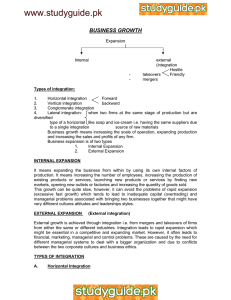

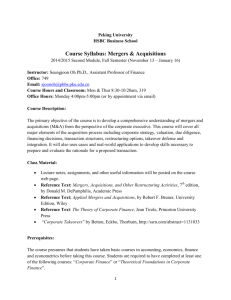

Mergers and Acquisitions: An Experimental Analysis of Synergies, Externalities and Dynamics 481

advertisement