Land Supply and Capitalization

advertisement

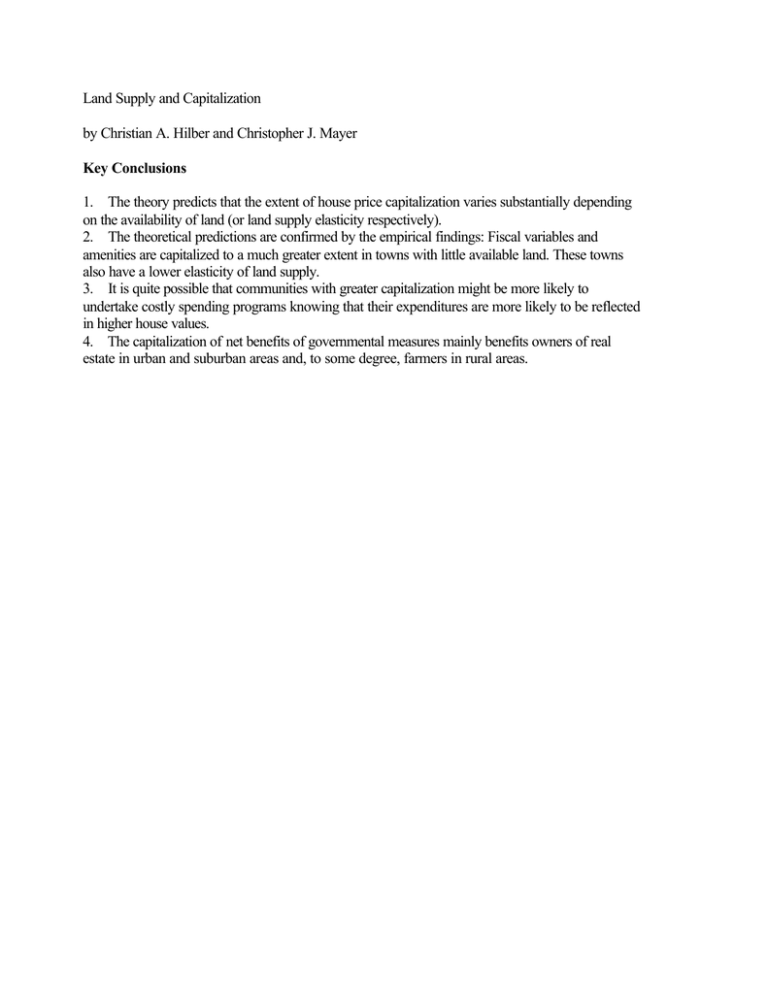

Land Supply and Capitalization

by Christian A. Hilber and Christopher J. Mayer

Key Conclusions

1. The theory predicts that the extent of house price capitalization varies substantially depending

on the availability of land (or land supply elasticity respectively).

2. The theoretical predictions are confirmed by the empirical findings: Fiscal variables and

amenities are capitalized to a much greater extent in towns with little available land. These towns

also have a lower elasticity of land supply.

3. It is quite possible that communities with greater capitalization might be more likely to

undertake costly spending programs knowing that their expenditures are more likely to be reflected

in higher house values.

4. The capitalization of net benefits of governmental measures mainly benefits owners of real

estate in urban and suburban areas and, to some degree, farmers in rural areas.

1

LAND SUPPLY AND CAPITALIZATION

by

Christian A. Hilber

and

Christopher J. Mayer∗

Abstract:

Researchers and policy makers typically assume that house prices capitalize amenities and fiscal

variables at a constant rate across locations. In this paper we argue that the extent of house price

capitalization can vary substantially depending on the availability of developable land. In

particular, we expect that the extent of capitalization of fiscal variables and amenities should be

especially high in urban areas where the elasticity of land supply is low and quite low in rural

locations where land is more readily available. We establish this point in a two-community

model (urban/suburban and rural towns) with perfectly mobile households and endogenous

property tax rates. The second part of the paper tests the major theoretical predictions using a

unique data set for Massachusetts that includes a measure of available land by community.

Consistent with the theory, we find that fiscal variables and amenities are capitalized to a much

greater extent in towns with little available land, and confirm that these locations have a lower

elasticity of land supply.

JEL classification: H53, H7, R14

Keywords: Capitalization, land supply, urbanization

∗

Christian Hilber is Visiting Scholar at The Wharton School, University of Pennsylvania. Christopher Mayer is

Associate Professor at The Wharton School, University of Pennsylvania. The authors wish to thank Harold

Elder, Joe Gyourko, Bob Inman, Wallace Oates, and Todd Sinai for helpful comments. Any errors, of course, are

our own. Financial assistance from the Swiss National Science Foundation and the Max Geldner Foundation is

gratefully acknowledged.

2

1

Introduction and Background

Following the publication of Oates’ pioneering paper in 1969, a large theoretical and

empirical literature has addressed house price capitalization in a variety of forms. For the most

part, the literature agrees that long-run house va lues should fully reflect cross-sectional

differences in the present discounted value of future tax burdens or benefits, after controlling for

housing characteristics. Such an approach depends on demand factors alone, and assumes that

the supply of land is inelastic and similar across locations.

A few theoretical papers have argued the opposite point; that the supply of land is perfectly

elastic, and thus the degree of capitalization should be quite limited. For example, Edel and Sclar

(1974) suggest pressure from developers will successfully pressure communities to expand any

type of housing that earns economic rents. Hamilton (1975) shows that under very restrictive

assumptions, including perfectly elastic housing supply, there is no capitalization of local

amenities.

Recent econometric studies (among others Yinger et al. 1988, Stull and Stull 1991, Man

and Bell 1996, Palmon and Smith 1998a and 1998b, Sinai 1998, and Black 1999) strongly

confirm the existence of capitalization, although the literature fails to reach consensus regarding

the extent of capitalization. One exception is MacMillan and Carlson (1977), who use a sample

of small Wisconsin towns and show that amenities are not capitalized in a hedonic regression. 1

In this paper we attempt to reconcile these two alternative literatures on capitalization. We

posit that capitalization of fiscal variables and amenities should vary across communities, with a

greater degree of capitalization in communities with a more inelastic supply of residential land.

This result is quite intuitive. As long as land supply is not perfectly inelastic (or perfectly elastic)

and communities are not perfect substitutes, both price and quantity will adjust in response to

demand shocks. However, price adjustment should be larger (and quantity adjustment smaller) in

places with less available land.

Regional differences in the extent of house price capitalization can have important policy

implications. Consider intergovernmental transfers from federal or state governments to

communities based on the number of poor residents. Such transfers will raise property values in

communities receiving the transfers. Many authors have pointed out that location-based aid (as

1

However, as we argue later, such a regression suffers from a number of possible biases, including measurement

error and aggregation, that make it difficult to interpret their results.

3

opposed to grants to poor individuals) can have adverse consequences since poor residents are

typically renters who will be forced to pay higher rents if the transfers are capitalized into higher

house prices. Our results suggest that such adverse redistributional effects should be

concentrated mainly in urban areas. 2 Also consider the debate over the capitalization of the

mortgage interest deduction and the implications of other types of fundamental tax reform in the

US.3 Our findings imply that subsidies to home ownership are capitalized into higher house

values to a much greater extent in urban areas with little available land.

In the following analysis we argue that the extent of capitalization of fiscal variables and

amenities should be particularly high in densely populated places—typically urban and suburban

communities—where residential land supply is relatively inelastic because (almost) all land is

already zoned for residential purposes. 4 In rural areas, however, residential land supply is

typically quite elastic. When the relative attractiveness of rural communities increases, open

farmland is converted into residential land, leading to relatively minor effects on local residential

land values. Our assumption is founded on the findings of the “endogenous zoning literature”. 5

For example, the empirical estimates of Pogodzinski and Sass (1994) strongly indicate that after

controlling for selection bias, land-use regulations appear to “follow the market”.

To establish the point that the land supply elasticity influences the extent of capitalization,

Section 2 presents a model of two jurisdictions that differ in their land supply elasticity.

Households are assumed to be perfectly mobile and property tax rates are taken as endogenous.

Equilibrium is established when residents are indifferent between the two communities. In this

framework, the extent of capitalization of an exogenous demand shock, such as a change in fiscal

subsidy from the state or federal government, depends negatively upon the land supply elasticity

2

3

4

5

Hamilton (1976) first makes the link between capitalization and inequality. He argues that if differential fiscal

surpluses are fully capitalized into demand curves for property, there can be no inequality in a static world.

Wyckoff (1995) suggests that voter movement will cause equalizing intergovernmental aid (such as state

education aid) to be capitalized into housing prices. Assuming a fixed housing supply, he shows theoretically

that in many cases, intergovernmental grants have no net effect on the welfare of the poor citizens (i.e. the

welfare effect of intergovernmental aid on poor voters is completely offset by higher housing costs), and in a few

cases, the grants may even make them worse off. However, if land supply is not completely inelastic fiscal

differences do not have to be fully capitalized into housing values and therefore the conclusions of Wyckoff need

not hold.

For a discussion of the effect of mortgage interest deductions on housing prices see Capozza, Green, and

Hendershott (1996).

For example Yinger (1982) points out that the finite size of urban areas makes land a scarce resource. Fischel

(1990) points to a number of political factors that explain why commu nities pass restrictive zoning measures that

move beyond just solving demand externalities and effectively limit supply.

For a summary of the “endogenous zoning literature” see Pogodzinski and Sass (1994). The literature on

“economics of zoning” is founded on Mills and Oates (1975). For a general review of the literature see Fischel

(1990) and Pogodzinski and Sass (1991).

4

and can therefore differ from full capitalization. Thus, the model suggests that capitalization

depends crucially on the degree of urbanization of a particular jurisdiction. In fact, our model

describes circumstances in which capitalization rates could even exceed unity in a community

with little available land.

In section 3 we test the theoretical predictions using data for the Commonwealth of

Massachusetts. We build on the empirical framework used in Bradbury, Mayer and Case (1999)

that avoids many of the empirical problems that Palmon and Smith (1998b) argue have plagued

past capitalization studies. 6 This procedure uses exogenous variation from a tax limit,

Proposition 2½, to help predict spending levels across communities and looks at how house

prices respond to variations in spending using instruments drawn from the tax limit. Consistent

with theory, our results suggest that fiscal differentials and amenities are capitalized into house

values to a much greater extent in locations with greater land availability, as measured by the

amount of undeveloped land in each city and town based on aerial photos. Finally, we confirm

that locations with more undeveloped land have a greater land supply elasticity. We conclude in

section 4 with a brief discussion of policy implications.

2

Theoretical Framework

We want to explore how the residential land supply elasticity affects the extent of

capitalization of fiscal variables and amenities into land values. Our initial intuition is that the

extent of capitalization is particularly high in urban and suburban areas where residential land is

not easily expandable. In rural areas, however, exogenous improvements in local attractiveness

should lead to the conversion of open farmland into residential land rather than just an increase

in land values.

6

Virtually all past empirical capitalization studies are based on Lancaster’s (1966) hedonic price index approach

that treats a commodity as a bundle of characteristics. Utilizing the market parallel to Lancaster’s approach, the

price of a house can be described as a function of the valuation of the various characteristics of the house, such as

site, structure, neighborhood, public services and taxes. However, this empirical procedure has a number of

important problems that can lead to significant biases when it is implemented. Palmon and Smith (1998b) place

the empirical problems into five broad categories: (1) underidentification, (2) potential correlation between

included and excluded variables, (3) measurement error in the variables, (4) simultaneity bias, and (5) potential

misspecification.

5

2.1 A Simple Model with a Single Community

To establish this point, we begin by considering a model with a single community where

the number of households is fixed. This simple model distinguishes between two cases: a

urban/suburban community and a rural location. The urban/suburban community has low

commuting costs to the central business district (CBD) and consists of a relatively large number

of households that live in houses on lots of a fixed size. All land in this community is zoned as

residential land, that is, the residential land supply QS is completely inelastic. In the rural

community, the commuting costs to the CBD are high and there are relatively few households.

By assumption, the rural community is the same size as the urban/suburban community,

however, the share, θ, of land that is zoned as residential land is a function of its price: Open

farmland is converted into residential land as the price of residential land increases. 7

Figure 1 compares the effects of an equal-sized demand shock on land prices r in the

urban/suburban and rural communities, assuming a constant elasticity of land supply in the rural

location. Demand for land QD is larger in the urban/suburban community due to its lower

commuting costs. Consequently, the price of residential land is lower in the rural community. 8

7

8

In reality, this political zoning process only works in one direction. It is highly improbable that land that is once

zoned as residential land is reconverted into farmland as residential land prices decrease.

The price elasticity of the demand for residential land is assumed to be –1 in both cases. This result can be

derived from the maximization problem in appendix A. Most recent empirical findings even suggest a higher

elasticity of the demand for residential land. Using a two-stage-least squares specification, Gyourko and Voith

(2000) find that the price elasticity of demand for residential land is fairly high, -1.6. In addition, they report

empirical evidence that OLS estimates of the price elasticity are biased upward substantially as predicted by

Bartik (1987) and Epple (1987).

6

Figure 1: Inelastic versus Elastic Land Supply in a Single Community Model

r

r

QS

r1*

QS

Q1D

r0*

r1*

Q0D

r0*

Q

Q1D

Q0D

Q

Q

urban/suburban community

rural community

Q

In this simple world, the extent of capitalization is negatively affected by the elasticity of

the land supply. In the urban/suburban community, an exogenous demand shock—such as a

ceteris paribus decrease in property taxes—is fully capitalized into land values. In the rural

location, however, an equal-sized demand shock not only changes the price of land (the

capitalization effect), but also changes the per capita consumption of land (the quantity effect).

Therefore, the extent of capitalization per square unit of land is smaller in the rural community

than in the urban/suburban location.

For small changes in property tax rates, the extent of property tax capitalization Cap∆t , ∆r

depends only on the elasticity of the land supply ? where

Cap∆t ,∆r = −

1

.

1 +η

(1)

(See appendix A for a mathematical derivation of this result.) Thus, if the land supply elasticity ?

is 1 in the rural community, changes in the tax rate are capitalized at a 50 percent rate (or -1/2

from the above equation). In the urban/suburban community (completely inelastic land supply ?

of 0), property tax changes are fully capitalized.

7

One problem with this simple setting is that it is explicitly partial-equilibrium and ignores

potential equilibrium responses such as mobility and endogenous changes in local tax rates. In a

more realistic setting, the result is less obvious. In particular, households might move away from

densely populated communities when house prices rise, mitigating the impact of shocks to the

attractiveness of these communities. In the next section, therefore, we consider a model with a

urban/suburban and a rural community where households can costlessly relocate and property

tax rates are endogenous.

2.2 Model with Mobile Households

We consider a two-community model with perfectly mobile households, that is, the

number of residents of a community and its density of development are endogenous. All

households i = 1, …, N work in the CBD and earn the same income yi but live in one of two

purely residential communities k = A, B. 9 The urban/suburban community A is located nearer to

the CBD than the rural community B and therefore has lower commuting costs Ck.

This model has its foundations in Tiebout’s (1956) original vote-with-the- feet model and in

the standard monocentric models of urban land use pioneered by Muth (1961 and 1971) and

Alonso (1964). However, nothing in our model requires a monocentric city. In solving this

model, we assume that the densely populated (urban/suburban) community A with no

undeveloped land has lower commuting costs. This could easily be the case in a city with

suburban sub-centers, so long as the locations with less available land are located closer to the

sub-centers. Furthermore, the presented model has similarities to the framework in Hilber

(1998) and in Hoyt’s (1999) model about capitalization and city size. However, these previous

papers assume that land supply elasticities are constant across jurisdictions.

We make the following assumptions:

1. All households have identical Cobb-Douglas 10 preferences.

9

10

Therefore, we assume that in suburbs and rural communities no land is zoned as industrial land. Of course, land

is used for many purposes other than housing and farming, but the latter two are by far the most important in

suburban and rural areas. The other forms of land use are neglected here for analytic simplicity.

The Cobb-Douglas utility function assumes certain restrictions on preferences. In particular, it assumes that a

constant share of the available income is spent on each good independent of the relative price. Using a more

realistic specification of preferences, a change in land rents is also expected to cause a substitution effect, i.e. the

household expenditures for all other goods (including house construction expenditures) change. However, as

long as land q and the numeraire good z are normal goods, the effect of a demand shock on rental land prices will

still persist, albeit to a reduced degree.

8

2. Household i in community k receives utility from two goods : a numeraire private

good zki and residential land (or housing) 11 qki, available at a (rental) 12 price of rk.

3. All households can relocate between the two communities A and B without cost,

thus ∑ nk = N where nk is the number of households in community k.

k = A, B

4. The rural community B has x times the size (in square units) of the urban/suburban

community A, thus, QB QA = x where Qk is the total amount of available land in

community k and where x can be smaller than, equal, or larger than one.

5. Lot sizes are not fixed in either community. The residential land supply in the

urban/suburban community A is completely inelastic, that is, all land is already

zoned as residential land (θA=1). In the rural community B the share of zoned

residential land θB is not fixed but increases proportional to the relative rental land

price rB / rA , given rB < rA .

The opportunity costs of open land are low as long as community B is relatively

unattractive compared to community A; that is, rB /rA is low. The political pressure to transform

open agricultural land into residential land increases with the opportunity costs of open land.

Thus, the share θB of zoned land in community B increases. If both communities were equally

attractive, that is, rB = rA, all land in community B would be zoned as residential land and the

community would become a urban/suburban community. We do not explicitly model the

political process that leads to this result. However, the assumption that more farmland is

converted to residential use as residential land values increase is consistent with the findings of

the “endogenous zoning literature” (see section 1). We also assume that the urban/suburban

community A is more “attractive” to residents than the rural community B, that is rB < rA .

Fiscal differentials 13 between the two communities are modeled as follows:

6. Each community has exogenous expenditures of gk per capita for local services (that

are private goods). While expenditures gk can differ between the two communities,

local services in both communities are of equal quality.

11

12

13

For analytic simplicity we do not distinguish between residential land and housing (i.e. residential land plus

structure). However, structure still exists in the model as part of the numeraire good z.

The model consists only of one time period what implies that the rental price is equal to the land value.

Fiscal differentials may occur because the two communities differ (1) in their cost-efficiency of providing public

services, (2) in their level of positive or negative spillovers from other communities, or (3) in their level of grants

from the state or federal government.

9

Thus, we neglect the impact of local services on the household utility function and gk can

be interpreted as non-benefit expenditures or as net costs per capita of the local provision of

public services.

7. Expenditures gk are financed with property taxes t k on the value of the land in

community k.

Therefore, the property tax rate t k is endogenous. For analytic simplicity we assume that

this tax is only levied on residential land and not on structure. The tax rate is determined by the

“attractiveness” (level of non-benefit expenditures gk and level of commuting costs Ck) of

community k.

8. There is no pure public good in the model. 14

The maximization problem of household i can be written as

max U ki = α ⋅ ln qki + β ⋅ ln z ki

(2)

qki ,zki , k

s.t.

yi = (1 + t k ) ⋅ rk ⋅ q ki + z ki + Ck

t k ⋅ rk ⋅ qki = g k ,

(2.1)

(2.2)

where

Uki

is the utility of household i in community k.

Equilibrium Conditions

Given the assumptions above, we state two equilibrium conditions:

14

As our model consists of homogenous households and as our goal is not to explain sorting effects between

different income groups or between groups with different preferences, this turns out to be not a very restrictive

assumption. In addition, in reality property tax revenues on the local level are ma inly spent for school

expenditures that have more the economic character of a private than of a pure public good.

10

Condition 1. The utility of household i must be the same in both communities, with all

households having chosen optimal consumption levels given the rental price where * denotes the

equilibrium solution. Assuming that not all individuals live in the same community, this can be

expressed as

*

U *Ai (q*Ai , z*Ai ) = U *Bi (qBi

, z *Bi ) .

(3)

Condition 2. Supply of housing must equa l demand for housing in both communities. This

requires that

and

Q A = n*A (rA* ) ⋅q*Ai (r A* )

(4)

r*

*

* *

*

*

θ B ⋅ QB = B ⋅Q B = nB ( rB ) ⋅ q Bi (rB ) .

*

rA

(5)

Equilibrium Solution

The optimal choice of qki* , zki* can be expressed as

α ⋅( y − C − g α)

i

k

k

(qki* , zki* ) =

, (1 − α ) ⋅ ( y i − C k ) .

r *k

(6)

The relationship between housing rents in A and B at the optimum is

rA*

=

rB*

yi

yi

1−α

− C A − g A / α yi − C A α

≡Ψ.

⋅

− CB − g B / α yi − CB

(7)

The population density in each community k=A,B can be expressed as

n*

d k* = k .

Qk

(8)

11

Using the equations (4) to (8), the relationship between population densities in A and B at

the optimum is

2 − 2α

*

dA

y − CA − g A /α

yi − CA α

ˆ .

= i

≡Ψ

⋅

*

y

−

C

−

g

/

α

y

−

C

dB i

B

B

i

B

(9)

Assuming that the urban/suburban community A is more “attractive” than the rural

community B, that is, rB* < rA* (see assumption 5), we conclude that d *A > d *B .

Comparative Statics

Consider a change in per capita expenditures gk in one of the two communities. This

change can be interpreted as a lump sum federal grant or state aid given to one or the other of

these communities. With Cobb-Douglas preferences, the change in per capita expenditures in

each community exactly equals the change in the value of consumed land, or

rk1 ⋅ qk1 − rk 0 ⋅ q k 0

= −1 .

gk1 − gk 0

(10)

For small changes in expenditures, equation (10) can also be written as

∆rk ⋅ qk ∆qk ⋅ rk

+

= −1 .

∆ gk

∆g k

(10.1)

The first term of the expression represents the price effect (extent of capitalization of

expenditures) while the second term represents the quantity effect. Mathematically, the extent of

capitalization of expenditures into land values in community k is expressed as

Cap∆gk , ∆rk =

drk

⋅ qk .

dg k

(11)

12

Using the equations (4) to (9) we can solve for rk as a function of exogenous variables.

Differentiating rk with respect to g k , we can finally express the extent of capitalization

(equation 11) in both communities as

Cap∆g A , ∆rA = −1 −

1

1

, Cap∆gB , ∆rB = −

.

ˆ

x

Ψ

1+

1+

ˆ

Ψ

x

(11.1)

Thus, the relative extent of capitalization can be represented as

R∆g k , ∆ rk =

Cap∆ g A , ∆ rA

Cap∆g B , ∆ rB

=1+

2⋅ x

.

ˆ

Ψ

(12)

Given that x and Ψ̂ are strictly positive, equation (12) shows that R∆g k , ∆rk is always

strictly greater than 1. If both communities are otherwise identical, except for differences in the

elasticity of the land supply, the relation R∆g k , ∆rk = 3. Thus, ceteris paribus, land supply

elasticity negatively affects the extent of capitalization.

Interpretation of the Results

Unlike the simple analysis in section 2.1, in this model a shift in the attractiveness of either

of the two locations causes a quant ity response in both communities. Any exogenous change of

non-benefit expenditures gk in one community always simultaneously affects the demand for land

in the other community as a result of the relocation of the households. If, for example, the

urban/suburban community A receives an additional grant from the federal government, ceteris

paribus, new households are attracted from the rural community B. This causes an additional

increase in demand for residential land in A and a decrease in community B. Thus mobility

reinforces the direct capitalization effect.

Equation (11.1) implies more than full capitalization of expenditures in the urban/suburban

community A. This outcome is the result of two effects:

13

Tax capitalization effect: A federal grant is used to reduce non-benefit expenditures gA

in the beneficiary community A. This exogenous shock allows a decrease of the

property tax rate in community A. Given Cobb-Douglas preferences, each household

always spends the same share of available income for each good. Thus, holding the

number of households in each community constant and assuming completely inelastic

land supply, the decrease in the per capita tax burden exactly equals the additional

expenditures for land. In addition, the average lot size remains constant. An increase in

demand for land leads to an increase in the rental price for residential land (full

capitalization), but does not cause a quantity effect (i.e. change in individual land

consumption).

Migration effect: The tax decrease in community A makes community A relatively

more attractive compared to community B. As a consequence some households move

from B to A until the equilibrium conditions are fulfilled again (i.e. all households are

indifferent between the two communities). Migration to A increases demand for

residential land in A and, as the land supply is inelastic, decreases average lot sizes and

causes an additional increase of the residential land price in community A (additional

capitalization effect). The extent of this “migration based” effect depends on the

relative density of the two communities ( Ψ̂ ) and on the relative community size (x).

(See explanation below.)

On the other hand, the rural community B exhibits less than full capitalization. As

described in section 2.1, an exogenous decrease of non-benefit expenditures gB in the rural

community B leads to a positive land price effect and a positive quantity effect (i.e. the land

consumption increases as land supply is elastic). Thus, the “tax capitalization effect” in the rural

community is smaller than 1. The “migration effect” also consists of a positive price effect but of

a negative quantity effect (i.e. ceteris paribus the individual land consumption decreases as new

residents move to the rural community B). Thus, the extent of capitalization is larger than the

pure “non-migration effect” but always remains <1 as indicated in equation (11.1). The extent of

the migration based change in demand for land also depends on the relative density of the two

communities (i.e. Ψ̂ ) and on the relative community size (i.e. x).

14

Equation (12) implies that the elasticity of the land supply always has a negative effect on

the extent of capitalization. The strength of this nega tive effect, however, depends on two

factors: R∆g k , ∆rk increases with x and decreases with Ψ̂ . The reasoning behind this result is

quite intuitive. First, a shift in the non-benefit expenditures in a community always changes the

relative attractiveness of the two communities. If the affected community is small, the relative

change in demand for land is large and thus the relative price effect is stronger. The smaller the

urban/suburban community compared to the rural community (i.e. the larger x), the larger is the

relative price change in the urban/suburban community compared to the price change in the rural

community. Second, a change in per capita expenditures per square unit of land , the

denominator of equation 11), is much higher in densely populated areas than in non-dense areas.

The model also allows us to analyze the impact of a change in commuting costs, such as

widening access roads or adding a new rail line, on land values. In contrast to a change in percapita expenditures, it is possible to show with simulations that the extent of capitalization of

commuting costs is not necessarily higher in the urban/suburban community where the elasticity

of the land supply is low. (See appendix B for a mathematical derivation of this result).

Finally, we note that the model incorporates a single period, so there is no distinction

between owning and renting. In this case, the price of land is equivalent to its rental value. In

reality, a majority of households in the United States are owner-occupiers. Our model ignores the

possibility that when the rental price of residential land increases, the affected households receive

a capital gain that may offset the increased price. This wealth effect ceteris paribus increases the

available income and thus the demand for land. Unless owners of valuable land mostly live in

rural areas, however, this wealth effect will be stronger in urban/suburban areas than in rural

communities as land values are generally higher in urban/suburban areas. Thus, in a multi period

model with home ownership, the effect of land supply elasticity on the extent of capitalization of

fiscal variables and amenities (see below) should be even stronger than the theoretical model

suggests.

15

3

Empirical Results

The model in the preceding section predicts that land prices, and thus house prices, in areas

with little available land should change more strongly in response to an exogenous demand shock

than house prices in rural areas. To test this hypothesis, we turn to data from Massachusetts and

look at the impact of a popular tax limit measure—Proposition 2½—on property values. In doing

so, we utilize the basic framework in Bradbury, Mayer and Case (1999—referred to as BMC,

below) to explore empirically how capitalization rates vary with the amount of available land in a

community.

BMC examine how Proposition 2½ affected the fiscal behavior of cities and towns in

Massachusetts and the capitalization of that behavior into property values. Proposition 2½ places

important limits on local municipal spending: effective property tax rates are capped at 2.5

percent and nominal annual growth in property tax revenues is limited to 2.5 percent, unless

residents pass a referendum allowing a greater increase. BMC analyze a time period—1990 to

1994—when Massachusetts municipalities faced significant fiscal stress because of a 30 percent

cut in real state aid and a demographically driven increase in school enrollments. These

conditions presented a good setting to explore the impact of spending changes on housing values.

BMC have three principal findings: 1) Proposition 2½ significantly constrained local

spending in some communities, with most of its impact on school spending, 2) constrained

communities realized gains in property values to the degree that they were able to increase school

spending despite the limitation, and 3) changes in non-school spending had little impact on

property values. By constraining school spending, Proposition 2½ may have added a scarcity

premium for housing in localities that were able to increase school spending at a time of great

fiscal stress. The authors interpret their results as indicating that the marginal homebuyer may

place a higher value on school spending than the median voter, possibly because typical

homebuyers may have been more likely to have children in public schools. BMC also show that

communities with higher beginning of period school test scores had higher appreciations rates,

reinforcing the positive correlation between high quality schools and house prices.

We choose the methodology from that paper for a number of reasons. First and foremost,

BMC are able to estimate the impact of government policy on house values using a wellidentified methodology. Identification is quite important given that fiscal variables, such as

government grants and property taxes, are not chosen randomly, and may depend on local

16

conditions, including house prices. Thus it is often difficult to estimate a basic capitalization

equation, even before considering differences in the extent of capitalization across communities.

BMC use community characteristics and measures of Proposition 2½ from the date of its original

passage in 1980 as instruments for spending changes ten years later.

Second, and equally important, we have very detailed data on land availability in

Massachusetts that allows us to directly look at the amount of available land in each community,

rather than using proxies such as density or distance from the city center. After all, the

theoretical model depends on potential new construction to mitigate changes in house prices.

Density can depend on other factors such as the amount of commercial development and local

zoning restrictions that might obscure our ability to link capitalization with land availability.

Similarly, distance from the city center only proxies for land availability in a typical monocentric

city without suburban sub-centers and with equal access to the city center from all directions.

Neither of these assumptions holds for Boston, the major metropolitan area in our sample.

Finally, we focus on changes in spending and house prices, rather than levels of those

variables, which differs from most previous research. Using first differences controls for the

omitted variable problems that can bias cross-sectional regressions. In addition, we address the

possibility that the values of some fixed attributes change over time. Controlling for changes in

the value of attributes such as town location and school quality is important because these

attributes may be correlated with factors related to Proposition 2½.

3.1 Empirical Specification

Specifically, we examine whether the capitalization of changes in local school spending

and school quality are larger in locations with little available land. Following BMC, our basic

estimating equation for house prices is as follows:

∆P = β 0 + β1 (local characteri stics) + β 2 ( ∆spending) + β 3 ( ∆Q) + ε .

(E1)

This equation is derived by differencing a standard hedonic equation. Recognizing the

difficulty in measuring the quality of local services and schools, we include only spending on the

right- hand side of the equation. Following Brueckner (1982), we interpret the coefficient on

17

(change in) school spending as the net impact on house prices of spending another dollar on

schools, holding constant the taxes necessary to pay for the additional spending.

Regressions for house price changes between 1990 and 1994 are estimated using two-stage

least squares 15 and assume that changes in spending and new single- family home permits (∆Q)

are endogenous. Instruments include the amount of developable land in 1984 and lagged permits

as instruments for change in quantity, and additional instruments for spending changes using

variables from the time immediately surrounding 1980 when the tax limit was passed. One group

of such instruments comes directly from Proposition 2½, while a second group of instruments

add resource and cost factors that affect spending changes, including the growth in state aid from

1981 through 1984 to capture the state government’s immediate response to Proposition 2½. As

with BMC, we also report a second set of estimates that utilize additional instruments from the

late 1980s that help identify changes in non-school spending, but are less clearly exogenous. (See

BMC for a more detailed explanation of these instruments and possible issues relating to

exogeneity for all of these regressions.)

The estimating equation also contains a number of levels variables to account for possible

changes over time in the capitalized value of selected town characteristics as a result of aggregate

shocks. 16 For example, the aging of the baby boom and the associated echo baby boom has led to

an increase in public school enrollments in Massachusetts since 1990. The resulting increase in

the number of households with children in public schools has raised the demand for houses in

towns with good quality schools. BMC show that the increase in demand for good schools led to

higher house prices in communities with good test scores over the 1990-94 time period.

In examining differential capitalization, we divide the sample into 2 groups based on a

number of different indicators of land supply elasticity. Our most direct measure is the

percentage of open and public (undeveloped) land in each community. This variable comes from

a University of Massachusetts aerial survey of the entire Commonwealth of Massachusetts in

1984. All land is classified into 21 uses, including open or undeveloped land. We divide the

sample into 2 equal-sized groups and compare the coefficients across these two groups. We also

examine the measure population density, but expect that this measure will perform more poorly

than the amount of undeveloped land.

15

16

We are utilizing White’s (1980) heteroskedasticity-consistent estimator of the variance-covariance matrix and

thus report robust standard errors.

Using a similar data set, but an earlier time period, Case and Mayer (1996) find that the capitalized values of

good schools, of proximity to Boston, and of other town attributes vary significantly over time.

18

The most direct test of our hypothesis suggests that the coefficient on school spending (β 2 )

will be smaller in communities with additional available land. We also expect that school quality

will be capitalized to a greater extent in locations with a smaller elasticity of new supply.

A second test of the model comes when we compare the supply or quantity response across

different types of communities. To do so, we specify a supply equation consistent with the

demand equation (E1):

∆Q = γ 0 + γ 1 ( ∆P) + γ 2 (lagged permits ) + µ .

(E2)

We have a large number of demand instruments from equation (E1), and include all

exogenous demand variables as instruments when we estimate equation (E2). Our model predicts

that locations with more available land will have a greater land supply elasticity (γ1 ) and,

possibly, higher levels of new construction (γ2 ). This second test provides important reinforcing

evidence that the differences in capitalization identified in the price equation are due to

differences in the land supply elasticity as opposed to differences in “unobserved” community

attributes that may be correlated with available land.

In assessing the results, notice that our empirical specification looks at changes in house

prices over a 4-year period and thus is likely capturing short-run price and quantity responses to

changes in policy. To the extent that long-run supply is more elastic than short-run supply, our

empirical work might over-estimate the price effects and underestimate the quantity effects of a

given fiscal change in towns with more available land. This will bias us against finding any

effect of land availability on capitalization and supply elasticities.

3.2 The Data

The analysis below includes a large number of community characteristics, school

indicators, and fiscal variables. These variables are summarized in Table 1. During the 1990-94

period, communities show significant variation in all of these variables. For example, despite an

average increase in school spending of 15 percent, individual towns had large positive and

negative changes over the relatively short four-year time period.

The house price indexes presented in this paper are obtained from Case, Shiller, and Weiss,

Inc. and are estimated using a variation on the weighted repeat sales methodology first presented

19

in Case and Shiller (1987). 17 Because the indexes involve repeat sales of the same property, they

are not affected by the mix of properties sold in a given time period or differences in average

housing quality across communities. We use the same sample as BMC, which includes 208 of

the 351 cities and towns. In general, communities were dropped from the sample because they

had too few sales to generate reliable indexes. As such, this data limitation might lead us to

underestimate the impact of supply elasticity on capitalizatio n. Communities with the fewest

transactions that are dropped from the sample also are likely to have the most available land and

thus exhibit the smallest degree of capitalization.

3.3 Results

To begin, we estimate the same equation as in BMC, but split the sample into two parts

based on the percentage of available developable land. In doing so, we test the basic hypothesis

above, that the extent of capitalization is larger in communities with less available land. The

results—reported in Table 2—are strongly consistent with the model posited above. Our

preferred specification is reported in columns (Ia) and (Ib). In all cases, coefficients in the house

price equation in column Ia—communities with little available developable land—are larger in

absolute value than coefficients in the house price equation in column Ib—locations with more

available land. The variable of greatest interest in BMC—change in school spending—has a

coefficient that is almost three times larger (0.32 versus 0.12) in towns with little available land.

In fact, the coefficient for change in school spending is not statistically different from zero in

column (Ib), but is highly statistically significant in column (Ia). We find smaller, but

qualitatively similar results for the average test score. A test of equality for all of the coefficients

in columns (Ia) and (Ib) rejects the hypothesis with a p- value of 0.06.

The coefficients on other variables are also of interest. For example, price changes with

respect to new supply are muc h larger in developed communities, where there is much less

construction. Good commuting locations appear to matter more in communities with little

available land—communities in the Boston MSA and in the suburban ring—although our

17

The method uses arithmetic weighting described by Shiller (1991) and is based on recorded sales prices of all

properties that pass through the market more than once during the period. The Massachusetts file contains over

135,000 pairs of sales drawn between 1982 and 1995. First, an aggregate index was calculated based on all

recorded sale pairs. Next, indexes were calculated for individual jurisdictions.

20

theoretical model does not make strong predictions about the impact of commuting costs on

capitalization.

Columns (IIa) and (IIb) report the same regressions using a broader set of instruments from

BMC. The results here are quite consistent with those in the first two columns in virtually all

cases, although the difference in coefficients is slightly smaller in a couple of cases.

Table 3 reports the same regressions, except that we split the sample based on population

density instead of available land. In general we would expect that these results would be weaker

than those in Table 2. Cross-sectional differences in commercial development and zoning

policies could weaken the relationship between available supply and population density.

However, population density is reported in 1990, more contemporaneous to our sample period

than land availability, which is only available in 1984. Consistent with our model, in most cases

the primary variables, change in school spending and average test scores, are larger in absolute

value in dense than less dense locations. Nonetheless, as expected, these results are somewhat

weaker than in the previous table.

Finally, we return to the quantity test described above. Here we find evidence in favor of

the hypothesis that locations with more available land have a higher elasticity of land supply.

That is consistent with our theoretical model, as it suggests that shocks to demand lead to greater

new construction in locations with more available land. As we demonstrate above, these

locations also have a lower extent of capitalization of demand shocks.

The number of single- family home permits is the dependent variable in all supply

equations. It is important to keep in mind that these regressions measure short-run changes in

supply over a four year period and thus might significantly understate long-run differences.

Columns (Ia) and (Ib) in Table 4 report land supply elasticities without using lagged supply as

exogenous variable. The two columns show large differences between the two groups. The

coefficient on change in house prices is quite small and not statistically significant in the more

developed locations. The test of equality between the coefficients in columns (Ia) and (Ib) rejects

with a p-value of 0.11. Columns (IIa) and (IIb) in Table 4 include lagged permits to control for

other factors that might lead to new construction. The coefficient on change in house prices is

about one third larger in locations with more available land, and the test of equality between the

coefficients in columns (Ia) and (Ib) rejects with a p-value of 0.13. In addition, the constants

suggest that steady-state construction is one-half as large in relatively developed regions. We

21

would also note, however, that the estimated elasticities are much lower in this paper than other

work that looks at longer time periods. (See Gyourko and Voith 2000, for example.)

4

Conclusion

In this paper we present a model and supporting empirical work that shows that the extent

of capitalization depends critically on the supply elasticity of available land within a metropolitan

area. In particular, we argue that capitalization of fiscal variables and amenities should be

especially high in urban areas where the elasticity of land supply is low and capitalization should

be quite low in rural locations where land is more readily available. We establish this point in a

two-community model (urban/suburban and rural towns) with perfectly mobile households and

endogenous property tax rates. The second part of the paper tests the major theoretical predictions

using a unique data set from Massachusetts that includes a measure of available land for a large

number of communities. Consistent with the theory, we find that fiscal variables and amenities

are capitalized to a much greater extent in towns with little available land, and confirm that these

locations have a lower elasticity of land supply.

We see a number of possible directions for future research. Our model could be expanded

to consider political conflicts between farmers and owners of residential land, and to include

multiple income groups. We could also add homeownership and a pure public good. On the

empirical side, one could gather data on grants across localities to explicitly test the prediction of

more than full capitalization. However, any such project would have to overcome the daunting

problem that redistributive grants are not given exogenously, but instead to communities that

often have fiscal problems that might have an independent effect on house prices. In addition,

one might explore how the political support for public spending differs in communities

depending on the extent to which that spending is capitalized into higher house prices. It is quite

possible that communities with greater capitalization might be more likely to undertake costly

spending programs knowing that their expenditures are more likely to be reflected in higher

housing values.

While our model makes no distinction between renting and owning a home, we can

consider a number of possible redistributional implications of our findings. Free mobility implies

that any governmental measure—such as federal grants or state aid—targeted at one location can

impact house prices across a metropolitan area. In fact, subsidies or taxes to urban locations can

22

result in more than full capitalization, while the same subsidies or taxes in rural locations result in

much less than full capitalization. We can conclude that the capitalization of net benefits of

governmental measures mainly benefits owners of real estate in urban and suburban areas and, to

some degree, farmers in rural areas. To the extent that homeowners are wealthier than renters,

adverse redistribution effects caused by capitalization should be stronger in urban areas than in

rural areas.

23

References

Alonso, W. 1964. Location and Land Use. Cambridge: Harvard University Press.

Bartik, T. J. 1987. The Estimation of Demand Parameters in Hedonic Price Models. Journal of

Political Economy 95:81-88.

Black, S. E. 1999. Do Better Schools Matter? Parental Valuation of Elementary Education.

Quarterly Journal of Economics 114:577-599.

Bradbury, K. L., C. J. Mayer, and K. E. Case. 1999. Property Tax Limitis, Local Fiscal Behavior,

and Property Values: Evidence from Massachusetts under Proposition 2½. Discussion

paper forthcoming in Journal of Public Economics.

Brueckner, J. K. 1982. A Test for Allocative Efficiency in the Local Public Sector. Journal of

Public Economics 19:311-31.

Capozza, D. R., R. K. Green, and P. H. Hendershott. 1996. Taxes, Mortgage Borrowing, and

Residential Land Prices. In Economic Effects of Fundamental Tax Reform, edited by H. J.

Aaron and W. G. Gale. Washington, D.C.: Brookings Institution Press.

Case, K. E. and R. J. Shiller. 1987. Prices of Single-Family Homes since 1970: New Indexes for

Four Cities. New England Economic Review September/October:45-56.

Edel, M., and E. Sclar. 1974. Taxes, Spending, and Property Values: Supply Adjustment in the

Tiebout-Oates Model. Journal of Political Economy 82:941-954.

Epple, D. 1987. Hedonic Prices and Implicit Markets: Estimating Demand and Supply Functions

for Differential Products. Journal of Political Economy 95:59-80.

Fischel, W. A. 1990. Do Growth Controls Matter? A Review of Empirical Evidence on the

Effectiveness and Efficiency of Local Government Land Use Regulation. Lincoln Institute

of Land Policy Working Paper, May.

Gyourko, J. and R. Voith. 2000. The Price Elasticity of the Demand for Residential Land. The

Wharton School Working Paper, February.

Hamilton, B. W. 1975. Zoning and Property Taxation in a System of Local Governments. Urban

Studies 12: 205-211.

Hamilton, B. W. 1976. Capitalization of Intrajurisdictional Differences in Local Tax Prices.

American Economic Review 66:743-753.

Hilber, C. 1998. Auswirkungen Staatlicher Massnahmen auf die Bodenpreise. Eine theoretische

und empirische Analyse der Kapitalisierung. Zurich: Verlag Rüegger.

24

Hoyt, W. A. 1999. Leviathan, Local Government Expenditures, and Capitalization. Regional

Science and Urban Economics 29: 155-171.

Lancaster, K. J. 1966. A New Approach to Consumer Theory. Journal of Political Economy

74:132-157.

McMillan, M. L., and R. Carlson. 1977. The Effects of Property Taxes and Local Public Services

Upon Residential Property Values in Small Wisconsin Cities. American Journal of

Agricultural Economics 59:81-87.

Man, J. Y., and M. E. Bell. 1996. The Impact of Local Sales Taxes on the Value of OwnerOccupied Housing. Journal of Urban Economics 39:114-130.

Mills, E. S. and W. E. Oates. 1975. Fiscal Zoning and Land Use Control. The Economic Issues.

London: Lexington Books.

Muth, R. F. 1961. The Spatial Structure of the housing market. Papers and Proceedings of the

Regional Science Association 7:207-220.

____. 1971. The Derived Demand for Residential Land. Urban Studies 8:243-254.

Oates, W. E. 1969. The Effects of Property Taxes and Local Public Spending on Property Values:

An Empirical Study of Tax Capitalization and the Tiebout Hypothesis. Journal of Political

Economy 77:957-971.

Palmon, O. and B. A. Smith. 1998a. New Evidence on Property Tax Capitalization. Journal of

Political Economy 106:1099-1111.

____. 1998b. A New Approach for Identifying the Parameters of a Tax Capitalization Model.

Journal of Urban Economics 44: 299-316.

Pogodzinski, J. M. and T. R. Sass. 1991. Measuring the Effects of Municipal Zoning Regulations:

A Survey. Urban Studies 28: 597-621.

____. 1994. The Theory and Estimation of Endogenous Zoning. Regional Science and Urban

Economics 24: 601-630.

Sinai, T. 1998. Are Tax Reforms Capitalized into House Prices? The Wharton School Working

Paper, December.

Shiller, R. J. 1991. Arithmetic Repeat Sales Price Estimators. Journal of Housing Economics 1:

110-126.

Stull, W. J., and J. C. Stull. 1991. Capitalization of Local Income Taxes. Journal of Urban

Economics 29:182-190.

25

Tiebout, C. M. 1956. A Pure Theory of Local Expenditures. Journal of Political Economy

64:416-424.

White, H. 1980. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test

for Heteroskedasticity. Econometrica 50:483-499.

Wyckoff, P. G. 1995. Capitalization, Equalization, and Intergovernmental Aid. Public Finance

Quarterly 23:484-508.

Yinger, J. 1982. Capitalization and the theory of local public finance. Journal of Political

Econonmy 90:917-943.

Yinger, J., H. Bloom, A. Börsch-Supan, and H. F. Ladd. 1988. Property Taxes and House Values.

The Theory and Estimation of Intrajurisdictional Property Tax Capitalization. London:

Academic Press.

26

Appendix

A. Basic Model with Immobile Households and Comparative Statics

We consider a purely residential community with a fixed number of households that all

have identical Cobb-Douglas preferences. All households i = 1,…,N work in the central business

district (CBD), earn the same income yi and have commuting costs of C. Only two goods are of

interest to household i: a numeraire private good zi and residential land qi, available at a rental

price r. The property tax t is assumed to be a pure non-benefit tax and is exogenous. Thus, the

maximization problem of household i can be written as

max U i = α ⋅ ln qi + β ⋅ ln zi

(A.1)

qi ,zi

s.t.

yi = r ⋅ qi + t ⋅ r ⋅ qi + z i + C ,

(A.2)

where

Ui

α, β

is the utility of household i,

are the shares of available income that are spent on residential land and on the numeraire good

(all other goods) where α + β =1 ,

Urban/suburban Case (Inelastic Land Supply)

In equilibrium, demand for residential land must equal supply. Mathematically, this

equilibrium condition can be expressed as

N S ⋅ q *i ( r * ) = Q ,

(A.3)

where Q is the total amount of available land in the community, where N S is the number of

households in the urban/suburban case, and where * denotes the equilibrium solution.

Solving the maximization problem and using equation (A.3), the rental price of residential

land can be written as

*

r =

α ⋅ ( yi − CS ) ⋅ N S

.

(1 + t ) ⋅ Q

(A.4)

27

where C S are the commuting costs in the urban/suburban case.

Rural Case (Elastic Land Supply)

The land market equilibrium can be expressed as

θ ( r * ) ⋅ Q = N R ⋅ qi* ( r * ) ,

where

{

(A.5)

}

θ = min λ ⋅ ( r *)η ,1 ,

(A.6)

with η as the elasticity of the land supply, λ as a constant, and N R as the number of households

in the rural case.

For the elastic part of the supply curve (θ < 1), the equilibrium solution for the price for

residential land can be written as

1

α ⋅ ( yi − CR ) ⋅ N R 1+η

r * =

.

(1 + t ) ⋅ λ ⋅ Q

(A.7)

Comparative Statics

We now consider an exogenous demand shock: The federal government gives a grant to the

community that is used to lower taxes. Using the equations (A.4) and (A.7), the residential land

price effects of a change in the property tax rate t can be expressed as

dr

1 α ⋅ ( yi − C S ) ⋅ N S

=−

⋅

dt

(1 + t )

(1 + t) ⋅ Q

(A.8)

for the urban/suburban case and as

1

α ⋅ ( yi − C R ) ⋅ N R 1+η

dr

1

=−

⋅

dt

(1 + η) ⋅ (1 + t ) (1 + t) ⋅ λ ⋅ Q

(A.9)

28

for the rural case.

In our simple model with Cobb-Douglas preferences the change in property tax payments

exactly equals the change in the value of consumed land. This can be expressed as

or as

∆r ⋅ q + ∆q ⋅ r

= −1

∆T

(A.10)

∆r ⋅ q

∆q ⋅ r

+

= −1 .

(∆t ⋅ r ⋅ q ) + t ⋅ ( ∆r ⋅ q + ∆q ⋅ r ) (∆t ⋅ r ⋅ q ) + t ⋅ ( ∆r ⋅ q + ∆q ⋅ r )

(A.11)

The first term of equation (A.11) represents the price effect (capitalization effect) while the

second term represents the quantity effect. The extent of tax capitalization can also be expressed

as

Cap∆t , ∆r =

1

1

=

,

∆q q ∆t ⋅ r + t ⋅ (1 + η )

∆t

r⋅

+ t ⋅ 1 +

∆r

∆r

∆r r

(A.12)

where η is the elasticity of the land supply. Equation (A.12) points out that the elasticity of the

land supply negatively affects the extent of tax capitalization. Using the derivations of the

expressions in equation (A.12) and simplifying mathematically, this can also be expressed as

Cap∆t, ∆ r =

dr (1 + t )

⋅

.

dt

r

(A.13)

Inserting the equations (A.4), (A.7), (A.8) and (A.9) into equation (A.13), we finally find

that

Cap∆t , ∆ r = −

1

.

1 +η

(A.14)

Thus, the extent of property tax capitalization only depends on the elasticity of the land

supply.

29

B. Capitalization of Changes in Commuting Costs

The capitalization of a change in commuting costs in community k can be expressed as:

Cap∆Ck , ∆rk =

drk

⋅ qk ,

dCk

(B.1)

where

α+

( yi − C A − g A α ) ⋅ ( 2 − 2α )

yi − C A

ˆ x

1+ Ψ

Cap∆C A , ∆r A = −α −

(B.2)

and

ˆ ⋅ (1 − α ) ⋅ ( yi − C B − g B / α )

−α − 1 − x Ψ

yi − C B

Cap∆C B , ∆rB =

.

ˆ x

1+ Ψ

(

)

(B.3)

The relation of the extents of capitalization can be expressed as

R∆C k , ∆rk =

Cap∆C A , ∆r A

Cap∆C B , ∆rB

2 ⋅ x x (2 − 2 ⋅ α ) ⋅ ( yi − C A − g A α )

+ ⋅ 1 +

ˆ

ˆ

α ⋅ (yi − C A )

Ψ

Ψ

.

x (1 − α ) ⋅ ( yi − C B − g A α )

1 + 1 − ⋅ 1 +

ˆ

α ⋅ ( yi − C B )

Ψ

1+

=

As can be shown with simulations, this expression can be smaller or larger than 1.

(B.4)

30

Table 1

Variable List and Means

N=208

Variable

Standard

Deviation

Minimum

Maximum

-0.077

0.15

0.083

0.046

0.057

0.09

0.158

0.038

-0.208

-0.15

-0.323

0.001

0.071

0.54

0.680

0.230

Fiscal Variables:

Effective property tax rate, FY1980

Dummy, one year of initial levy reductions, FY1982

Dummy, two years of initial levy reductions, FY1982-83

Dummy, three years of initial levy reductions, FY1982-84

Excess capacity as percentage of levy limit, FY1989

Dummy variable, at levy limit and no overrides, FY1989*

Dummy variable, passed override(s) prior to FY1990

Dummy variable, "unconstrained" in FY1989*

Equalized property value per capita, 1980 (000)

Nonresidential share of property value, FY1980

Percentage of revenue from state aid, FY1984

Percentage of revenue from state aid, FY1981

Percentage increase in state aid, FY1981-84

0.031

0.46

0.12

0.034

0.018

0.44

0.11

0.46

16.4

0.19

0.26

0.19

0.43

0.009

0.50

0.32

0.181

0.036

0.50

0.31

0.50

6.2

0.09

0.10

0.08

0.31

0.012

0

0

0

0.000

0

0

0

6.3

0.04

0.05

0.05

-0.44

0.086

1

1

1

0.200

1

1

1

44.1

0.60

0.52

0.43

3.38

Community Characteristics:

School test scores, 1990*

Fraction of 1980 population under age 5

Dummy variable, in Boston metro area (PMSA)

Dummy variable, in Boston suburban ring*

Developable land per housing unit, 1984*

Single family permits per 1990 housing unit, 1989

Enrollment/population ratio, 1981

Median family income, 1980 (000)

Dummy variable, member of regional district

Dummy variable, member of regional high school

Percent of adult residents with college education, 1980

2690

0.062

0.45

0.19

0.66

0.008

0.20

21.0

0.26

0.19

0.20

168

0.013

0.50

0.40

0.41

0.007

0.04

5.6

0.44

0.39

0.12

2160

0.032

0

0

0.04

0.000

0.08

11.5

0

0

0.05

3080

0.112

1

1

2.17

0.038

0.42

47.6

1

1

0.60

Endogenous Variables:

Percent change in house prices, FY1990-94

Percent change in school spending, FY1990-94

Percent change in non-school spending, FY1990-94

Single family permits, 1990-94, per 1990 housing unit

Mean

Notes, marked with asterisks:

"At levy limit" is defined as levy within 0.1 percent of levy limit.

"Unconstrained" communities are not at levy limit in FY1989 and have passed no overrides prior to FY1990.

School test scores is combined math and reading MEAP test score for 8th graders in 1990.

Boston suburban ring is defined as within MSA but outside PMSA.

Developable land is defined as open, non-public acres plus land in residential use.

Sources: Massachusetts Department of Education; Massachusetts Department of Revenue, Division of Local Services,

Municipal Data Bank; U.S. Department of Commerce, Bureau of the Census.

31

Table 2

House Price Regression Results

Dependent Variable: Percent Change in House Prices, Fiscal Years 1990-1994

Sample divided by percentage of open and public (undeveloped) land in each community

Specification

Explanatory Variable

Base set of instruments

(Ia)

developed

(Ib)

undeveloped

Base set of instruments

plus Proposition 2½ variables

from late 1980s

(IIa)

(IIb)

developed

developed

Single family permits, 1990-1994,

per 1990 housing units

-.64 **

(.20)

-.14

(.17)

-.49 **

(.15)

-.087

(.15)

Percent change in school spending,

FY 1990-94

.32 **

(.12)

.12

(.11)

.24 **

(.088)

.13

(.087)

Percent change in non-school spending,

FY 1990-94

Combined math and reading MEAP test

score, 8th grade students, 1990

Dummy variable, in Boston metro area

Dummy variable, in Boston suburban ring

Constant

Number of observations

.064

(.089)

.038

(.061)

.033

(.051)

-.021

(.038)

.00014 **

(.000028)

.00011 **

(.000032)

.00014 **

(.000026)

.00012 **

(.000026)

.097 **

(.013)

.075 **

(.011)

.095 **

(.011)

.076 **

(.011)

.11 **

(.022)

.036 **

(.0094)

.10 **

(.019)

.036 **

(.0089)

-.55 **

(.078)

-.42 **

(.081)

-.54 **

(.069)

-.46 **

(.068)

104

104

104

104

Numbers in parentheses are robust standard errors.

* Significantly different from zero with 90 percent confidence.

** Significantly different from zero with 95 percent confidence.

Notes: Bold variables are endogenous. Instruments in column (Ia) and (Ib) include effective tax rate in 1980,

dummy variables for the number of years required to reduce spending due to Proposition 2½, 1980 levels of

resource variables from Table 1 (equalized property value per capita), non residential share of property value,

median family income, and percentage of adults with a college degree), percentage increase in state aid 1981-84,

percentage of revenue from state aid in 1984, and dummies for regional school district or high school. Instruments

in column (IIa) and (IIb) include those from column (Ia) and (Ib) plus 1989 constraint variables (excess capacity as

a percentage of the levy limit, dummy indicating the community is at its levy limit, and a dummy indicating the

community had previously passed an override) and the increase in education spending from 1993-94 required by

the education reform bill.

32

Table 3

House Price Regression Results

Dependent Variable: Percent Change in House Prices, Fiscal Years 1990-1994

Sample divided by population density in each community

Specification

Base set of instruments

Explanatory Variable

(Ia)

dense

(Ib)

non-dense

Single family permits, 1990-94,

per 1990 housing units

.027

(.25)

-.27

(.18)

Percent change in school spending,

FY 1990-94

.26 *

(.15)

Percent change in non-school spending,

FY 1990-94

Combined math and reading MEAP test

score, 8th grade students, 1990

Dummy variable, in Boston metro area

Dummy variable, in Boston suburban ring

Constant

Number of observations

.14 *

(.083)

Base set of instruments

plus Proposition 2½ variables

from late 1980s

(IIa)

(IIb)

dense

non-dense

.013

(.22)

-.11

(.13)

.12

(.10)

.15**

(.073)

-.076

(.085)

.042

(.054)

.026

(.050)

-.038

(.041)

.00018 **

(.000028)

.000069 **

(.000030)

.00016 **

(.000023)

.000081 **

(.000030)

.10 **

(.014)

.072 **

(.0092)

.086 **

(.011)

.073 **

(.0092)

.059 **

(.012)

.058 **

(.013)

.056 **

(.011)

.057 **

(.011)

-.64 **

(.078)

-.32 **

(.082)

-.57 **

(.060)

-.36 **

(.082)

104

104

104

104

Numbers in parentheses are robust standard errors.

* Significantly different from zero with 90 percent confidence.

** Significantly different from zero with 95 percent confidence.

Notes: Bold variables are endogenous. Instruments in column (Ia) and (Ib) include effective tax rate in 1980,

dummy variables for the number of years required to reduce spending due to Proposition 2½, 1980 levels of

resource variables from Table 1 (equalized property value per capita), non residential share of property value,

median family income, and percentage of adults with a college degree), percentage increase in state aid 1981-84,

percentage of revenue from state aid in 1984, and dummies for regional school district or high school. Instruments

in column (IIa) and (IIb) include those from column (Ia) and (Ib) plus 1989 constraint variables (excess capacity as

a percentage of the levy limit, dummy indicating the community is at its levy limit, and a dummy indicating the

community had previously passed an override) and the increase in education spending from 1993-94 required by

the education reform bill.

33

Table 4

Land Supply Elasticity Regression Results

Dependent Variable: Single family permits, 1990-1994, per 1990 housing units

Sample divided by percentage of open and public (undeveloped) land in each community

Specification

Explanatory Variable

Percentage change in house prices,

1990-1994

Base set of instruments

(without lagged supply as

exogenous variable)

(Ia)

(Ib)

developed

undeveloped

.0070

(.056)

.15

(.080)

*

Single family permits, 1989,

per 1989 housing units

Constant

Number of observations

Base set of instruments

(with lagged supply as

exogenous variable)

(IIa)

(IIb)

developed

undeveloped

.13 **

(.038)

.18 **

(.047)

4.9 **

(.44)

3.6 **

(.43)

.043 **

(.0055)

.064 **

(.0086)

.016 **

(.0049)

.032 **

(.0062)

104

104

104

104

Numbers in parentheses are robust standard errors.

* Significantly different from zero with 90 percent confidence.

** Significantly different from zero with 95 percent confidence.

Notes: Bold variable is endogenous. The instruments are all of the exogenous variables in the demand equation in

table 2 plus the exogenous instruments from the demand equation of columns (Ia) and (Ib) in table 2.