LEVERAGING OUR CORE EXPANDING

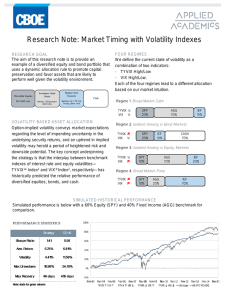

advertisement