DISCUSSION PAPER Selling a Dollar for More Than a Dollar?

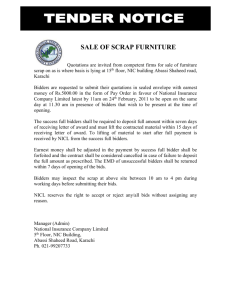

advertisement