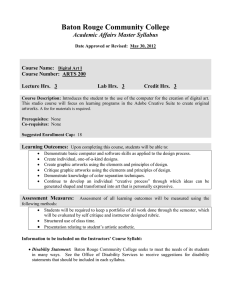

Baton Rouge Community College Academic Affairs Master Syllabus

advertisement

Baton Rouge Community College Academic Affairs Master Syllabus Date Approved or Revised: March 1, 2012 Course Name: Entrepreneurial Finance Course Number: FINA 252 Lecture Hrs. 3 Lab Hrs. 0 Credit Hrs. 3 . Course Description: Provide the student with a basic knowledge of the financial requirements for starting, sustaining and growing a privately held business. Prerequisites: BUSN 110 and CSCI 190 and FINA 150 and ACCT201 or ACCT 203 Co-requisites: None Learning Outcomes: Upon completion of this course, the successful students will be able to: 1. Describe the process in which new business ventures are created. 2. Identify the financial aspects of the decision making process and day-to-day operations of a business. 3. Distinguish the various debt and equity sources of financing available to new and growing businesses. 4. Apply the mechanics of cash flow and pro forma logic to income statement and balance sheet construction and analysis. 5. Distinguish appropriate tools for measuring and evaluating financial performance. 6. Recognize local, regional, national and global resources utilized by successful entrepreneurs. Assessment Measures: Instructors may use a variety of assessment measures to assess student performance. But, the following assessments will be used in all sections: 1. Homework, projects, presentations, and/or class work. 2. Exams and/or quizzes. 3. Common questions will be administered by all sections of the course at the end of the semester assessing the student's knowledge of the learning outcomes. Information to be included on the Instructors’ Course Syllabi: Disability Statement: Baton Rouge Community College seeks to meet the needs of its students in many ways. See the Office of Disability Services to receive suggestions for disability statements that should be included in each syllabus. Grading: The College grading policy should be included in the course syllabus. Any special practices should also go here. This should include the instructor’s and/or the department’s policy for make-up work. For example in a speech course, “Speeches not given on due date Page 1 of 2 will receive no grade higher than a sixty” or “Make-up work will not be accepted after the last day of class.” Attendance Policy: Include the overall attendance policy of the college. Instructors may want to add additional information in individual syllabi to meet the needs of their courses. General Policies: Instructors’ policy on the use of things such as beepers and cell phones and/or hand held programmable calculators should be covered in this section. heating and Plagiarism: This must be included in all syllabi and should include the penalties for incidents in a given class. Students should have a clear idea of what constitutes cheating in a given course. Safety Concerns: In some programs this may be a major issue. For example, “No student will be allowed in the safety lab without safety glasses.” General statements such as, “Items that may be harmful to one’s self or others should not be brought to class.” Library/ Learning Resources: Since the development of the total person is part of our mission, assignments in the library and/or the Learning Resources Center should be included to assist students in enhancing skills and in using resources. Students should be encouraged to use the library for reading enjoyment as part of lifelong learning. Expanded Course Outline: Part I: INTORDUCTION AND OVERVIEW • From the Idea to the Business Plan. • Financial Aspect of the Business Plan. • Identifying Resources PART II: ORGANIZING AND OPERATING THE VENTURE. • Organizing a New Venture. • Financing a New Venture. • Financial Systems / Operations • Measuring Financial Performance. • Evaluating Financial Performance. PART III: PLANNING FOR THE FUTURE. • Financial Planning: Short Term and Long Term. • Types and Costs of Financial Capital. • Legal Considerations When Obtaining Venture Financing. PART V: STRUCTURING FINANCING FOR THE GROWING VENTURE. • Professional Venture Capital. • Other Financing Alternatives. • Security Structures and Determining Enterprise Values. PART VI: EXIT AND TURNAROUND STRATEGIES. • Harvesting the Business Venture Investment. • Turnaround Opportunities Page 2 of 2