Alums Have Maximum Impact in Insurance Industry

advertisement

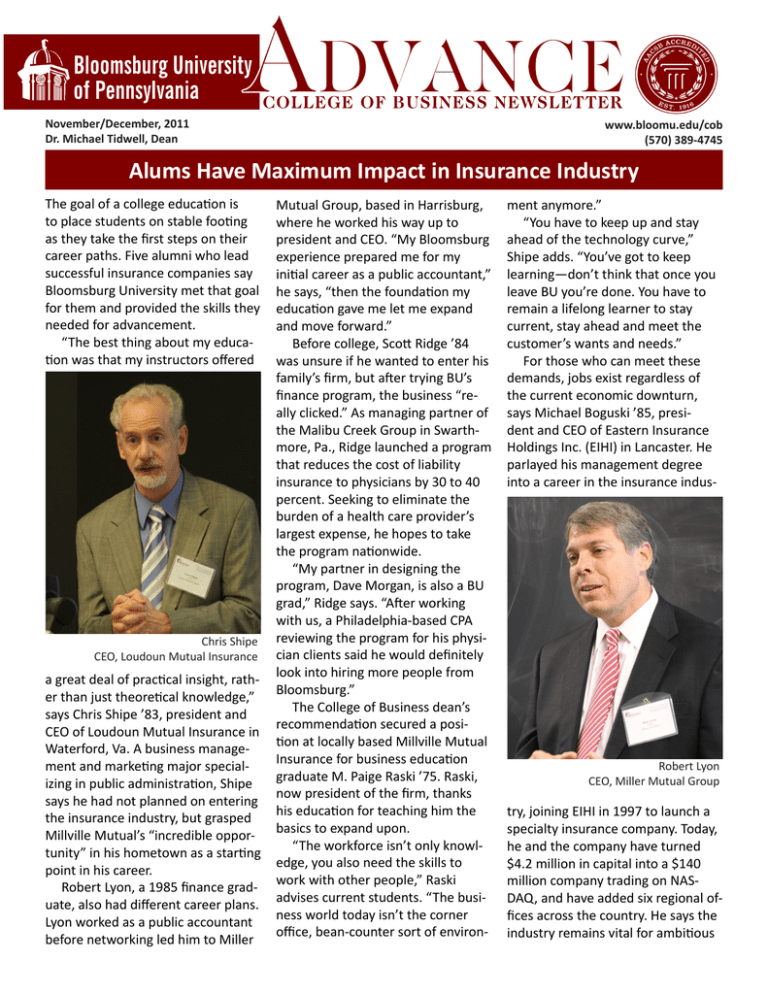

November/December, 2011 Dr. Michael Tidwell, Dean www.bloomu.edu/cob (570) 389-4745 Alums Have Maximum Impact in Insurance Industry The goal of a college education is to place students on stable footing as they take the first steps on their career paths. Five alumni who lead successful insurance companies say Bloomsburg University met that goal for them and provided the skills they needed for advancement. “The best thing about my education was that my instructors offered Chris Shipe CEO, Loudoun Mutual Insurance a great deal of practical insight, rather than just theoretical knowledge,” says Chris Shipe ’83, president and CEO of Loudoun Mutual Insurance in Waterford, Va. A business management and marketing major specializing in public administration, Shipe says he had not planned on entering the insurance industry, but grasped Millville Mutual’s “incredible opportunity” in his hometown as a starting point in his career. Robert Lyon, a 1985 finance graduate, also had different career plans. Lyon worked as a public accountant before networking led him to Miller Mutual Group, based in Harrisburg, where he worked his way up to president and CEO. “My Bloomsburg experience prepared me for my initial career as a public accountant,” he says, “then the foundation my education gave me let me expand and move forward.” Before college, Scott Ridge ’84 was unsure if he wanted to enter his family’s firm, but after trying BU’s finance program, the business “really clicked.” As managing partner of the Malibu Creek Group in Swarthmore, Pa., Ridge launched a program that reduces the cost of liability insurance to physicians by 30 to 40 percent. Seeking to eliminate the burden of a health care provider’s largest expense, he hopes to take the program nationwide. “My partner in designing the program, Dave Morgan, is also a BU grad,” Ridge says. “After working with us, a Philadelphia-based CPA reviewing the program for his physician clients said he would definitely look into hiring more people from Bloomsburg.” The College of Business dean’s recommendation secured a position at locally based Millville Mutual Insurance for business education graduate M. Paige Raski ’75. Raski, now president of the firm, thanks his education for teaching him the basics to expand upon. “The workforce isn’t only knowledge, you also need the skills to work with other people,” Raski advises current students. “The business world today isn’t the corner office, bean-counter sort of environ- ment anymore.” “You have to keep up and stay ahead of the technology curve,” Shipe adds. “You’ve got to keep learning—don’t think that once you leave BU you’re done. You have to remain a lifelong learner to stay current, stay ahead and meet the customer’s wants and needs.” For those who can meet these demands, jobs exist regardless of the current economic downturn, says Michael Boguski ’85, president and CEO of Eastern Insurance Holdings Inc. (EIHI) in Lancaster. He parlayed his management degree into a career in the insurance indus- Robert Lyon CEO, Miller Mutual Group try, joining EIHI in 1997 to launch a specialty insurance company. Today, he and the company have turned $4.2 million in capital into a $140 million company trading on NASDAQ, and have added six regional offices across the country. He says the industry remains vital for ambitious 2011 Year in Review Dr. Larry Kleiman completed a book entitled: Employee Selection: A Procedural and Legal Guide (Release in 2012) David Williams CEO of Make-a-Wish Foundation Zeigler Institute for Professional Development Speaker Maria Cannon VP of Operations, Cisco Systems Voted to the Power 100: The Most Powerful Women Of The Channel Brenda I. Nichols CFO of Larson Design Group Nominated to College of Business Executive Advisory Board Nobel ‘Bud’ Quandel CEO of Quandel Construction Named “Businessman of the Year” by Schuylkill Chamber of Commerce Michael Gillespie CAO of Hersha Hospitality Trust Won CFO of the Year Growth Specialist Category Insurance Industry continued... new graduates entering the field as the workforce reaches retirement. “Historically, the industry is very stable and secure,” says Shipe. “Even now, throughout the economic hard times, insurance was not impaired. A lot of companies are getting hit with storms now and, as they weather their issues, it’s a chance for our industry to prove itself—when bad things happen to good people, we respond.” All five leaders remained positive about the future of the insurance industry, emphasizing success lies in a broad business skill set, a willing- ness to strive for constant improvement, and the vital technology and communication skills. “We’re the tortoise, not the hare,” says Shipe. “Insurance may not be glamorous, but we are slow and steady and it works.”