Stevens Property Company (C) Buying Cheap in Tennessee

advertisement

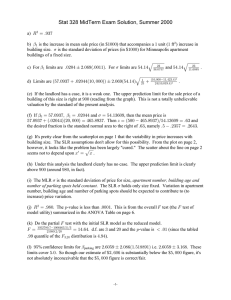

Stevens Property Company (C) Buying Cheap in Tennessee The Deal. Rich Stevens, Founder & CEO of Stevens Property Company, a development/brokerage firm, was excited about acquiring a distressed property while also expanding his company into a new market. The former Appalachian Insurance Company (“AIC”) headquarters included 3 vacant office buildings totaling 530,000 SF, 2 surface parking lots, and a parking 1 garage in the Knoxville, Tennessee CBD . The negotiated price was $7.2 million “as is”, or less than ten cents on the dollar 2 from the $75 million price paid by the prior owner in 2004 . Rich figured he was paying $14 per SF for the office buildings and getting the land and parking garage for free. The Market. Knoxville’s estimated population was 180,000 in 2013; the MSA totaled 850,000 inhabitants and had a 2.4% CAGR over the past 5 years. Settled in 1786, Knoxville was the first capital of Tennessee, grew as a major wholesaling and manufacturing city after the Civil War, and hosted the 1982 World’s Fair. Knoxville was home to the University of Tennessee (UT) with 27,000 students and also served as the gateway to the Great Smoky Mountains National Park. Within a 2 mile radius of the property were 20,000 employees and 40,000 residents. The 145-acre UT Innovation Corridor on the CBD’s east side was a 20 minute walk from SPC’s site. This $1 billion redevelopment project promised to turn blocks of vacant buildings and overgrown lots into vibrant, productive space, and was a joint venture of UT, the regional power company, and a regional healthcare system. The first factory conversion opened in 2011 with over 200,000 SF of lab and tech space. 600,000 SF of research, office and residential space followed, including 240 apartments and a 200-room hotel. The 4.4 million SF CBD office market was 10% vacant; 40% of the space was Class A. Gross asking rents averaged $22 PSF for Class A and $12 PSF for Class B (net rents were $16 and $6, respectively). Over the past 5 years, the market annually averaged 100,000 SF of gross absorption, but zero net absorption. Cap rates for Class A office ranged from 7-9%. Since 2010, 250 apartment units were absorbed per year in the CBD; 7 apartment projects with 560 units were under construction or planned in the CBD. Vacancy rates were 7% in the CBD. Recent apartment sales occurred at 6-8% cap rates. The Plan. SPC would demolish the obsolete 6-story office building and construct 350 apartment units on that vacant lot plus the surface parking lot land in 2 phases with amenities, small units, and features targeting the under-35 resident. Parking would be shared with the 2 remaining office buildings in the existing parking garage. The apartment land would have a cost basis of $20,000 per unit and the apartment pro forma showed a 18% leveraged IRR and 1.9x equity multiple assuming a 5.5% exit cap in year 5. The stabilized yield was 7% on today’s rents. The 380,000 SF of office space would be allocated a cost basis of $1 PSF. With renovation and TI costs, the total project cost for the 18-story tower and the 2-story building would be under $75 PSF, way below replacement cost, including carry on the vacant space of $1 million per year. The budget included a 3-year lease up on the tower and a 2-year lease up on the 2-story building. The unlevered IRR was 15% with an equity multiple of 1.7x, assuming a year five 10% exit cap rate. The stabilized yield was 12%, assuming $10 net rents. See Exhibit I. Next Steps. To tie up the deal at this price, SPC had paid a $1 million nonrefundable deposit. Due diligence would end in 30 days; so far, no deal breakers had emerged. Rich was negotiating with an investor group to contribute $7.5 million of equity to close the deal and make immediate design and renovation expenditures. SPC and Rich would be committing $1.0 million of equity to the deal. SPC would receive market fees for work performed and a to-be-negotiated promote. __________________________________________________________________________________ This case was written by Adjunct Professor Asuka Nakahara, with assistance from Liz Bell and Chris Wheeler, as the basis for class discussion rather than to illustrate effective or ineffective handling of a business situation. Some names, financial information, and other facts have been disguised or altered to preserve confidentiality or for educational purposes. Copyright 2015 by Asuka Nakahara. All rights reserved. 1 Three tracts of land totaling 4.3 acres with a 350,000 GSF, 18-story office tower built in 1980, a 6-story office building with 150,000 GSF built in 1951, and a 2-story, 30,000 GSF office building with an attached 700 car parking garage, both built in 1992, all contiguous or across the street from one another. 2 A net lease REIT purchased the property based on a 10 year lease signed by AIC in 2004. When the lease expired in 2014, AIC vacated and caused the CMBS loan to go into default. The servicer subsequently sold the property as part of a troubled asset portfolio. The portfolio buyer was now selling each asset individually and was willing to sell this property ‘cheap’. EXHIBIT I: INVESTMENT ANALYSIS Apartments NOI Total Project Cost Office Buildings $2,940,000 $3,494,480 $42,000,000 $28,500,000 7.0% 12.3% Yield Exit Cap 5.5% 10.0% Sales Price $53,454,545 $34,944,800 Profit $11,454,545 $6,444,800 Total $17,899,345 Leveraged IRR 18% NA Unleveraged IRR NA 15% Equity Multiple 1.9 1.7 Equity $16,800,000 Debt $25,200,000 $28,800,000 $0 Total Capital $42,000,000 $28,800,000 Discussion Questions: 1. As the operator, do you like the deal? 2. As the investor, do you like the deal? 3. What are the major risks in the deal? How can they be mitigated? 4. Provided you are a ‘go’, how would you finance this deal?