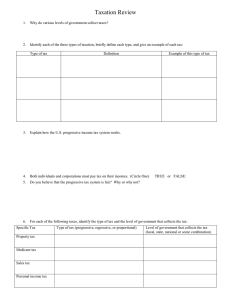

advertisement