Consumption Amenities and Location Decisions: Measurement Issues Jessie Handbury, Wharton

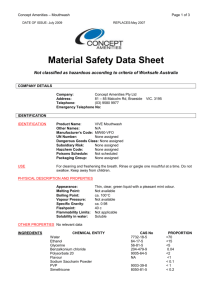

advertisement

Consumption Amenities and Location Decisions: Measurement Issues Jessie Handbury, Wharton Frontiers of Urban Economics October 7, 2015 1 / 53 Consumption amenities and agglomeration • Consumer-based agglomeration is in the background of various urban models. e.g., NEG tradition, Rosen-Roback • They are also now central to the discussion among urban analysts and policy-makers attempting to explain the resurgence of metropolitan centers. • But they receive less academic attention than agglomeration forces increasing worker productivity because they are harder to measure. exc., Glaeser, Kolko, Saiz (2001), Glaeser and Gottlieb (2006), Albouy (2008) How do we measure consumption amenities and their relevance for household (and firm) location decisions? 2 / 53 What are consumption amenities? • Urban amenities are a counterpart to urban productivity. ◮ Urban productivity is measured directly with wage data. ◮ Urban amenity is traditionally measured indirectly as a compensating differential. • All city attributes aside from housing prices or wages (Glaeser et al. (2001)). ◮ Variety of services (including the distribution of consumer goods) ◮ Aesthetics and physical setting ◮ Public services (schools, crime) ◮ Speed (costs of commuting to employment, social, and consumption opportunities) 3 / 53 What are consumption amenities? • Urban amenities are a counterpart to urban productivity. ◮ Urban productivity is measured directly with wage data. ◮ Urban amenity is traditionally measured indirectly as a compensating differential. • All city attributes aside from housing prices or wages (Glaeser et al. (2001)). ◮ Variety of services (including the distribution of consumer goods) ◮ Purchased (or visited) ◮ Produced or distributed locally (typically infinite trade costs) ◮ Endogenous and time-varying ◮ Aesthetics and physical setting ◮ Public services (schools, crime) ◮ Speed (costs of commuting to employment, social, and consumption opportunities) 4 / 53 Why do we care about urban variety? Hedonic Results • “Are Big Cities Bad Places to Live?” Albouy (2012) Q̂l = sy p̂l − (1 − τ ′)sw ŵl • Quality-of-life estimates are correlated with both fixed and endogenous “consumption” amenities. ◮ In Santa Barbara, compensated by sunshine. ◮ In New York, compensated by good food and museums. 5 / 53 Why do we care about urban variety? Hedonic Results Q̂l = sy p̂l − (1 − τ ′)sw ŵl • Real wages are inversely correlated with both fixed and endogenous amenities. ◮ Albouy (2008) “Are Big Cities Bad Places to Live?” • Real wages are declining in urban centers and in large, relative to small, cities. ◮ Glaeser, Kolko, and Saiz (2002) “Consumer Cities” and Glaeser and Gottlieb (2006) “Urban Resurgence and Consumer City” • Evidence of skill-biased amenities ◮ Lee (2010), Black, Kolesnikova, and Taylor (2012), Guerrieri, Hartley, and Hurst (2012) and Diamond (2015) 6 / 53 Why do we care about urban variety? Direct Estimates • Valuation of available variety varies fairly dramatically: ◮ Across cities ◮ ◮ Across neighborhoods ◮ ◮ Handbury and Weinstein (2015) Hottman (2015), Couture (2015) Across individuals ◮ Davis, Dingel, Monras, Morales (2015), Handbury (2013) • Differences in urban variety may, therefore: ◮ Play a key role in location decisions and sorting behavior. ◮ ◮ Couture and Handbury (2015) Be important to account for in measuring welfare and inequality. ◮ Moretti (2013), Diamond (2015), Beraja, Hurst, and Ospina (2015) 7 / 53 Today Methods to Urban Variety and Its Value Assessing the Relevance of Urban Variety What role do consumption amenities play in recent urban revival? The Frontier What do we know? What we want to learn more about? 8 / 53 Outline Methods to Urban Variety and Its Value Assessing the Relevance of Urban Variety What role do consumption amenities play in recent urban revival? The Frontier What do we know? What we want to learn more about? 9 / 53 Measuring Urban Variety: New Data Sources • Barcoded Products (Nielsen, TDLinx) ◮ Handbury & Weinstein (2015), Handbury (2015), Hottman (2015) • Restaurants & Nightlife (Yelp, County Business Patterns) ◮ Couture (2015), Davis, Dingel, Monras, & Morales (DDMM 2015), Schiff (2015), Cosman (2015) • Services & Entertainment (National Establishment Time-Series, Dun & Bradstreet)) ◮ Couture & Handbury (2015) 10 / 53 Measuring Urban Variety: Not Just a Count! • How do households interact with their environment? Approach: Model consumption decisions ◮ Davis, Dingel, Monras & Morales (2015, DDMM) • How do households value the consumption opportunities in their environment? Approach: Measure location-specific consumption gains as price indexes ◮ Handbury and Weinstein (2015), Handbury JMP, Couture JMP, Hottman JMP ◮ Fuctional form governed by (or governs) consumption behavior model. • What role do consumption opportunities play in household location decisions? Approach: Model residential (and workplace) location decisions ◮ Couture and Handbury (2015) ◮ Employs price indexes measuring location-specific consumption gains. 11 / 53 Amenity Consumption Model • Workhorse demand system: CES/discrete-choice logit model ln Vig = ln βg − ln pgl + 1 εig σ −1 • Welfare measure: CES price index (Anderson, dePalma, and Thisse (1987)) Pl = " ∑ g∈Gc pgc βg 1−σ # 1−1σ ∀l ∈ Lc 12 / 53 Key Point of Differentiation: Treatment of Spatial Frictions • Workhorse demand system: CES/discrete-choice logit model Variations reflect broadening data availability and allow for more flexibility in spatial frictions. 1. Model preferences over differentiated products available in a location. e.g., Handbury & Weinstein, Handbury 2. Model preferences over spatially-differentiated products, estimating spatial frictions. • using consumer-firm distance e.g., Couture - extension in Davis, Dingel, Monras, and Morales (2015) • using price data e.g., Hottman - extended in Handbury, Rahkovsky, and Schnell (2015) 13 / 53 Approach 1: Modeling Product Choice e.g., Handbury & Weinstein (2015), Handbury JMP • How do households value products sold by any retailer within a discrete spatial unit? 1. Estimate preferences over traded product varieties: ln Vig = ln βg − ln pgl + 1 εig σ −1 σ ≥ 1 is a measure of differentiation between products. εig are idiosyncratic Type 1 extreme value utility draws. 14 / 53 Approach 1: Modeling Product Choice e.g., Handbury & Weinstein (2015), Handbury JMP • How do households value products sold by any retailer within a discrete spatial unit? 1. Estimate preferences over traded product varieties: ln Vig = ln βg − ln pgl + 1 εig σ −1 2. Use estimates to calculate price index for representative consumer at any location in a city c: " # 1 pgc 1−σ 1−σ Pl = ∑ ∀l ∈ Lc βg g∈G c ◮ Assumes no frictions within a spatial unit (MSA, county, etc.), infinite frictions between. 15 / 53 Approach 2: Modeling Retailer Choice with Location Data e.g., Couture JMP • How do households value differentiated retailers? 1. Estimate preferences over traded product varieties: ln Vir = − ln (p + 2γ dir ) + 1 εir σ −1 16 / 53 Approach 2: Modeling Retailer Choice with Location Data e.g., Couture JMP • How do households value differentiated retailers? 1. Estimate preferences over traded product varieties: ln Vir = − ln (p + 2γ dir ) + 1 εir σ −1 2. Use estimates to calculate price index for representative consumer in a specific location: Pl = ◮ " ∑ (p + 2γ dlr ) r∈R 1−σ # 1 1−σ Explicitly models spatial differentiation, but not product or price differentiation. ◮ ◮ Measures spatial frictions with travel distance. σ̂ parameter accounts for other sources of differentiation between retailers (and product offerings). 17 / 53 Approach 2: Modeling Retailer Choice with Price Data e.g., Hottman JMP • How do households value differentiated retailers? 1. Estimate preferences over product varieties and stores: U= " ∑ (δ s Q s ) s∈S µ −1 µ # µ µ −1 where Qs = " ∑ g∈Gs βg qg σ −1 σ # σ σ −1 18 / 53 Approach 2: Modeling Retailer Choice with Price Data e.g., Hottman JMP • How do households value differentiated retailers? 1. Estimate preferences over product varieties and stores: U= " ∑ (δ s Q s ) µ −1 µ s∈S # µ µ −1 where Qs = " ∑ βg qg g∈Gs σ −1 σ # σ σ −1 2. Use estimates to calculate a price index for each location within a fixed spatial unit c: Pl = ◮ " ∑ s∈Sc Ps δs 1−µ # 1−1 µ ∀l ∈ Lc where Ps = " ∑ g∈Gs pgs βg 1−σ # 1−1σ Explicitly models differentiatedness in product and prices, but not spatial differentiation. ◮ Measures product differentiation using detailed product price and quantity data. ◮ µ̂ parameter accounts for spatial (and other) frictions differentiating retailers. 19 / 53 Data • Key requirements: Geo-coded info on consumption decisions and choice sets ◮ What products are households purchasing and where? ◮ ◮ What products do households have access to and where? ◮ ◮ Nielsen, Yelp, National Household Travel Survey (NHTS) Establishment censuses: NETS, Yelp, County Business Patterns What are the spatial frictions between locations? ◮ Travel times: NHTS, Google Maps • Useful additional layers to help control for sorting: ◮ Amenity characteristics (prices, quality indicators, controls) ◮ Household characteristics (demographics, income) ◮ Panel data to use fixed effects 20 / 53 Frontier: Modeling Product, Location, and Origin Choice Davis, Dingel, Monras & Morales (DDMM) Spatial and Social Frictions 1. Extends Couture JMP model to ◮ account for various departure points: 21 / 53 Frontier: Comparing Frictions Davis, Dingel, Monras & Morales (DDMM): Spatial and Social Frictions 1. Extends Couture JMP model to: ◮ Account for various departure points ◮ Measure for social frictions (Xir ) 1 Virom = βom dirom + β 2 Xir + εirom where i denotes individual, r restaurant, o origin, and m mode. 2. Focus on characterizing frictions that govern consumer choices, rather than measuring relative utility. ◮ Potential for rich amenity indexes to employ in residential-workplace location choice modeling (Albouy and Lue (2014), Couture and Handbury (2015)). 22 / 53 Measurement Issues: Large Choice Sets • What if you don’t observe every product? ◮ Species accumulation curves (Handbury and Weinstein) • Computing ◮ Sampling, using McFadden (1978) result (DDMM) ◮ Nesting (Handbury and Weinstein, Hottman) • Independence of Irrelevant Alternatives (IIA): overstate gains from variety? ◮ Nesting (Couture) ◮ Parameter estimates robust to different randomly-selected choice sets (DDMM) 23 / 53 Measurement Issues: Consumer Heterogeneity • Different households interact with, and value, their urban environments differently. ◮ Non-homothetic preferences over products (Handbuy JMP) ◮ Homophily, gender-specific tastes (DDMM) • Identification: households sorting into locations near their amenities ◮ Detailed amenity characteristic controls (DDMM) ◮ Instruments for entry based on pre-existing retail environment (Couture and Handbury) 24 / 53 Outline Methods to Urban Variety and Its Value Assessing the Relevance of Urban Variety What role do consumption amenities play in recent urban revival? The Frontier What do we know? What we want to learn more about? 25 / 53 Outline Methods to Urban Variety and Its Value Assessing the Relevance of Urban Variety What role do consumption amenities play in recent urban revival? The Frontier What do we know? What we want to learn more about? 26 / 53 Couture and Handbury (2015) Urban Revival in America 1. Document the recent revival of America’s urban areas. ◮ Establish a set stylized facts on urban revival: who, when, where? 2. Explain this trend. ◮ Identify the factors driving this urban revival: residential location choice model. 27 / 53 Couture and Handbury (2015) Urban Revival in America 1. Document the recent revival of America’s urban areas. ◮ Recent phenomenon (2000-2010) ◮ Localized in downtown areas of mostly large cities ◮ Driven by younger cohorts: college-educated 18-45 year olds 2. Explain this trend using a residential location choice model. ◮ Changing preferences (especially for amenities) matter more than changing environment. 28 / 53 Stylized Facts • Study urban vs suburban growth within CBSA. • Define urban areas as the set of tracts closest to CBD accounting for 5% of CBSA population. ◮ Robust to alternatives. • Questions: ◮ When? Look at all decades from 1970 to 2010. ◮ Where? Look in the largest 100 CBSAs, by decile. ◮ Who? Look at different age and education group and their interactions. ◮ Why? Look at commute patterns to disantangle role of job location from residential characteristics. 29 / 53 Downtown vs Suburban Growth, Total Population by CBSA population rank (groups of 10) 8 6 Number of CBSAs 0 2 4 6 0 2 4 Number of CBSAs 8 10 1980−1990 10 1970−1980 1−10 11−20 21−30 31−40 41−50 51−60 61−70 71−80 81−90 91−100 1−10 11−20 21−30 31−40 51−60 61−70 71−80 81−90 91−100 61−70 71−80 81−90 91−100 10 8 0 2 4 6 Number of CBSAs 8 6 4 2 0 Number of CBSAs 41−50 2000−2010 10 1990−2000 1−10 11−20 21−30 31−40 41−50 51−60 61−70 71−80 81−90 91−100 # Urban grows faster 1−10 11−20 21−30 31−40 41−50 51−60 # Suburb grows faster 30 / 53 Downtown vs Suburban Growth, College Educated by CBSA population rank (groups of 10) 8 6 Number of CBSAs 0 2 4 6 0 2 4 Number of CBSAs 8 10 1980−1990 10 1970−1980 1−10 11−20 21−30 31−40 41−50 51−60 61−70 71−80 81−90 91−100 1−10 11−20 21−30 31−40 51−60 61−70 71−80 81−90 91−100 61−70 71−80 81−90 91−100 10 8 0 2 4 6 Number of CBSAs 8 6 4 2 0 Number of CBSAs 41−50 2000−2010 10 1990−2000 1−10 11−20 21−30 31−40 41−50 51−60 61−70 71−80 81−90 91−100 # Urban grows faster 1−10 11−20 21−30 31−40 41−50 51−60 # Suburb grows faster 31 / 53 Downtown vs Suburban Growth, College Educated, 2000−2010 by CBSA population rank (groups of 10) 8 6 Number of CBSAs 0 2 4 6 0 2 4 Number of CBSAs 8 10 25−34 years 10 18−24 years 1−10 11−20 21−30 31−40 41−50 51−60 61−70 71−80 81−90 91−100 1−10 11−20 21−30 31−40 51−60 61−70 71−80 81−90 91−100 61−70 71−80 81−90 91−100 10 8 0 2 4 6 Number of CBSAs 8 6 4 2 0 Number of CBSAs 41−50 45−64 years 10 35−44 years 1−10 11−20 21−30 31−40 41−50 51−60 61−70 71−80 81−90 91−100 # Urban grows faster 1−10 11−20 21−30 31−40 41−50 51−60 # Suburb grows faster 32 / 53 Stylized Facts: Commute Patterns • Percentage growth in population living and working at different distances from CBD All Workers in All CBSAs High-Income Workers in Largest 10 CBSAs Notes: Data are from LODES for 2002 and 2011. The top 10 CBSAs are NY, Chicago, Dallas-Fort Worth, Houston, Washington DC, Miami, Atlanta, San Francisco, and Detroit. Middle-Income worker earn $1250-3333 per month and high-income workers earn more than $3,333 per month. 33 / 53 Explaining Urban Revival • Why are young professionals urbanizing? ◮ Changing environment (amenities, proximity to jobs, house prices). ◮ Changing preferences (amenities, proximity to jobs, house prices). • Monocentric city model generates: ◮ Testable hypotheses on location choices of rich and poor ◮ An indirect utility function, which provides basis for discrete-choice estimation 34 / 53 Residential Location Choice Model • Utility of individual i in group d choosing tract j in CBSA c at time t is: d + udj + ξjtd + εjtid max Vjtid = αtd Ajt + βtd Tjt − γtd pjt + θc(j)t j • Error Structure: ◮ d : group specific, time-variant CBSA c(j) quality θc(j)t ◮ d Logit model: θc(j)t is a fixed-effect. ◮ d Nested-logit model: θc(j)t has joint EV distribution with εjtid ◮ udj group specific, time-invariant quality of of tract j ◮ ξjtd group specific, time-variant quality of tract j ◮ εjtid individual- and time-variant logit taste shock for tract j. • Extension based on residential-workplace location choice model to account for commuting. 35 / 53 Estimating Equation ∆ ln s̃dj = d d ∆Ãj + ∆α d Ãj,2000 + β2010 ∆T̃j + ∆β d T̃j,2000 α2010 d +γ2010 ∆p̃j + ∆γ d p̃j,2000 + σ d ∆ ln s̃dj|c(j) + ∆ξ̃jd + εjtd • All variables are differenced relative to a national base tract. • Dependent variable: ∆ ln s̃dj ◮ 2000-2010 change in the share of age-education group d residing in tract j in CBSA c relative to the change in share residing in a national base tract. • Regressors: Ãj , T̃j , p̃j ◮ Coefficient on changes in characteristics (e.g. ∆Ãj ) captures level of preferences. ◮ Coefficient on levels of characteristics (e.g. Ãj,2000 ) captures change in preferences. • Nested logit and error terms: σ d ∆ ln s̃dj|c(j) + ∆ξ̃jd + εjtd ◮ As in Berry (1994), but in first-difference: time-invariant tract unobservables cancel. 36 / 53 Data • House price index from Zillow for all homes ( ∆p̃j , p̃j,2000 ) • Job location from LODES (∆T̃j , T̃j,2000 ) ◮ Inverse distance-weighted job opportunities in three wage groups from tract j. ◮ Average distance travelled to work for tract j resident. • Consumption amenity indexes using NETS data (∆Ãj , Ãj,2000 ) ◮ Universe of establishments in 11 categories (theaters, restaurants, apparel store, food stores, etc.) for 2000 and 2010. ◮ Couture (2013) love-of-variety indexes: amenity price index decreases with density increases with travel time (from Google Maps). ◮ Working on new weighted amenity indexes based on ESRI survey on preferences (e.g. young professionals like Trader Joe’s). 37 / 53 Identification • Reverse causality affects variables capturing 2000 to 2010 changes. ◮ Instrument change in house prices with natural amenities (Lee and Lin, 2013). ◮ Instrument change in job location with Bartik predictions using CBSA-industry-level employment growth and 2000 tract-industry employment level. ◮ Instrument change in consumption amenities: based on national expansion strategy of chains and “suitability” of 2000 business environment near tract. • Omitted variables possibly correlate with 2000 levels because differencing only removes time-invariant tract shocks. ◮ Instrument for level of house prices and neighborhood socio-economic characteristics using natural amenities, and 1970 socio-economic shares. ◮ Add additional controls: ◮ Share college (endogenous amenities) in 2000. ◮ Same age-educ group 10 years younger (stayers) in 2000. ◮ Level and change in population density. ◮ School district ranking within state from Schooldigger.com. 38 / 53 Consumption Amenity Instrument • Idea: Predict chain or SIC8 exit and entry in tract by exploiting: ◮ Attractiveness of pre-existing business landscape (Bartik 1991) ◮ National business expansion strategy (Igami and Yang 2015, Toivanen and Waterson 2005) • Method: 1. Regress 2000-2010 change in the number of SIC8 establishments in tract j as a function of the 2000 location of establishments: ◮ At distance: 0-1 mile,..., 4-8 mile from centroid of j ◮ In the same SIC8, the same SIC6 (but diff. SIC8), or the same SIC4 (but diff. SIC6), and wholesale suppliers. 2. Use fitted value of this regression for each SIC8 to predict entry in amenity category. 39 / 53 Consumption Amenity Instrument • Regression Results: ◮ Cannibalization/competition best predictor of entry. ◮ ◮ Same-SIC8 establishments within 0-1 mile has a negative effect for almost all codes. Agglomeration is also important. ◮ Same SIC6 or SIC4 establishment within 0-1 mile usually has a positive effect. • Implication: if there aren’t any burger joints, but there are other fast food restaurants near tract j then we predict the entry of burger chain(s) in the centriod of tract j • Does instrument satisfy exclusion restriction? ◮ Robust to change in local preferences because regression at national level. ◮ Robust to change in national preferences for amenity category conditional on controlling for amenity level in second-stage regression. 40 / 53 Results 25-34, Non-college Educated 25-34, College Educated Variable Change Level Change Level House Price Index Cohort Share Job Opportunities Avg. Travel Distance Theater Museums Movie Theaters Golf Courses Sports Restaurants Drinking Places Personal Services General Merchadise Stores Food Stores Apparel Stores -0.2*** – 0.05*** 0.14*** 0.04 -0.08** 0.05 0.28*** -0.1** -0.01 -0.12*** 0.16*** 0.004 0.007 -0.21*** -0.16*** 0.12*** 0.014 0.1*** 0.07*** -0.004 -0.001 0.14*** -0.13*** -0.01 -0.09*** 0.26*** 0.04 0.09** -0.2*** -0.02 – 0.14*** 0.1*** -0.27*** -0.04 0.06** 0.27*** 0.14*** -0.15** -0.3*** 0.16*** -0.14*** -0.03 -0.03 -0.04*** -0.17*** 0.14*** 0.06*** -0.2*** 0.02 0.05*** 0.14*** 0.12** -0.15** -0.31*** 0.3*** -0.09*** 0.1* -0.06 Observations 19,825 16,603 Note: * – 10% significance level; ** – 5% significance level; ***–1% significance level 41 / 53 Results • Young college and non-college have different preferences. ◮ College more attracted to certain amenities like theaters and restaurants, to job opportunities, and less sensitve to high house prices. ◮ These differences are often becoming more pronounced from 2000 to 2010 • Young and middle-age preferences differ from that of older people (not shown). ◮ Younger people more attracted to amenities like theaters, restaurants, drinking places and apparel stores. ◮ These differences are often becoming more pronounced from 2000 to 2010 42 / 53 Can model explain urban revival? • Can preferences that we estimate explain our stylized facts? ◮ Model predicts tract-level population shares, not urban/suburban shares. ◮ No control for proximity to CBD or for city size. • Use fitted value from model to compute, for different groups, growth in urban and suburban areas in cities of different sizes. 43 / 53 Can model predict urban revival? Model Actual by CBSA population size Number of CBSAs 10 15 5 il m 3 >= )m ,3 .5 [1 .5 [0 [0 # Suburb grows faster il il )m ,1 .5 .3 ,0 .5 )m il m .3 <0 [1 # Urban grows faster il 0 m 3 >= )m ,3 .5 il il il )m .5 ,1 .5 [0 [0 .3 ,0 <0 .5 .3 m )m il il 0 5 Number of CBSAs 10 15 20 Urban vs Suburban Growth (Actual), 25−34, college, 2000−2010 by CBSA population size 20 Urban vs Suburban Growth (All regressors), 25−34, college, 2000−2010 # Urban grows faster # Suburb grows faster Urban vs Suburban Growth (Actual), 25−34, non−col, 2000−2010 by CBSA population size by CBSA population size # Urban grows faster il m 3 ,3 .5 [1 >= )m il il 5) [0 . 5, 1. 5) 3, 0. .3 <0 [0 . # Suburb grows faster m il m il m m 3 ,3 [1 .5 il 0 # Urban grows faster >= )m il il m 5) 1. [0 . 5, 0. 3, [0 . <0 .3 5) m m il il 0 5 Number of CBSAs 5 10 Number of CBSAs 10 15 15 20 Urban vs Suburban Growth (All regressors), 25−34, non−col, 2000−2010 # Suburb grows faster 44 / 53 Can model predict urban revival? Model Actual by CBSA population size Number of CBSAs 10 15 5 # Suburb grows faster il m >= 3 )m il ,3 .5 [1 [0 [0 .5 .3 ,1 ,0 .5 .5 3 [1 # Urban grows faster )m il m )m il il 0 il m <0 . .5 >= 3 ,3 )m il )m il .5 [0 [0 .5 .3 ,1 ,0 <0 . .5 3 m )m il il 0 5 Number of CBSAs 10 15 20 Urban vs Suburban Growth (Actual), 35−44, college, 2000−2010 by CBSA population size 20 Urban vs Suburban Growth (All regressors), 35−44, college, 2000−2010 # Urban grows faster # Suburb grows faster Urban vs Suburban Growth (Actual), 35−44, non−col, 2000−2010 by CBSA population size by CBSA population size # Urban grows faster 3 >= [1 . 5, 3) m m il il il m 1. .5 , [0 .3 ,0 .5 [0 # Suburb grows faster 5) )m il m .3 <0 >= 3 m 3) 5, [1 . il 0 # Urban grows faster m il il il m 5) 1. .5 , [0 .3 ,0 .5 [0 <0 .3 m )m il il 0 5 5 Number of CBSAs 10 15 Number of CBSAs 10 15 20 20 Urban vs Suburban Growth (All regressors), 35−44, non−col, 2000−2010 # Suburb grows faster 45 / 53 What variables explain relative urbanization of college vs non-college? • 25-34 year old college-educated vs 25-34 year old non college-educated 46 / 53 Results • Changes in preferences for jobs and amenities seem to explain urban revival better than changes in the environment. ◮ Generally, pre-existing preferences are becoming more pronounced. • On-going work: identify whether changes in preferences are related to... ◮ Changes in nature of amenities. ◮ Changes in underlying within-group demographics (household formation, income). 47 / 53 Outline Methods to Urban Variety and Its Value Assessing the Relevance of Urban Variety What role do consumption amenities play in recent urban revival? The Frontier What do we know? What we want to learn more about? 48 / 53 Outline Methods to Urban Variety and Its Value Assessing the Relevance of Urban Variety What role do consumption amenities play in recent urban revival? The Frontier What do we know? What we want to learn more about? 49 / 53 What have we learned? • Amenities matter for welfare measurement. ◮ There are large variety gains from market size and density (Handbury and Weinstein, Couture, Hottman). ◮ Aside: fewer gains from lower prices (though larger market are more competitive, Hottman). ◮ There are additional gains from sorting (minimizing social frictions - DDMM - and preference externalities - Handbury). • Consumption amenities (seem to) matter for location decisions. ◮ Preliminary results from Couture and Handbury. 50 / 53 Outline Methods to Urban Variety and Its Value Assessing the Relevance of Urban Variety What role do consumption amenities play in recent urban revival? The Frontier What do we know? What we want to learn more about? 51 / 53 Outstanding Questions • How relevant are consumption amenities for location decisions in general? ◮ As firms become more mobile, are they following workers to consumption centers? • What are the policy implications? ◮ Are the poor better or worse off in locations that attract highly educated households and associated amenities? ◮ Can (and should) we design policies to encourage or discourage) sorting? • Are “consumer cities” a developed world phenomenon? • Is the internet a complement or substitute for urban consumption amenities? 52 / 53 Thanks. 53 / 53