Slides to Lecture 1 of Introductory Dynamic Macroeconomics

advertisement

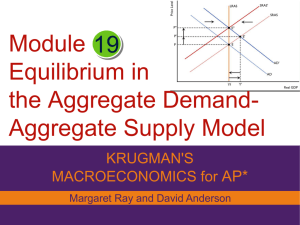

Short overview Slides to Lecture 1 of Introductory Dynamic Macroeconomics 1. ’Statics and dynamics’ Concepts and definitions. 2. Dynamic analysis Models and methods. 3. Wage-price dynamics (a dynamic view at the supply-side of macro models) Ragnar Nymoen University of Oslo, Department of Economics 4. Macro dynamics. • Review of demand side (closed economy); Role of asset markets • Stabilization policy, rules versus discretion August 17, 2007 • Open economy AS-AD model. Short-and long run. • Foreign exchange market. Regime dependency. • Current monetary policy 1 1 Consult (frequently!!) the detailed plan at http://folk.uio.no/rnymoen/ECON3410 h07 index.html which is the workpage of the course. You can access the workpage from the Department of Economics web page for ECON 4410. 2 ‘Statics and dynamics’, an introduction Economic agents typically take time to adjust their behaviour to changes in circumstances–because of habits, learning, norms and other institutions (for example annual wage setting). Instantaneous adjustment is the exception in economics. Adjustments lags represent the rule. At the aggregate (macro) level: a shock typically affects the economy several periods after the it first occurred–the effects of a shock are dynamic. Expectations: Backward-looking expectations are another explanation of lags Forward-looking expectations sometimes creates a particular form of dynamics: large adjustments first (“over-shooting”), then more gradual adjustment. 3 4 Time lags as a premise for decision making. Norges Bank [The Norwegian Central Bank] is typical of many central banks’ view: By the way, before it was changed in the summer of 2004, the same passage on Norges Banks internet pages read: “Monetary policy influences the economy with long and variable lags. Norges Bank sets the interest rate with a view to stabilizing inflation at the target within a reasonable time horizon, normally 1-3 years” “A substantial share of the effects on inflation of an interest rate change will occur within two years. Two years is therefore a reasonable time horizon for achieving the inflation target of 2 12 per cent.” Hence policy decisions–meaning interest rate setting–is based on Norges Banks beliefs about the dynamic nature of the monetary transmission mechanism. Taken at face value, this shows that Norges Bank’s belief/model of the transmission mechanism changed in the summer of 2004. Later in the cause we will be able to assess the likely impact of such a change on policy decisions! In economics, beliefs means models, implicit or explicit. Hence, the statement illustrates two theses: policy is model based, and policy models are dynamic. 5 6 A static model A static demand schedule, by definition: Definition: ‘statics and dynamics’ Formal Dynamic analysis in economics is a relatively new invention. It all began with Ragnar Frisch who worked intensively with the foundations of the discipline he dubbed macrodynamics in the early 1930s. His definition of dynamics is: A dynamic theory or model is made up of relationships between variables that refer to different time periods. Conversely, when all the variables included in the theory refer to the same time period (or, more generally, the model is conceptualized without time as an entity), the system of relationships is static. Xt = aPt + b + εd,t, with a < 0 and b > 0 as parameters. The thre variables: X and P,and εd (denoting a random demand shock) are all provided with time subscript t. t might represent for example a year (the time period is annual); or a quarter (the period is quarterly); or month (the period is monthly). In theoretical models we usually set t = 0, 1, 2, ....T . Where t = 0 is referred to as the initial period and T the terminal period. Sometimes though, the terminal period is not specified, so we write t = 0, 1, 2, ..... In empirical models, t refers to calendar time periods: years, quarter, months for example. 7 8 If we supplement the demand equation with a static supply equation, we obtain the static marked equilibrium model Xt = a Pt + b + εd,t, demand, and εs,t Supply shocks 0.01 0.00 <0 Xt = c Pt + d + εs,t, >0 supply. determining the endogenous variables Xt and Pt for known values of the exogenous variables εd,t and εs,t (and fixed and known values of the 4 parameters a − d). We assume that εd,t and εs,t are random variables. Their role is to represent shocks, or in Frischean terminology, impulses to the system. We do not need to be specific about the distribution of εd,t and εs,t: but if it might be helpful to fix ideas to think of them as normally distributed with zero mean and a constant variances. -0.01 0 75 20 40 60 80 100 120 140 time Density 50 25 -0.0175 -0.0150 -0.0125 -0.0100 -0.0075 -0.0050 -0.0025 0.0000 0.0025 0.0050 0.0075 0.0100 0.0125 0.0150 0.0175 Figure 1: Example of normally distributed supply shocks. 9 Pt 10 Nature of exogenous variables Later in the course we will also introduce exogenous variables with a non-zero average and with a deterministic component. Demand curve (average position) P1 Supply curve (average position) C B D Such variables are exogenous economic explanatory variables. P0 A They may be determined on the world marked, or controlled by the government for example. But for the time being, in order to discriminate clearly between static and dynamic models, it is convenient to only use purely random exogenous variables. X1 X0 Xt Figure 2: A static marked equilibirum model. IDM fig 1.1. 11 12 Static marked equilibrium model Characteristics of a static model Static marked equilibrium model 1.00 0.03 market price Dynamic multipliers net demand shock 0.02 The whole effect of a shock is contained in the equilibrium values of P and X in the period of the shock. 0.75 0.01 0.50 0.00 0.25 There are no spill-over effects of a shock in period t = 1 to period 2, 3, and later periods -0.01 10 20 30 40 50 Dynamic marked equilibrium model 0 1.0 0.050 10 15 20 Dynamic multipliers market price We say that impulses in period 1 are not propagated to later periods 5 Dynamic marked equilibrium model net demand shock 0.5 0.025 • The time series of Pt (and Xt) are perfect mirror images of the shocks εd,t and εst. Fig 3 a). 0.0 0.000 -0.5 -0.025 10 • The sequence of dynamic multipliers, for example ∂Pt/∂εs,1 (t = 1, 2, 3...) are zero, expect for ∂Pt/∂εs,1. Fig 3 b) 13 20 30 40 50 0 5 10 15 20 Figure 3: Static model and dynamic (cobweb) model. IDM fig 1.2. 14 Let t = 0 denote the initial situation with εs,0 = 0. According to the dynamic model, supply in period t = 1 is given by A dynamic model (cobweb) Xt = a Pt + b + εd,t, demand, and <0 Xt = c Pt−1 + d + εs,t, >0 supply. The only change is in the supply equation, where Pt−1 replaces Pt. By Frisch’s definition the supply equation is now dynamic, since the relationship is in terms of variables from different time periods. This is a seemingly trivial change in specification. But it affects both the economic interpretation and the propagation of shocks fundamentally. Interpretation: In some markets supply is fixed in the short-run. No matter how high or low the price is in the current period, the supply of the good is ‘frozen’ by decisions of the past. Classic example: agricultural products such as pork and wheat. 15 X1 = cP0 + d. Supply in period 1 is a function of P0 which is pre-determined from history, and not the price in period 1. The supply in period 1 (short-run supply) is thus completely inelastic with respect to the price, P1. Pt−1 is therefore called a pre-determined variable. The parameter c is thus not a short-run slope coefficient in the way is was in the static model, instead it gives the response of supply to a lasting change in price. We define c as the long-run slope coefficient, for the stationary relationship X̄ = cP̄ + d, where are stationary values of supply and price (Xt = Xt−1 = X̄ and Pt = Pt−1 = P̄ ) 16 Xt = c Pt−1 + d + εs,t, Pt “Short-run” and “long-run” are not absolute terms, is relative to the modelspecificatin. Here, with Long-run supply curve supply. >0 we only have to wait one period to see the full response of a price change in period t on supply. Xt does not change, but Xt+1 changes with derivative coefficient c. Demand curve (average position) B P1 D A P0 Supply is elastic with a one period lag. In other modes this will be different, typically the response is more sluggish. C P2 But even this simple case of one-period supply lag has a large impact on the behaviour of the equilibrium values of price and quantity, compared to the static model. To see how, assume that the initial period is also a stationary situation, with X0 = X̄ and P0 = P̄ , and εd,0 = εs,0 = 0. X0 X2 Xt Figure 4: The cobweb model. IDM fig 1.3 Then, consider a demand shock in period 1: εd,1 > 0. 17 Static marked equilibrium model 18 Characteristics of dynamic models Static marked equilibrium model 1.00 0.03 market price Dynamic multipliers net demand shock 0.02 The whole effect of a shock is no longer contained in the equilibrium values of P and X in the period of the shock. 0.75 0.01 0.50 0.00 There are spill-over effects of a shock in period t = 1 to period 2, 3, .... 0.25 -0.01 10 20 30 40 50 Dynamic marked equilibrium model 0 1.0 5 10 15 20 Dynamic marked equilibrium model 0.050 Impulses in period 1 are propagated to later periods Dynamic multipliers market price net demand shock • The time series of Pt (and Xt) are not perfect mirror images of the shocks εd,t and εst. 0.5 0.025 0.0 0.000 -0.5 -0.025 10 20 30 40 50 0 5 10 15 20 • The sequence of the dynamic multipliers, for example ∂Pt/∂εd,1 (t = 1, 2, 3...) are generally non-zero, but may approach zero for large values of t, if the dynamics is stable. Figure 5: Copy of figure 3: Static model and dynamic (cobweb) model. • Dynamics is a system property : even if only a single relationship in system is dynamic, the response of the whole system is affected (in general) 19 20 Dynamic market equilibrium model, habit formation. Another example: effects of habit formation. 1.00 0.050 market price Dynamic market equilibrium model, habit formation. net demand shock dynamic multipliers 0.75 0.025 0.50 Xt = aPt + b1Xt−1 + b0 + εd,t, demand and Xt = c0Pt + c1Pt−1 + d + εs,t.supply The demand function is now a dynamic equation. The parameter b1 instead measures by how much an increase in Xt−1 shifts the demand curve. This can be rationalized by habit formation, in which case we may set 0 < b1 < 1. 0.000 0.25 -0.025 10 20 30 40 Dynamic market equilibrium model, cobweb. 50 1.0 0 5 10 15 Dynamic market equilibrium model, cobweb. 0.050 20 Dynamic multipliers market price net demand shock 0.5 0.025 In any given period, Xt−1 is determined from history and cannot be changed. Hence in this model there are two pre-determined variables: Pt−1 and Xt−1. 0.0 0.000 -0.5 -0.025 The supply equation is a generalization of the cobweb model, with supply showing some within-period response to a price change (coefficient c0). 10 20 30 40 0 50 5 10 15 20 Figure 6: Two dynamic models. IDM fig 1.4. 21 22 The short-run and the long-run The cobweb model and habit model are both dynamic. In the static model, the full effect of a shock on the endogenous variables were reached in the same time period as the shock. But their bproperties are different: • Cobweb model amplifies shocks, the habit model dampens shocks (compare panel c) and a)) The telling difference is that in the two dynamic models, the endogenous variables’ response to shocks were not instantaneous, and the system took several periods to adjust to a shock in period t. • Dynamic multiplier: changing signs (‘pork cycles’), and geometrically declining (habit formation) The exact shapes of the responses, which we dubbed dynamic multipliers above, depend on the detailed model specification. The two model illustrates some of the capability of linear systems of equations to represent many quite different dynamic behaviour of economic variables. 23 We draw from this that static models as a framework for analysis, is best suited when the speed of adjustment of the variables are so fast that we can ignore that ‘actually’ there is some time delay between the impulse (or shock) and the response. 24 Frisch: “Hence it is clear that the static model world is best suited to the type of phenomena whose mobility (speed of reaction) is in fact so great that the fact that the transition from one situation to another takes a certain amount of time can be discarded. If mobility is for some reason diminished, making it necessary to take into account the speed of reaction, one has crossed into the realm of dynamic theory.” The choice between a static and a dynamic analysis will therefore vary from application to application: Sometimes it might be a good simplifying assumption that there is a high speed of reaction to impulses. Nut typically, a more realistic assumption to make is that there is a moderate or even long response lag. It is a paradox that phenomena which in an everyday meaning of the word are really dynamic, with lots of volatility, as for example the market for foreign exchange, can be analyzed scientifically with a static framework; ....at least as a first approximation, which brings out that the choice between static and dynamic analysis may also be relative to the level of ambition of our study, and to the time and other resources available for modelling 25 Another example of the “relativism” of the static vs dynamic approaches: The intellectual rationale for the IS-LM model is that we think it captures some really important and dominant aspects of the macroeconomy over a period of 1-2 years for example. This does not deny that for example fiscal policy stimulus have effects beyond that short horizon. The static IS-LM model by definition cannot help us in the modelling of those effects, which therefore remain beyond the scope and ambition of the IS-LM based analysis. One of the goals of our course is to extend the analysis of monetary and fiscal policy into the realm of dynamic theory. 26 However, apart from resource constraints and a need to simplify, the scales are tilted in the favour of dynamic models in macroeconomics: Frisch: “In real life both inertia and friction act as a brake on speed of reaction”. Frisch also noted that “The static theory’s assumption regarding an infinitely great speed of reaction contains one of the most important sources of discrepancy between theory and experience.” Therefore Frisch anticipated the increased use of dynamics in economics–it would increase the degree of realism and scope of macroeconomic analysis. 27 28 Short-run and long-run models However, there is also another, quite different, interpretation of static models which will figure prominently in this course. It is that static equations express what the dynamic model would correspond to in a counterfactual situation where no shocks, impulses or changes in incentives occurred. Recall the model with habit effects in the demand equation. Figure 6 a) above (fig 1.4 in IDM) shows the full solution for Pt. Sometimes, when we are unable to derive the solution of the dynamic model, we will still be able to answer two important questions: 1. What are the short-run effect of a change in an exogenous variable? And 2. What are the long-run effects of the shocks. As we become accustomed to dynamic analysis, we will refer to this correspondence by saying that static relationships can represent the stationary state (or steady state) of a dynamic model. The technique we will use is based on the distinction between the short-run model given by It is custom to use the terms stationary (or steady state) equation interchangeably with the term long-run equation. Xt = aPt + b1Xt−1 + b0 + εd,t, (demand) Xt = c0Pt + c1Pt−1 + d + εs,t, (supply), taking the predetermined variables Xt−1 and Pt−1 as exogenous, and the longrun model which is defined for the stationary situation of Xt = Xt−1 = X̄, Pt = Pt−1 = P̄ and εd,t = ε̄d = 0, εs,t = ε̄s = 0. 29 30 P Short-run supply curve a 1 P̄ + b0, long-run demand, and 1 − b1 1 − b1 X̄ = (c0 + c1)P̄ + d, long-run supply Long-run supply curve X̄ = The long-run model applies to a hypothetical stationary situation where there are no new shocks, and all past shocks have worked their way through (and “out of”) the system. C B A Graphically we can represent the short-run and long-run models in one diagram, using lines with different slopes to illustrate the difference between the shortand long-run. Short-run demand curve Long-run demand curve X We can then analyze the short-run, or impact, effect of a shock (to demand for example), as well as the long-run effect. Figure 7: Graphical analysis of a demand shock in the habit formation model 31 32 Stock and flow variables Starting from a stock variable like Pt, a flow variable results from obtaining the change of that variable, hence Dynamic models often include both flow and stock variables. • Flow: in units of (for example) million kroner per year • Stock: in units of (for example) million of kroner at a particular period in time (for example start or end of the year). Population, and capital stock are examples of stock variables. But so are also price indices: Pt may represent the value of the Norwegian CPI in period t (a month, a quarter or a year), and indicators of the wage level. In practice: the values of P will be index numbers. The number 100 (often 1 is used instead) refers to the base period of the index. If Pt > 100 it means that relative to the base period, prices are higher in period t. CPI in Norway • zt ≈ yt by the properties of the (natural) logarithmic function, see for example the appendix of IDM, if in doubt. An typical empirical trait of stock variables are that they change gradually, as a result of finite growth rates. 1500 Sometimes however, stock variables jump from one value in period t to quite another in period t + 1. 1000 200 1.5 • yt × 100 is inflation in percentage points. In this course we often stick to the rate formulation (hence, we omit the scaling by 100) CPI in the UK 400 1760 are examples of flow variables. Note that: 34 33 600 the (absolute) change xt = Pt − Pt−1, Pt − Pt−1 yt = , the relative change, and Pt−1 zt = ln Pt − ln Pt−1 the approximate relative change 1780 1800 1820 1760 0.4 Inflation in Norway 1.0 1780 1800 1820 Inflation in the UK Empirically, the rate of change then becomes very large. Norwegian “price history” at the breakdown of the union with Denmark is an example (see graph) 0.2 When stock variables change gradually, we need explicit dynamic models to account for their evolution. 0.5 0.0 0.0 -0.5 -0.2 1760 1780 1800 1820 1760 1780 1800 1820 Sometimes though, stock variables can be treated theoretically as if they are jump-variables. An example of such a theory is the portfolio model of the foreign exchange market. That model is static. Figure 8: Consumer price indices (stock variables), and their rate of change (flow). Norway and UK 35 36 75 The Norwegian current account Billion kroner 50 As noted, economic dynamics often arise from the combination of flow and stock variables. 25 0 The behaviour of national debt (a stock) is linked to the value of the current account (flow) in the following way 1980 1985 1990 1995 2000 1990 1995 2000 Norwegian net foreign debt debt = − current account + last periods debt + corrections. For example: If there is a primary account surplus for some time (and ignoring corrections for simplicity), this will lead to a gradual reduction of debt–or an increase in the nation’s net wealth. Conversely, a consistent current account deficit raises a nation’s debt. Billion kroner 0 -250 -500 -750 1980 1985 Figure 9: The Norwegian current account (upper panel) and net foreign deb (lower panel)t. Quarterly data 1980(1)-2003(4) 37 38 Continuous and discrete time An empirical example In the relationship: ẏ = ay(t) + ε(t), a < 0, (1) y(t) denotes a variable y which is a continuous function of time, t. The exogenous variable ε(t) is also a continuous function of t. The left hand side variable ẏ denotes the derivative of y with respect to time. a is a parameter, assumed to be negative (with no loss of generality). Time plays an essential role in model (1): If there is an increase in ε(t), ẏ will be larger, and through time there will also be an increase in y. Hence, there are propagation effects, just like in the corresponding formulation for discrete time: yt = αyt−1 + εt, α > 0, or yt − yt−1 = (α − 1)yt−1 + εt, α > 0, (2) The textbook consumption function, i.e., the relationship between real private consumption expenditure (C) and real households’ disposable income (IN C) is an example of a static equation Ct = f (IN Ct), f 0 > 0. (3) Two examples of static consumption functions: Ct = β0 + β1IN Ct + et, ln Ct = β0 + β1 ln IN Ct + et, (linear) (log-linear) (4) If this is unfamiliar, read in IDM about the properties of these two functional forms. For example for the interpretation of β1. Using quarterly data for Norway, for the period 1967(1)-2002(4), we obtain, by using the method of least squares: to make the correspondence even clearer. In (2),yt − yt−1 corresponds to ẏ in (1), and (α − 1) corresponds to a. ln Ĉt = 0.02 + 0.99 ln IN Ct 39 40 (5) 12.0 êt = ln Ct − ln Ĉt, (6) 11.8 11.6 ln C t where the “hat” in Ĉt is used to symbolize the fitted value. Next, use (4) and (5) to define the residual êt: 11.4 which is the empirical counterpart to the static model’s disturbance et. 11.2 11.0 11.0 11.1 11.2 11.3 11.4 11.5 11.6 11.7 11.8 11.9 12.0 ln INCt Figure 10: The estimated static consumption function. 41 42 0.15 The dynamic consumption function: Residuals of (1.7) Residuals of (1.4) 0.10 ln Ct = β0 + β1 ln IN Ct + β2 ln IN Ct−1 + α ln Ct−1 + εt (7) 0.05 is an example of a so called autoregressive distributed lag model, ADL, which we treat in Ch. 2 of IDM. The emprical version is: ln Ĉt = 0.04 + 0.13 ln IN Ct + 0.08 ln IN Ct−1 + 0.79 ln Ct−1 (8) Compare graph of residuals ε̂t and êt to judge which model is best. Which explanatory variables contribute most to the improved fit? 0.00 −0.05 −0.10 −0.15 −0.20 ln Ct−1 itself! Illustrates that the dynamic framework is important. −0.25 The low estimated income elasticities (0.130 and 0.08) reflect that Norwegian households have a low propensity to consume out of income rises that are transitoy. As we shall see, the results imply that the propensity to consume a permanent change in income is much larger. 43 1965 1970 1975 1980 1985 1990 1995 2000 Figure 11: Residuals of the two estimated consumptions functions (5), and (8), 44 The road immediately ahead Next week we start a more systematic introduction to the modelling tools of dynamics, see IDM Ch 2. Present a general framework for dynamic single equation models, called the autoregressive distributed lag model, ADL model. In the ADL framework, the concept of the dynamic multiplier, used several times already, can be made precise. The dynamic multiplier is a key concept in this course The ADL model also defines a typology of dynamic equations, as special cases, each with their distinct features. The analysis is extended to simple dynamic systems-of-equations. Then we turn to wage-and-price setting, which is an essential part of the supply side of modern macroeconomic model. 45