PRELIMINARY DRAFT q William M. Gentry Graduate School of Business, Columbia University

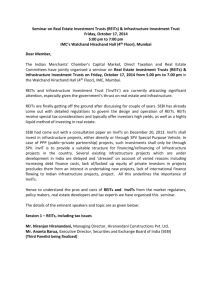

advertisement