Do Low-Income Housing Subsidies Increase the Occupied Housing Stock?

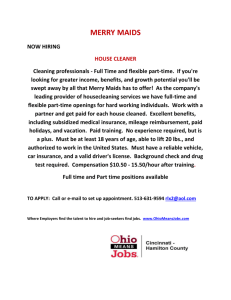

advertisement