THE COMMERCIAL REAL ESTATE BUBBLE A J. L *

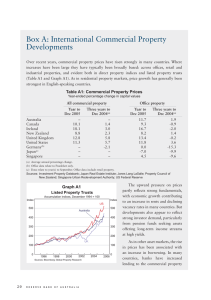

advertisement