Distributed Information Management System Using FIBO to Analyze and Manage Risk

advertisement

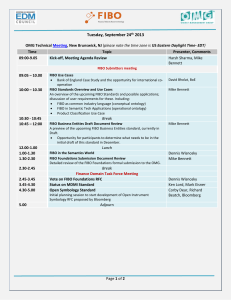

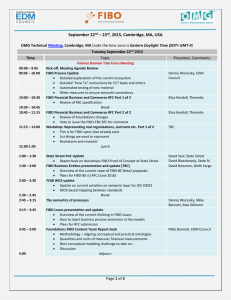

Distributed Information Management System Using FIBO to Analyze and Manage Risk Michael Lang, David Schaengold, EDMC, March 2012 Agenda Background on a Distributed Information Management System (DIMS) – How does semantics deal effectively with highly distributed data? Demo ‐ Financial Services use case – Classifying Interest Rate Swaps with distributed data, rules and inference – Assessing risk across LEIs Data Sources FactSet provided excellent data on Legal Entity Structures Open Finance provided excellent data on swap instruments EDMC provided the Financial Instrument Business Ontology (FIBO) Thanks to all! Semantic Technology Anyone can say Anything about Anything Standards URI/URL - the universal identification and location scheme RDF – basic description language and data model OWL – the logic based description language - FIBO SPARQL - the query language for the RDF data model RIF – RDF based rules language Benefits URIs give universal identifiers (non-local) identifiers to “things” RDF is schema-less; extensibility is not an issue SPARQL - defines federation capabilities OWL – combines data, metadata and logic RIF – Rules Language (close up the open world) Assessing Risk We need to classify all instruments by type so aggregated exposure can be calculated – This is tricky for swap instruments as the contracts can vary We need to calculate total risk for all counterparties by type of instrument – The web of corporate relations can be difficult to navigate, but can be determined and integrated – We need to classify legal entities by type The Last Forty Years Siloed Information Management Systems All data in a single shared databank ● Rigid schemas, resistant to change ● Data and metadata are different things ● Query processor only knows about its local data expressed in a fixed schema ● Excellent ACID / CRUD capability ● Very difficult to use for comprehensive analytics ● The Next Forty Years The information management technology for the next forty years will all rest on precise, formalized descriptions of “things” • • • • Schema Data Mappings Provenance • • • • Rules Locations of data Logic Processes Anyone can say Anything about Anything The Next Forty Years Distributed Information Management Systems • Data, metadata, and logic ‐ everywhere • all of it will be discoverable & machine readable • Extensibility ‐ constant change is assumed • Provenance – all data can found and used properly • Reasoning and inference (rules and logic) • Emergent Analytic capability IT infrastructure is going to get smart Distributed Information Management System Assessing Risk We need to classify all instruments by type so aggregated exposure can be calculated – This is tricky for swap instruments as the contracts can vary We need to calculate total risk for all counterparties by type of instrument – The web of corporate relations can be difficult to navigate, but can be determined and integrated – We need to classify legal entities by type Rules and Inference 1‐ In order to determine the types of swaps: – Write FOL rules to say precisely what collection of properties each type of swap must have – Evaluate all of the properties of each instrument according to each rule – Assert the type 2‐ Follow the same procedure for classifying legal entities Some rules are in FIBO, some are external Our Solution Distributed Information Management Systems (DIMS) enables a new enterprise management paradigm • Assumes enterprise data is widely distributed • Assumes change is constant • Meanings and locations are computer readable and easily interpreted by humans • The provenance of all information in the enterprise is described and understood by the IT infrastructure • Enables a truly agile analytic capability • Enables enterprise‐wide Governance, Risk, and Compliance • Provides sophisticated knowledge management The Shift is On Distributed Information Management System Emergent Analytics is available now Questions Revelytix.com for additional information Thank You