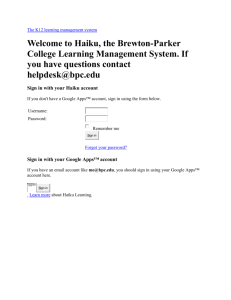

H D :

advertisement