Global Resources and International Conflict sipri

advertisement

sipri

Stockholm International Peace Research Institute

SIPRI is an i n d e p e n d e n t institute for research into p r o b l e m s

of peace and conflict, especially those of arms control and

d i s a r m a m e n t . It was established in 1966 to c o m m e m o r a t e

Sweden's 150 years of u n b r o k e n peace.

T h e Institute is financed by the Swedish Parliament. T h e staff,

the G o v e r n i n g B o a r d and the Scientific Council are

international.

T h e G o v e r n i n g Board and Scientific Council are not responsible

for the views expressed in the publications of the Institute.

Global Resources and

International Conflict

Environmental Factors in

Strategic Policy and Action

Edited by

ARTHUR H. WESTING

sipri

Governing Board

Stockholm International Peace Research Institute

Ernst M i c h a n e k , C h a i r p e r s o n (Sweden)

Egon Bahr ( P R G e r m a n y )

Francesco C a l o g e r o (Italy)

Tim G r e v e ( N o r w a y )

Max J a k o b s o n (Finland)

Karlheinz Lohs ( G e r m a n D e m o c r a t i c Republic)

E m m a Rothschild ( U n i t e d K i n g d o m )

T h e Director

Director

Frank Blackaby (United K i n g d o m )

sipri

Stockholm International Peace Research Institute

Pipers Viig 2 8 . S-171 73 Solna. Sweden

C a b l e : PEACERESEARCH S T O C K H O L M

T e l e p h o n e : 46 8/55 97 00

Oxford • New York

OXFORD

1986

UNIVERSITY

PRESS

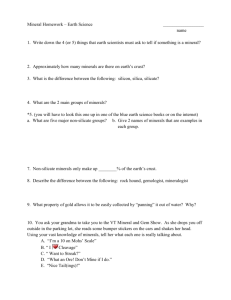

4. Minerals as a factor in strategic

policy and action

Helge Hveem

University of Oslo

I. Introduction

International conflict over natural resources is basically caused by

the concern of g o v e r n m e n t s and private firms over long-term

predictability and reliability of resource supplies. Such concern is

particularly strongly felt with respect to those natural resources

which are perceived as vitally needed for military-political or

e c o n o m i c reasons, or both. T h e present study has selected some

such resources for special scrutiny: c h r o m i u m , cobalt, and u r a n i u m .

T h e s e are a m o n g the so-called strategic minerals.

Strategic minerals are not considered strategic solely for military

r e a s o n s . T h e overall e c o n o m i c position and the industrial strength

of nations are intimately linked to military planning and to prog r a m m e s for national defence. Many in fact would conceive of the

former as pre-conditions for the latter.

T h e supply of strategic minerals is influenced by several factors:

(a) political bargaining or intervention; (b) the structure of world

industry; and (c) physical, ecological, e c o n o m i c , and technological

constraints. Conversely, d e m a n d for such minerals is influenced by

such factors as: (a) the d e g r e e of national self-sufliciency of the

main users; (b) global availability; ( r ) technological change; (d)

changes in social structure; (e) changes in consumption patterns;

and (f) the ability to adjust to perceived shortages of or barriers to

supply by domestic re-adjustment policies. Several of the

e n u m e r a t e d factors are a m o n g the chief d e t e r m i n a n t s of conflict

a m o n g nations and thus represent a considerable potential for such

conflict.

T h e present c h a p t e r builds upon previous work by the a u t h o r

( H v e e m , 1978; H v e e m & Malnes, 1980). It d o c s not cover oil or

natural gas (for which see chapters 2 and 3).

56

II.

Global

resources

and

international

conflict

Conflict o v e r natural resources

For analytical p u r p o s e s , the potential for conflict can be distinguished from the cause of conflict. Strategic minerals represent

m o r e of a potential for conflict than minerals in general. Six aspects

a p p e a r to be important clues in determining whether or not a

potential for conflict over natural resources exists:

1. T h e extent to which the military sector and industrial system

in the short to m e d i u m term are d e p e n d e n t on the natural resource,

that is, cannot do without it u n d e r prevailing technology and

applications;

2. T h e extent to which the industry concerned with the natural

resource is subject to m o n o p o l y , oligopoly, or other form of

d o m i n a n c e or selective control;

3. T h e extent to which imbalance in the supply position of

countries and firms prevails regarding the natural resource, such

imbalance being g r e a t e r the m o r e o n e country or firm is selfsufficient in supply relative to a c o m p e t i t o r ;

4. T h e extent to which there arc natural limits to the supply of

the natural resource, for e x a m p l e , imminent depiction or lengthy

t r a n s p o r t a t i o n routes;

5. T h e extent to which locations and routes of supply of the

natural resource cross the political-ideological divisions of the

international system; and

6. T h e extent to which a struggle for i n d e p e n d e n c e or a struggle

over disputed territory involves the natural resource.

E c o n o m i c factors, such as pricing behaviour on the side of

suppliers, may also represent a potential for conflict. Reactions of

s o m e major Western powers to the oil-price shock in 1973 indicate

this. N o n e of the other minerals which would fall under the term

strategic c o m e s close to oil in t e r m s of its importance in the import

b u d g e t s and the strategic planning of most developed nations (see

c h a p t e r s 2 and 3). It can therefore be assumed that the price of

strategic minerals o t h e r than oil is a less important factor to consider

than those m e n t i o n e d a b o v e . Within wide margins, the d e m a n d for

the strategic minerals is, in e c o n o m i c terminology, price-inelastic.

If supply could be assured, the buyer might be willing to pay a high

price in those cases w h e r e a total d e p e n d e n c e exists on the mineral

c o n c e r n e d for some vital application. T h e threat of an e m b a r g o is

far m o r e important than that of a price increase.

Minerals

57

Policy planners in government and industry turn to the above

aspects of the supply situation when they consider their own

position. If they are not in a position in which the threat of supply

distortion a p p e a r s to be imminent, their planning strategy would

nevertheless probably be attentive to the possibility. As shown

below, such a position is normally that of a country or firm not

particularly d e p e n d e n t on foreign supplies. Interest in this case lies

in the possibility that d e p e n d e n c e might c o m e in the future, or in

that the country or firm concerned is interested in influencing the

supply position of competitors.

If d e p e n d e n c e on foreign supplies exists, then the country or firm

will be either 'sensitive' or 'vulnerable' to interference with the

d e p e n d e n c y relationship ( K e o h a n e & N y e , 1977). It will be sensitive to the extent that it is liable to suffer costly effects from such

interference before policies can be introduced that would change

the situation. It will be vulnerable to the extent that it is liable to

suffer costs from outside interference even after policies to change

the situation have been introduced.

T h e vulnerability of a nation is a major cause of conflict over

natural resources, o n e of three to be stressed here. T h e threat or

actual imposition of an e m b a r g o on supplies of some strategic

mineral is normally seen as an act of unfriendly behaviour or

aggression by those w h o are the object of the e m b a r g o . But even the

fear, realistic or n o t , of being subjected to such act may cause the

affected party to take measures in order to pre-empt interference.

A second major resource-related cause of conflict is linked to the

issue of global distribution. If industrialized and non-industrialized

countries are c o m p a r e d , the consumption of natural resources is

seen to be highly uneven. M o r e o v e r , the consumption gap has

t e n d e d to widen in recent years. T h e explanation for this, especially

in most of the m o r e industrially advanced countries, is that the

d e m a n d for new products increases faster than their natural

resource base can provide the necessary inputs. If depiction of

natural resources is anticipated, extra weight is a d d e d to the

d o m e s t i c pressure. T h e outlet for such pressure is to seek increased

supplies from a b r o a d (Choucri & N o r t h , 1975), thus colliding with

the aspirations of o t h e r countries to increase their c o n s u m p t i o n . As

may h a p p e n in the case of vulnerability, distributive conflict may

lead the country to intervene politically or militarily in the supply

area.

58

Global

resources

and

international conflict

A third major resource-related cause of conflict is the play of

politics or the process of tough bargaining, the latter including

t h r e a t s and c o u n t e r - t h r e a t s . These threats may be m a d e in o r d e r to

interfere in the internal affairs of other nations or firms or otherwise

to c h a n g e the rules of international relations. T h e d e m a n d s of

developing countries for a so-called new international economic

o r d e r have meant that prices on primary commodities should be

regulated by global multilateral bodies, subject to increased

national control by the developing countries themselves; they have

further meant that primary commodities be increasingly processed

in the producing countries before export takes place. T h e s e

d e m a n d s , a m o n g o t h e r s , have led to o p e n conflict with many

developed countries and with transnational corporations. If the

d e m a n d s were i m p l e m e n t e d , the transnational corporations would

lose much of their control over the flow of global resources.

W h e n a relatively self-sufficient country seeks to control the

sources of supply in a n o t h e r country, the motive may be to hurt

s o m e third country which is supplied from these sources. More

precisely, the motive h e r e would be to take advantage of the

vulnerability of the m o r e d e p e n d e n t country. Such a motive could

explain past and present actions of the major powers in the Persian

Gulf and it may offer clues to their thinking about change in

southern Africa. T h e d e p e n d e n c e of the Western great powers on

supplies from s o u t h e r n Africa is a source of considerable concern to

those and o t h e r countries. This d e p e n d e n c e is also a possible source

of t e m p t a t i o n for the U S S R to intervene t h e r e , at least in the perception of Western military planners and analysts ( H a c k e d , 1981).

III.

Historical e x p e r i e n c e

T h r o u g h o u t history, conflicts over natural resources have often

been associated with competition over concessions or colonies. In

many cases, the interests of private firms have been the source of

expansionist policies. In many o t h e r s , national interests have

prevailed over private o n e s . W h e r e a s national and private interests

have often coincided, they have in a n u m b e r of cases clashed.

Publications of scholarly research into past cases of resource

conflict are rather scattered and of highly uneven quality. Only very

circumscribed conclusions can therefore be drawn from such

research. O n e safe observation would be that conflicts have b e e n

Minerals

59

located mostly in what is now commonly referred to as the Third

World. Disregarding the rather obvious cases of imperialist expansion and the 'colonial scramble' in the past century, past cases of

resource conflict a p p e a r to have fallen into one or a n o t h e r of three

distinct categories:

1. C o m p e t i t i o n a m o n g major powers which led them to intrude

upon each o t h e r s ' 'spheres of influence' for s o m e of the reasons

already suggested;

2. Conflict between investing or ownership interests (notably in

W e s t e r n capitalist countries) and national or local interests in

countries where the resources were located (notably in the Third

W o r l d ) ; and

3. Conflict owing to strong ideological-political differences, in

particular as these resulted from a s u d d e n change in government in

o n e of the countries c o n c e r n e d .

Most observers would agree that conflicts of the first type

e n u m e r a t e d above are no longer c o m m o n occurrences, whereas

those of the second two types are. An example of violent conflict

that involves a c o m m o d i t y of strategic i m p o r t a n c e — p h o s p h a t e s —

and that was caused by a mixture of ideological dispute, territorial

d i s p u t e , and external involvement, is the Western Sahara Revolt of

1976- (Kilgore, 1981; see also appendix 2, war 11). In fact, if the

a b o v e analysis is not restricted to war, then all three types remain

c o m m o n o c c u r r e n c e s . Such an e x t e n d e d interpretation of conflict is

necessary in o r d e r to include, on the one h a n d , post-war tensions

a m o n g the major powers a n d , on the o t h e r , so-called t r a d e wars

a m o n g major capitalist countries. E x a m p l e s of the latter have

b e c o m e quite c o m m o n during the 1970s and early 1980s.

Non-violent conflicts in the past which were caused by attempts to

control natural resources, or which in some o t h e r way involved

natural resources, dealt with control over: (a) production sites; (b)

t r a n s p o r t a t i o n r o u t e s ; or (c) some o t h e r key element of control, for

e x a m p l e , the local g o v e r n m e n t concerned or the marketing and

distribution system.

I V . N a t i o n a l vulnerability and international market

structures

During periods of crisis and war, governmental control in capitalist

countries has assumed a particularly important role in controlling

I

60

Global

resources

and

international

conflict

Minerals

61

access to natural resources. T h e declared policy of G e r m a n y during

W o r l d W a r II was to t a k e control of or else interdict the supply

r o u t e s of the Allied p o w e r s . This strategy led the Allies to organize

their supplies from both national and foreign sources into a joint

allocation s c h e m e (Leith etal., 1943).

T h e e m e r g e n c y m e a s u r e s of World W a r II dealing with natural

resources w e r e dissolved after the war as part of the general

liberalization of trade that took place in the late 1940s. H o w e v e r ,

even though g o v e r n m e n t a l control over the supply of raw materials

e n d e d in the U S A and United K i n g d o m , this did not re-introduce a

fully competitive m a r k e t . In a great n u m b e r of primary c o m m o d i t y

industries, the d e g r e e of concentration of production and exports

has remained high. National vulnerabilities therefore not only

affect the international industrial s t r u c t u r e ; they are also influenced

by it.

Looking at the p r o b l e m from the national point of view, high

import d e p e n d e n c e is a condition of sensitivity only if measures can

be t a k e n with great s p e e d and at minimum cost for the p u r p o s e of

a d a p t i n g to changes in supply. If m e a s u r e s can be taken only in the

long term or at great cost, then the country concerned is in a

situation of vulnerability. T h e r e is a considerable imbalance in the

a p p a r e n t import d e p e n d e n c e position of the major powers regarding minerals of particular i m p o r t a n c e in military and civilian

industrial applications ( H v e c m & Malnes, 1980, pages 6 7 - 7 5 ) .

W h e r e a s J a p a n is close to completely d e p e n d e n t on imports for

these minerals. W e s t e r n E u r o p e a n powers are s o m e w h a t less so

and the U S A is again a little less so. T h e U S S R is substantially less

d e p e n d e n t u p o n mineral imports than the U S A ; and the U S A , in

t u r n , less so than the United Kingdom (table 4.1).

A l t h o u g h d a t a on t r e n d s in import d e p e n d e n c e are i n c o m p l e t e ,

the general tendency a p p e a r s to be in the direction of greater r a t h e r

than lesser import d e p e n d e n c e for the U S S R and China. T h e

imbalance in the supply situation of the major powers is, however,

still quite considerable and will most probably remain so for the

next two d e c a d e s or so. This imbalance represents an i m p o r t a n t

part of the potential for international conflict.

T h e high d e g r e e of c o n c e n t r a t i o n in the global supply of minerals

is evident at the level of reserves, at that of p r o d u c t i o n , and at that

of e x p o r t s ( H v e e m & M a l n e s . 1980, pages 59-64). As to reserves,

only three countries account for HK) per cent of known global

platinum reserves, three countries for almost 100 per cent of known

c h r o m i u m reserves (table 4.2), and three countries for about 90 per

cent of known m a n g a n e s e reserves. As to p r o d u c t i o n , only three

countries account for close to HK) per cent of current platinum

Sources

and notes:

Minerals

" T a b l e p r e p a r e d by A. H. Westing.

* K n o w n - r e s e r v e values: (i) chromium for ca 1979 from M o r n i n g et al. (1980. page 171); (ii) cobalt for ca 1979 from Sibley

(1980. page 204); and (iii) uranium for 1982 from US Statistical Yearbook. New Y o r k . 33. table 104 (1982); the c o m p i l a t i o n

for u r a n i u m , h o w e v e r , does not take account of reserves in C h i n a , Czechoslovakia, Israel, the U S S R , and p e r h a p s e l s e w h e r e ,

for which the data are not made public.

' P r o d u c t i o n values: (i) chromium for 1983 from P a p p (1983, page 217); (ii) cobalt for 1983 from Kirk (1983, page 261); and

(iii) u r a n i u m for 1982 from UN Statistical Yearbook. New Y o r k , 33, table 104 (1982), adjusted for the missing value for the

U S S R , assumed here to be two-thirds that of the U S A ; h o w e v e r , the missing uranium values for C h i n a . Czechoslovakia and

Israel, assumed to be substantially smaller, are not t a k e n into account.

•'Export values: (i) c h r o m i u m for 1983 from Lofty et al. (1985, page 43); (ii) cobalt for 1979 from Sibley (1980. page 208); and

(iii) u r a n i u m for 1983 derived from Neff (1984. pages 215, 217).

' I m p o r t values: (i) c h r o m i u m for 1983 from Lofty et al. (1985. pages 44-15); (ii) cobalt for 1983 from Lofty et al. (1985, p a g e s

5 7 - 5 8 ) ; and (iii) uranium for 1983 derived from Nef (1984. pages 227. 235. 241, 247).

' T h e values for South Africa include those for N a m i b i a , a de facto possession of South Africa.

63

64

Global

resources

and

international conflict

p r o d u c t i o n and t h r e e countries account for about 90 per cent of

current m o l y b d e n u m p r o d u c t i o n . As to exports, only three

countries account for s o m e 85 per cent of current m o l y b d e n u m

e x p o r t s ; and t h r e e countries account for about 80 per cent of current

cobalt exports (table 4.2).

T h e s e high concentrations of mineral supply indicate a potential

for monopolistic behaviour and producer or exporter co-ordination

in the form of cartels, m a r k e t sharing deals, and the like. T h e

probability that such co-ordination in fact occurs is a function of

several factors, a m o n g t h e m political-ideological, e c o n o m i c ,

cultural, and geographical o n e s ( H v e e m , 1978).

A distinction should be m a d e b e t w e e n critical and non-critical

supplies. Potentially critical import d e p e n d e n c e occurs when supplies c o m e from o n e or a few suppliers, over long distances, or from

a c o u n t r y of different ideology. If all of these factors arc present, the

situation must be characterized as a highly vulnerable o n e , indeed.

Diversification of mineral supply has been an important goal for

several great powers over the past d e c a d e . It is less of a possibility if

c o n c e n t r a t i o n is high. T h e significance of high geographical or

structural concentration on the supply side is reinforced when it is

c o u p l e d with a pattern of consumption that is highly concentrated as

well. T h e industrialized capitalist countries c o n s u m e a very high

p r o p o r t i o n ( m o r e than two-thirds) of the global production of the

most important minerals; by contrast, the industrialized socialist

countries c o n s u m e a low proportion (less than o n e - t h i r d ) ; and the

developing c o u n t r i e s , including C h i n a , c o n s u m e the very small

remaining proportion ( p e r h a p s o n e - t e n t h ) .

Until the present recession started in the mid-1970s industrialization m e a n t a steady decrease in the self-sufficiency of the

industrialized and the newly industrializing countries. For e x a m p l e ,

w h e r e a s the U S A in 1950 relied on imports for m o r e than 50 per

cent of its r e q u i r e m e n t s for only four important minerals, by 1976

this list had grown to 23 minerals ( H a n k c e & King, 1978). For at

least 12 of these minerals, import d e p e n d e n c e was more than 80 per

cent. A considerable part of this growth has resulted from changes

in b o t h intermediate (industrial) and final ( c o n s u m e r ) d e m a n d s .

Lven though the overall d e m a n d for minerals grew over the p e r i o d ,

within that aggregation are hidden some important declines as well

as s o m e p h e n o m e n a l increases. Iron c o n s u m p t i o n , still of huge

p r o p o r t i o n s , declined in relative t e r m s ; on the o t h e r hand, the

Minerals

65

d e m a n d for certain so-called minor minerals grew rapidly until the

beginning of the 1980s. This latter growth was the result of qualitative i m p r o v e m e n t s in p r o d u c t s , both in the civilian and military

sectors.

All of the five major capitalist c o u n t r i e s — F r a n c e , FR G e r m a n y ,

J a p a n , the U n i t e d Kingdom, and the U S A — a p p e a r to be critically

d e p e n d e n t upon foreign supplies for a n u m b e r of strategic minerals,

especially c h r o m i u m and cobalt (table 4 . 1 ; H v e e m & M a l n e s , 1980,

pages 6 7 - 7 5 ) . C h r o m i u m , the most highly critical mineral from the

point of view of these five countries, is supplied largely by South

Africa, A l b a n i a , and the USSR (table 4.2). T h e United Kingdom is

in a relatively favourable i m p o r t - d e p e n d e n c e position regarding

m o l y b d e n u m , cobalt, and some other minerals because it receives

these mainly from C a n a d a , with which it has a close relationship.

H e r e vulnerable transportation routes a p p e a r to be the major

potential p r o b l e m . I m p o r t s by the U S A from C a n a d a and Mexico

are even m o r e secure when judged by political, e c o n o m i c , and

transportation factors.

For the U S S R and C h i n a , the two major socialist countries, the

picture is quite different. T h e U S S R a p p e a r s to be d e p e n d e n t — b u t

apparently not critically so—on supplies of aluminium, b a r i u m ,

cobalt, tungsten, and p e r h a p s a few additional minerals (table 4.1).

T h e Soviet imports of cobalt from C u b a could also be vulnerable in

the case of major crisis. China a p p e a r s to be d e p e n d e n t on foreign

supplies for at least some of its aluminium, c o p p e r , and iron ( C h i n ,

1983, page 184). T h e current large Chinese industrial expansion

p r o g r a m m e s could reduce import d e p e n d e n c e for some minerals,

but possibly increase it for others.

T h e second main class of concentration factors lies partly in the

domain of national politics and partly in that of the transnational

c o r p o r a t e d o m i n a n c e of world industries. G o v e r n m e n t s have m a d e

long-term bilateral a g r e e m e n t s for a large n u m b e r of supply lines

and for a n u m b e r of minerals. Of the order of one-third of world

trade in minerals takes place u n d e r some sort of c o u n t e r t r a d e

a g r e e m e n t , such as barter, counter-purchase ('offset'), or a compensation ( ' b u y b a c k ' ) a r r a n g e m e n t (BusinessWeek, 1982; M a h c r ,

1984). Military items are often tied to such deals ( N e u m a n , 1985).

In addition, transnational corporations conduct intra-firm t r a d e .

P e r h a p s one-third of world trade in minerals might be covered by

such organized exchange. Historically, transnational c o r p o r a t i o n s

66

Global

resources

and

international

Minerals

conflict

67

have been d o m i n a n t in many if not most of the mineral industries in

the world. They have integrated the product line vertically. Nationalizations have changed the bargaining situation in many instances,

but in far from the majority of cases. If in addition practices of

oligopolistic rule c o n t i n u e , with corporations operating cartels or

something similar, the corporations could potentially control access

to vital supplies. Lven if the considerable overlap between negotiated bilateral t r a d e and intra-firm trade is accounted for, the

conclusion must still be that world industries are highly organized

and highly politicized.

cause of these price increases for a n u m b e r of raw materials

( a l u m i n i u m , p h o s p h a t e s , and sisal having been notable exceptions). H o w e v e r , the perception of a substantial threat of cartel

d o m i n a n c e in the mineral industries (see, e.g., Bergsten, 1973)

proved to be largely ill-founded long before the recession in the

main industrial countries started ( H v e e m , 1978; Maull, 1984). Since

the late 1970s, raw-material prices have stagnated or declined,

causing the t e r m s of t r a d e of most developing countries to deteriorate seriously (World B a n k , 1985, pages 59, 153).

A l t h o u g h there are several possible motives behind the trends

that are suggested a b o v e , two implications become quite clear: (a)

access to supplies can be secured only following the completion of

bargaining over n o n - e c o n o m i c factors; and (/>) c o r p o r a t e dominance constitutes a gateway to supplies that has to be negotiated as

well. To the extent that such factors o p e r a t e , countries with greater

bargaining p o w e r and transnational corporations having a special

relationship with their h o m e governments will enjoy privileged

positions.

D e m a n d s by developing countries for a new international

e c o n o m i c o r d e r have led to negotiations at the United Nations

C o n f e r e n c e on T r a d e and D e v e l o p m e n t (first held at G e n e v a in

1964 and subsequently in various cities at three- or four-year

intervals) over proposals to regulate trade in a n u m b e r of minerals

and o t h e r primary c o m m o d i t i e s . Various industrialized nations

have o p p o s e d the idea of regulating raw-material industries in an

efficient m a n n e r a n d this has led to considerable N o r t h - S o u t h

conflict. A t t e m p t s to put the developing countries into a stronger

bargaining position have foundered for several reasons, a m o n g

t h e m the high i n d e b t e d n e s s of the developing countries and resulting lack of e c o n o m i c resilience, and their political disunity. This

failure has been a major cause of the worsening economic and social

p r o b l e m s being experienced today by many of the developing

countries.

Raw-material prices went up in 1974-75 owing to a n u m b e r of

factors, a m o n g t h e m ( H v e e m , 1978): (a) inflationary pressures

which began in 1971; (b) a spurt of industrial growth that led to an

increased d e m a n d for raw materials; and (c) anxiety over access to

minerals triggered by the O P E C actions in 1973 (see chapters 2 and

3). Producer-country collaboration was the result rather than the

V.

T h e strategic imperative and the potential for

adaptation

In trying to cope with a situation of potential or actual vulnerability,

several possible options could be considered by a country which is

powerful e n o u g h to influence its e n v i r o n m e n t . Short of war or

threat of o t h e r violent form of action aimed at influencing the

source of t r a d e disruption, the b u r d e n of adjustment may be passed

on to o t h e r s , w h e t h e r the disruption had been intended or not.

During the Second Indochina W a r , the U S A successfully pressured

its suppliers of nickel into allocating a larger share of available

supplies to US defence industries, forcing E u r o p e a n and J a p a n e s e

purchasers to turn to the U S S R and suffer a fivefold price increase

(Interfutures. 1979, page 53).

A country that p r o d u c e s and exports minerals can be considered

vulnerable when it cannot cope with a loss of income from e x p o r t s

without having to u n d e r g o major economic and social a d a p t a t i o n s .

This is the situation which characterizes a great n u m b e r of ThirdW o r l d countries. T h e e c o n o m i c resilience of these countries to

falling d e m a n d or to political pressures from importing countries is

very m o d e s t , a condition that was reinforced by the stagnant world

e c o n o m y at the e n d of the 1970s which had led to high interest rates,

balance-of-payment p r o b l e m s , huge foreign d e b t s , and so forth.

Most importing countries have been able to continue to maintain

secure sources for their desired raw-material imports. They have

accomplished this through their foreign policies or by means of their

transnational corporations. If options of this sort are either barred

to a country or insufficient for the p u r p o s e , then domestic readjustment b e c o m e s necessary. Such adjustment involves a consideration

of e c o n o m i c , social, and political costs. It is possible to assess where

68

Global

resources

and

international conflict

a country is positioned on the sensitivity-vulnerability c o n t i n u u m

with respect to minerals. For e x a m p l e , it has been shown that a

modest (5-10 per cent) disruption of energy supply would have

substantial effects on the US e c o n o m y , as reflected in a 3-5 per cent

d r o p in gross national product (Levine & Yabroff, 1975). Energy is

the most critical resource category in this respect, oil and coal m o r e

so than u r a n i u m . T h e impact in t e r m s of gross national product of

material shortages in the non-energy categories a p p e a r s in general

to be less d r a m a t i c than for the energy raw materials. A 15-30 per

cent shortage of supply for only about a dozen minerals could have

serious effects on the e c o n o m y . Some of these a r e , in decreasing

o r d e r of impact: titanium, platinum, cobalt, tin, c h r o m i u m ,

a l u m i n i u m , c o p p e r , silver, nickel, and tungsten (Levine & Yabroff,

1975). By way of e x a m p l e , for the U S A a 20 per cent cut in

aluminium supply would mean about a 3 per cent reduction in its

gross national p r o d u c t . For FR G e r m a n y , a 30 per cent cut in the

supply of several minerals could have a profound effect on the

e c o n o m y even though they account for only a small proportion of

the m o n e t a r y value of the nation's total trade (Economist, 1979).

M a n g a n e s e is estimated to be of equal importance to the e c o n o m y

of FR G e r m a n y as c o p p e r even though the m o n e t a r y import value

of the latter is p e r h a p s 30 times that of the former.

T h e scope for adjustments to o v e r c o m e supply disruptions is

large. Even if military r e q u i r e m e n t s for a n u m b e r of strategic

minerals are e s t i m a t e d to treble in the case of war or o t h e r major

crisis, policies of diverting consumption from civilian to military use

are believed to be able to k e e p the e c o n o m y as a whole of a

d e v e l o p e d nation running for at least a year (Little, 1974, page 60).

Lateral pressure for civilian consumption would ease under such

circumstances. If such circumstances did not apply, then the social

costs could be considerable in terms of an increased burden on

c o n s u m e r s or in e m p l o y e d people being laid off.

In o r d e r to protect themselves against having to face the option of

costly a d j u s t m e n t , g o v e r n m e n t s (as well as firms) have a d o p t e d a

series of m e a s u r e s of national p r e p a r e d n e s s against supply disruptions. T h e best known is stockpiling. Stockpiling used to be practised chiefly by the U S A . but during the late 1970s and early 1980s

several other countries also initiated such p r o g r a m m e s ( H a r g r e a v e s

& F r o m s o n . 1983; W a r n e c k e . 1980). These p r o g r a m m e s have m a d e

countries practically invulnerable in some of the most critical

Minerals

69

minerals, especially in the short term. G o v e r n m e n t s and firms are

able to defuse a threat of price increase or e m b a r g o by resorting to

their stockpiles.

Conservation is a n o t h e r measure which can strengthen the position of heavily i m p o r t - d e p e n d e n t c o n s u m e r s . If the efficiency of

recovering used material (scrap) is increased and the level of

c o n s u m p t i o n r e d u c e d , the life of the resource base (the reserve and

the stockpile) could be radically e x t e n d e d . More efficient processing techniques or material-saving designs are a m o n g the options.

Up to one-third or so of total domestic consumption of some

i m p o r t a n t industrial minerals was derived from recycling in the

major industrialized countries in the early 1970s. H o w e v e r , an

expansion of recycling is limited by technical and economic factors.

T h e degree of g o v e r n m e n t a l intervention may be a decisive factor in

this respect. T h u s recycling is more effective in FR G e r m a n y and

J a p a n than in the U S A , the main reason for the difference appearing to be that the former have instituted tax incentives and o t h e r

regulatory m e a s u r e s .

A third option is substitution. T h e range of possibilities for

substitution is very great for non-fuel minerals. H o w e v e r , substitution is not easily attained for political, e c o n o m i c , and technical

reasons. Long lead times or high investment r e q u i r e m e n t s may

reduce the feasibility of substitution. T h e use of composite

materials ( i . e . , synthetic materials reinforced with e m b e d d e d fibres

or particles) and plastics as substitutes for metals is on the increase.

In the long run, these materials could reduce a nation's d e p e n d e n c e

on mineral imports for a wide range of civilian and military

products.

Increased production from domestic deposits and exploitation of

the extra-territorial ocean floor and Antarctica are possibilities for

d e v e l o p e d countries in the medium- to long-term perspective,

although increased domestic extraction is not so much of an option

for Western E u r o p e or Japan as it is for the U S A or C a n a d a . Most

major p o w e r s did stress this latter option during the raw-material

crisis of the 1970s, but reductions in d e m a n d , increasing costs, and

e n v i r o n m e n t a l considerations have thus far precluded such action

to a great extent.

T h e technical feasibility of extracting minerals from the sea-bed

has been essentially p r o v e d , but when large-scale exploitation will

begin is largely an e c o n o m i c question. T h e nebulous future for the

70

Global

resources

and

international conflict

1982 Law of the Sea C o n v e n t i o n (see appendix 6)—not yet in force

primarily because of the unresolved issue of control over high-seas

mining—leaves a potential for future conflict. Third-World

countries have expressed great concern that such mining could

w e a k e n their position as mineral producers and suppliers. T h e y

have striven for international control of sea-bed mining u n d e r the

auspices of the United Nations that would serve the interests of all

countries. To this must be a d d e d the potential for international

conflict that arises from the growing interest in mineral exploitation

in the two polar regions. T h e Falkland/Malvinas Conflict of 1982

can be attributed in part to an interest in the natural resources of

Antarctica (see appendix 2, war 12).

VI.

S o u t h e r n Africa

T h e southern African region—primarily the area south of the

E q u a t o r — o c c u p i e s a p r o m i n e n t position in the strategic thinking of

several, if not all, of the major powers. O n e reason is the importance of the region for sea transportation routes vital to international

t r a d e . A n o t h e r is the role of the region as a supplier of several

strategic minerals. T h e increased political tension and the possibility of large-scale violent interracial conflict within South Africa

have m a d e the region the potentially most volatile o n e in the

coming years.

V a r i o u s parts of the region were the scene of violent conflict

during the 1960s and 1970s, and the cause is believed to have been in

part the interaction between political and racial tensions on the o n e

hand and natural resources on the other. For e x a m p l e , the present

Z a i r e was dragged into a resource-related conflict on a n u m b e r of

notable occasions: the abortive C o n g o Civil War of 1960-64 and its

two follow-up actions, in 1977 and 1978 (see appendix 2, war 5).

A p a r t from the political, e c o n o m i c , and logistical importance of

s o u t h e r n Africa in global strategic thinking, there are three aspects

of the regional situation that must be pointed out: (a) that a major

political and racial conflict in South Africa could poison NorthSouth relations and influence the relative positions of the major

p o w e r s in Africa and elsewhere in the Third World; (b) that the

region supplies Western powers and Japan with several of the most

critical minerals; (r) that the largest alternative present and future

supplier of s o m e of these minerals is the U S S R .

Minerals

71

A b o v e it is pointed out that c h r o m i u m and cobalt are at the top of

the list of strategic minerals which are particularly critical to the

vulnerability of the U S A , J a p a n , and Western E u r o p e . M a n g a n e s e

should be classed with these also, because of its importance in the

ferro-alloy industry, as should platinum and vanadium. Southern

Africa is the largest source of supply for these minerals. If to this

brief list are a d d e d gold (for its special role in financial reserve

systems) and uranium (for its role in nuclear energy and in the

m a n u f a c t u r e of nuclear w e a p o n s ) then the strategic importance of

southern Africa b e c o m e s even m o r e evident.

It has b e e n suggested that the worst-case scenario from the point

of view of strategic planners in the Western military alliance would

be o n e in which South Africa changed to black rule with a Marxist

philosophy that would m a k e it a logical ally for the USSR

( D u c h e n e , 1979). In that scenario, an e m b a r g o on supplies of

minerals to the Western countries has been suggested to be a

possible event. In a variant of this scenario, some kind of cartel

behaviour would occur whereby the governments of southern

Africa colluded with Moscow in order to dictate the conditions for

supplying Western countries.

Less d r a m a t i c scenarios would probably be more realistic.

R e p o r t s of Soviet involvement in the 1978 Shaba revolt (see

appendix 2, war 5) have not been substantiated, neither have

prophecies that Angola or Z i m b a b w e would turn against Western

interests after decolonization or after changing to leftist governm e n t s . I n d e e d , e m p l o y m e n t and national economic reasons as well

as normal political and diplomatic considerations seem to favour a

continuation of existing supply a r r a n g e m e n t s even if domestic

political systems change fundamentally. M o r e o v e r , there a p p e a r

already to exist secret collaborations between the USSR and South

Africa on the m a r k e t i n g of gold and of platinum that came to pass

irrespective of differences in political philosophy ( H a r g r e a v e s &

F r o m s o n , 1983, pages 12-13). Lastly, if an e m b a r g o is to be considered as a serious possibility, then it could be put into effect by the

present G o v e r n m e n t of South Africa as well as by a new governm e n t . I n d e e d , South Africa recently a n n o u n c e d the possibility of a

cut-off of c h r o m i u m to the U S A and Western E u r o p e ( A P , 1985).

C o n t i n u e d violent conflict within South Africa and between it

and some of its neighbouring countries, mounting pressure from

Western p o w e r s , and a growing socio-economic crisis in large parts

72

Global

resources

and

international

conflict

Minerals

73

of southern Africa all emphasize the volatile character of the

regional situation. This, coupled with the fact that most of the major

p o w e r s are particularly vulnerable with regard to some of the

minerals for which the region is a prime supplier, warrants special

attention to these minerals. An additional reason is what a p p e a r s to

be a growing need by the U S S R to import some of these minerals,

notably c h r o m i u m and cobalt (Little, 1977). Such need could lead

even the U S S R to turn to southern Africa for imports. If this is

indeed the case, a potential for E a s t - W e s t conflict over natural

resources in the region could, of c o u r s e , develop.

increasing share of world p r o d u c t i o n . T h e rapid expansion of

production in Albania during the past d e c a d e has m a d e it o n e of the

largest e x p o r t e r s . A decrease in Soviet exports of c h r o m i u m

a p p e a r s to reflect both a real decline in self-sufficiency and a policy

of protecting its own reserves from being depleted too rapidly. It is

even possible that the USSR will b e c o m e an important importer

before the e n d of the d e c a d e . A similar, if not quite as explicit,

tendency to reduce exports can also be discerned in several other

producing countries. Such a trend can only lead to an even m o r e

c o n c e n t r a t e d international supply situation.

U r a n i u m is extracted domestically by several of the nuclear

p o w e r s , but is still the object of considerable international t r a d e .

T h e very special role of uranium as both a source of energy and a

base for nuclear w e a p o n s also m a k e s it a potential source of

international conflict. This further e n h a n c e s the importance of

s o u t h e r n Africa, for the region is also a substantial source of that

mineral.

T h r e e of the strategically most crucial minerals associated with

s o u t h e r n Africa—chromium, cobalt, and u r a n i u m — a r e singled out

below for m o r e detailed examination.

A n o t h e r general tendency is for producing and exporting

countries to turn into processors (mainly of ferro-chromium) in

o r d e r to r e a p a higher share of value-added profit, or for reasons of

e c o n o m i c nationalism. This logically challenges the market shares

of established metallurgical, refractory, or chemical p r o d u c e r s and

the mineral policies of major powers that wish to preserve a

strategically important processing industry. This represents yet

a n o t h e r potential source of conflict.

If the c h r o m i u m industry is highly c o n c e n t r a t e d at the country

level, then the d e g r e e of concentration at the c o r p o r a t e level is even

m o r e p r o n o u n c e d . C h r o m i u m in the capitalist world is involved in a

complex and apparently stable c o b w e b of conglomerate corporations with o w n e r s h i p , p a r t n e r s h i p , or o t h e r linkages a m o n g t h e m selves. T h e A n g l o A m e r i c a n C o r p o r a t i o n of South Africa is

apparently the centrepiece of this oligopolistic system through its

d o m i n a n t position as a controlling agent in G E N C O R and some of

the o t h e r principal South African and Z i m b a b w e a n producing

c o m p a n i e s . T h r o u g h joint ventures with other corporations such as

the Rio T i n t o Zinc C o r p o r a t i o n in the United Kingdom, and by

integrating ' d o w n s t r e a m ' into the processing and refining of

c h r o m i u m and steel, the Anglo American C o r p o r a t i o n of South

Africa a p p e a r s to have secured for itself a key decision-making

position in the global c h r o m i u m industry.

T h e r e is relatively little a p p a r e n t ' u p s t r e a m ' integration by the

big steel and ferro-alloy producers in the U S A , C a n a d a , or Western

E u r o p e . T h e r e may, however, be an element of control by such

agents in the form of long-term contracts and special relations of a

m o r e informal character. Prices are not d e t e r m i n e d in a free

m a r k e t , but in negotiations by the corporations. T h e r e is also an

important element of price differentiation in specific market seg-

Chromium

By far the largest use of c h r o m i u m — p e r h a p s t h r e e - q u a r t e r s of it—

is for metallurgical p u r p o s e s . T h e bulk of the metallurgical applications is in the steel industry, where c h r o m i u m is a d d e d to steel in

o r d e r to m a k e it h a r d e r , less subject to corrosion, and m o r e heatresistant. It a p p e a r s to be an indispcnsible additive, at least in the

m e d i u m - t e r m perspective.

Reserves, p r o d u c t i o n , and exports are all highly concentrated at

the country level (table 4.2). South Africa a n d , to a lesser extent,

Z i m b a b w e together account for most known global reserves. T h e

USSR and South Africa are the current main p r o d u c e r s , whereas

South Africa. A l b a n i a , and the U S S R are the current main exp o r t e r s . Japan has been the main importer for a n u m b e r of years.

C o u n t r i e s currently producing m o d e r a t e a m o u n t s of c h r o m i u m

are: T u r k e y and the Philippines, both allied to the West and both

experiencing declining shares of world production; Finland and

Z i m b a b w e , both non-aligned and both with stable shares of world

p r o d u c t i o n ; and A l b a n i a , non-aligned and experiencing a rapidly

|

74

Global

resources

and

international

conflict

menls, assisted also by tariff and other barriers. Such features

could, in a light supply situation, lead to the less privileged buyers

being left out of normal supply.

T h e s e structural and political factors create a level of uncertainty

that has led to considerable efforts to diversify supplies and to

intensify m e a s u r e s of domestic adjustment. Diversification into

new territories or old mining sites with lower grade ores is,

h o w e v e r , always u n d e r the threat of South African p r o d u c e r s who

are in a position to cut prices and flood the market with cheap

c h r o m i u m , ferro-chromium, and even stainless steel. Domestic

adjustment therefore a p p e a r s to be a more feasible choice. T h e r e

a r c stockpiling p r o g r a m m e s in all of the major industrialized

c o u n t r i e s , both in the g o v e r n m e n t a l and private sectors. Recycling

is now providing of the o r d e r of o n e - q u a r t e r of all c h r o m i u m needs.

P e r h a p s one-third of the c h r o m i u m used today could theoretically

be substituted for; but for a range of important applications, as in

stainless steel, there is simply no substitute. C h r o m i u m could be

replaced for some purposes by materials such as titanium, nickel, or

composite materials based on boron or silicon. H o w e v e r , these

substitute materials suffer from either deficient performance or

higher cost, or b o t h . Technical innovations have so far not come far

in overcoming these p r o b l e m s . T h e r e f o r e , it a p p e a r s as if c h r o m i u m

is o n e mineral that will continue to occupy a highly strategic position

in the world a r e n a . T h e limits of domestic adjustment measures and

the uncertainty facing diversification strategies add to the e x t r e m e

concentration of control over the first links in the production chain,

to the unbalanced vulnerability of the major powers, and to the

location of reserves, p r o d u c t i o n , and c o r p o r a t e decision-making in

an increasingly unstable a r e a . T h e s e factors clearly combine to

m a k e control over c h r o m i u m a potential for international conflict.

Cobalt

C o b a l t , like c h r o m i u m , is a strategic mineral that is likely to become

involved in conflict. In 197b, transportation of cobalt from two of

the three main exporting countries—Zaire and Z a m b i a (table

4.2)—was interrupted for some time by the civil war that had just

then started in A n g o l a . In 197K, military forces o p p o s e d to the

Ciovernment of Z a i r e attacked mining installations in Shaba Province (see appendix 2, war 5), leading to an interruption of produc-

Mtnerals

75

tion ( C o m m e r c e , 1981). Belgium r e s p o n d e d , backed by some o t h e r

N A T O g o v e r n m e n t s , by deploying a military force in Shaba. T h e

resulting supply disruptions caused the U S A to declare cobalt a socalled priority metal in its national stockpile (bringing the list of

those to 11) ( G u t t m a n etal., 1983).

Cobalt is a vital alloying element in metals for the aerospace

industry. In fact, an estimated 17 per cent of US consumption goes

into the manufacture of jet aircraft (Maull, 1984, page 215). T h e

crucial p r o p e r t y of cobalt alloys is their resistance to high

t e m p e r a t u r e s . T h e second main application for cobalt is in p e r m a nent m a g n e t s and thus in electric m o t o r s ; and the third is for a

variety of uses in the chemical industry.

T h e availability of cobalt is highly d e p e n d e n t on the production

of c o p p e r and nickel as some 95 per cent of all cobalt is mined in

association with these two metals. As cobalt is also usually less than

3 per cent of the metal content of the ores m i n e d , the linkage of

cobalt to c o p p e r and nickel is an important structural d e t e r m i n a n t

for the world cobalt regime Only exceptional circumstances could

lead to a decision to mine cobalt without first considering the c o p p e r

or nickel situation. Since the mid-1970s, cobalt production has

stagnated owing to reduced d e m a n d s for copper and, to a lesser

e x t e n t , nickel.

World resources of cobalt are a b u n d a n t , especially so if the cobalt

content of sea-bed nodules is considered; the quantity of these seabed deposits is estimated to be huge ( G u t t m a n et al., 1983; Waldh e i m , 1975). H o w e v e r , in the short- to m e d i u m - t e r m perspective

the reserve situation is centered around access to deposits in Z a i r e ,

in Z a m b i a , and in the USSR (table 4 2). If low-grade currently noncommercial deposits of cobalt are considered, then C u b a . New

Caledonia (an overseas territory of F r a n c e ) , the Philippines, and

the U S A b e c o m e potentially important producers and. to a lesser

e x t e n t , also Finland and M o r o c c o . H o w e v e r , the U S A at present

r e m a i n s the major importer (table 4.2).

In the short- to m e d i u m - t e r m perspective, the two main African

p r o d u c e r s — Z a i r e and Z a m b i a (table 4.2)—occupy a strategic position, w h e r e a s in the longer t e r m , the Pacific producers may become

m o r e i m p o r t a n t . Reactions to the 1976 and 1978 Shaba events (see

appendix 2. war 5) suggest that the short-term perspective cannot

be o v e r l o o k e d . For e x a m p l e , the U S A started buying cobalt in 1976

in o r d e r to d o u b l e the size of its strategic stockpile ( G u t t m a n etal..

76

Global

resources

and

Minerals

international conflict

1983). This action and subsequent destruction of production facilities in Shaba led to soaring prices. T h e effect was all the more

d r a m a t i c as the Shaba incidents coincided with an increasing

d e m a n d for cobalt during a period of depressed d e m a n d for c o p p e r

and nickel. T h e price increases led to a sudden increase in purchases

from Z a m b i a and a r e n e w e d interest in producing cobalt domestically in the U S A , w h e r e production had ceased in 1971. T h e

response of Z a i r e was to reduce its selling price to well below the

cost of production and to far below what was considered a breakeven price for resumed production in the U S A or elsewhere. T h u s ,

instead of s o m e form of collusion between Zaire and Z a m b i a , there

d e v e l o p e d intense competition.

A knowledge of the c o r p o r a t e structure in cobalt is—as is also the

case with chromium—crucial to an understanding of the world

cobalt regime. T h e m a r k e t is highly organized. T h e Belgian

financial-industrial c o n g l o m e r a t e , Socicte" G £ n 6 r a l e , has a part in

the m a n a g e m e n t of G E C A M I N E S in Z a i r e and its trading arm

S O Z A C O M a n d . through its processing arm in Belgium, is one of

the main buyers of cobalt from Z a i r e , in association with copper.

I N C O of C a n a d a and Falconbridge Nickel Mines of C a n a d a are

important p r o d u c e r s of cobalt. A n o t h e r is the A n g l o American

C o r p o r a t i o n of South Africa, which holds an important share in the

Z a m b i a n p r o d u c e r , Z a m b i a Consolidated C o p p e r Mines. A s

d o m i n a n t p r o d u c e r s and as vertically integrated entities, these

c o r p o r a t i o n s logically have a c o m m o n interest in preventing diversification away from areas which they control and in keeping prices

low on the raw materials which they process. At the same time, they

may feel inclined to c o m p e t e for market shares when the m a r k e t is

unstable and when d e m a n d is d o w n .

As with c h r o m i u m , t h e r e is no world price for cobalt. Prices arc

set by p r o d u c e r s or negotiated in contractual a r r a n g e m e n t s , or are

simply a matter of infra-firm trading and hence a c o r p o r a t e decision. If the Belgian-Zairian sub-system may be considered a price

leader in the capitalist world, there arc several 'special relationships' where factors o t h e r than price count. Additionally, there

exist Cuban-Soviet and Japanese-Australian sub-systems. Imports

to the U S A are also highly concentrated (Kirk, 1983).

If diversificrtion has been inhibited so far by volatile prices,

adjustment m e a s u r e s seem to have had some success. Total cons u m p t i o n is being reduced by cutting down on the a m o u n t of cobalt

11

being used in specific applications. Cobalt can be applied in smaller

quantities and still offer its unique heat resistance, but it cannot be

completely substituted for. Besides, s o m e of the substitutes, such as

m o l y b d e n u m , are also critical materials. New techniques to apply a

c h a n g e d material composition already exist; the lead time is therefore not as long as is usually the case when substitution is considered. Recycling, on the o t h e r h a n d , seems to offer few adjustm e n t o p p o r t u n i t i e s because scrap is mostly spread in a large variety

a n d n u m b e r of p r o d u c t s , often in very small quantities.

T h e m e d i u m - t e r m availability of cobalt will be influenced largely

by d e v e l o p m e n t s in southern Africa. Political instability and fragility of t r a n s p o r t a t i o n n e t w o r k s are factors that must be t a k e n into

account. A g a i n , the highly unbalanced supply situation between the

m a j o r p o w e r s of East and West could provide a potential for

conflict. This is partly why the major Western powers, probably

even J a p a n , maintain stockpiles of cobalt. US stockpiles a p p e a r to

be sufficient for about six years of domestic consumption (Sibley,

1980, pages 206. 209-10).

Uranium

U r a n i u m is used in the manufacture of nuclear w e a p o n s and this

aspect alone m a k e s it a strategic mineral. Practically all nonmilitary uses are for the production of energy. In the immediate

aftermath of the 1973 oil crisis, access to uranium was considered by

m a n y countries to be important because of its use in producing

e n e r g y . For countries with nuclear-energy p r o g r a m m e s , it b e c a m e a

special m a t t e r of national security in the 1970s to obtain satisfactory

control over all relevant links in the extraction and manufacture of

uranium.

A l t h o u g h the perceived urgency of ensuring access to uranium

has eased s o m e w h a t owing to a radical d o w n w a r d revision of many

nuclear-energy p r o g r a m m e s , this is still considered highly importa n t . T h e military aspect of access to uranium has become ever more

important owing to continued proliferation of the capacity to

p r o d u c e nuclear w e a p o n s . In addition, environmental concerns

have b e c o m e far m o r e important to populations all over the world.

T h e e x p a n d e d p r o g r a m m e s of uranium production in the 1970s

led to a perception of impending depletion. A rush developed on

those uranium deposits that could still be considered not closely

78

Global

resources

and

international

conflict

controlled by the nuclear p o w e r s , such as those in Australia.

A l t h o u g h this rush has now slackened, t h e r e remains considerable

uncertainty as to the future d e v e l o p m e n t of the uranium industry.

Inasmuch as fuel being used to m a k e nuclear explosives accounts

for only a marginal s h a r e of total uranium d e m a n d , neither escalation of the nuclear arms race nor nuclear d i s a r m a m e n t would exert a

big effect on total d e m a n d .

A very considerable level of secrecy pervades the uranium

industry. T h e only national system which is relatively transparent is

the US o n e ; the Soviet system is especially o p a q u e , as is also that of

C h i n a . Major reserves are k n o w n to exist in Australia, South

Africa, and C a n a d a (table 4.2), although the USSR and China are

also thought to have large reserves. As regards current p r o d u c t i o n ,

the U S A heads the list, with South Africa and C a n a d a not far

behind (table 4.2). H o w e v e r . US production is at present declining

owing to a c o m b i n a t i o n of reduced d e m a n d and environmental

c o n c e r n s , so that C a n a d a will probably soon become the largest

producing country in the capitalist world. As there is a long lead

time from initiating uranium production to achieving an o u t p u t in

the form of fuel, changes do not take place rapidly. It is expected

that in the 1990s and 2000s the US nuclear industry will be importing

up to 35 per cent of its total uranium c o n s u m p t i o n , largely from

C a n a d a , as c o m p a r e d with an import level of less than 10 per cent in

the 1970s and early 1980s ( R e a g a n , 1984). J a p a n , F r a n c e , and FR

G e r m a n y are the current major importers (table 4.2).

U r a n i u m extraction and manufacture are tightly regulated. S o m e

90 per cent of all sales are covered by long-term (at least 10-year)

contracts, often containing restrictive clauses. Only a small proportion of these contracts are m a d e without g o v e r n m e n t a l participation. T h e structure of the m a r k e t and the high strategic importance

of the products imply that there is no world price. This only goes to

e m p h a s i z e that availability and security of supply are considered by

most users as being much more important than price. Price competitiveness m a y , h o w e v e r , be important for small utilities and for

those w h o c o m p e t e directly with o t h e r energy p r o d u c e r s .

A considerable part of uranium production is controlled through

vertical integration and by c o n g l o m e r a t e s . Nuclear energy prod u c e r s ( e . g . . the Westinghouse C o r p o r a t i o n in the U S A and C o m pagnie G^ndrale d'Electricitd in France) and energy diversifies or

c o n g l o m e r a t e s ( e . g . , Exxon in the U S A ) are therefore to s o m e

Minerals

79

extent involved in u r a n i u m production. T h e r e are also some socalled u r a n i u m i n d e p e n d e n t s ( e . g . , A m e r i c a n Nuclear). Finally

t h e r e are the c o n g l o m e r a t e mineral p r o d u c e r s , some of which are

also vertically integrated. T h e most important ones are the Anglo

A m e r i c a n C o r p o r a t i o n of South Africa, the Rio Tinto Zinc Corporation in the U n i t e d K i n g d o m , and the N e w m o n t Mining Corp o r a t i o n in the U S A . T h e two former control practically all of the

c o m b i n e d production in South Africa (including N a m i b i a ) , A n g l o

A m e r i c a n being the leading p a r t n e r in N U F C O R , the South African m a r k e t i n g cartel. Cross-ownership or minority ownership link

several of the large c o r p o r a t i o n s , facilitating co-ordination and coo p e r a t i o n . An international cartel was organized in 1972 (with

h e a d q u a r t e r s in Paris) a m o n g uranium p r o d u c e r s in Australia,

C a n a d a , F r a n c e , FR G e r m a n y , and the U S A which is said to have

organized a market-sharing a g r e e m e n t that for several years led to

major price increases ( B e t h e l , 1977). Since Rio T i n t o Zinc is also

strong in Australia (the country which has e x p a n d e d production the

most since the 1970s), the A n g l o A m e r i c a n - R i o T i n t o Zinc link

must be considered a vital o n e in future world trade in u r a n i u m .

US u r a n i u m p r o d u c e r s have formed N U E X C O , w h e r e a s most of

the o t h e r c o r p o r a t e producers are m e m b e r s of the U r a n i u m

Institute in L o n d o n . T h e role of the U r a n i u m Institute is not well

k n o w n , but it probably serves as a co-ordinating unit and information pool, p e r h a p s even as a quasi-cartel. It can be assumed to have

s o m e influence over t h r e e of the main uranium trade routes: from

s o u t h e r n Africa to W e s t e r n E u r o p e and J a p a n ; from Australia to

J a p a n and the U n i t e d K i n g d o m ; and from C a n a d a to Western

E u r o p e . H o w e v e r , some of the producing countries are not

regulated by the 1968 T r e a t y on the Non-Proliferation of Nuclear

W e a p o n s (for which see G o l d b l a t , 1982, pages 172-74) and this may

have an important effect on the international m o v e m e n t of

u r a n i u m . T h u s the uranium regime a p p e a r s able to secure longterm supplies of uranium for enrichment facilities throughout the

capitalist world. H o w e v e r , it must be considered weak when it

c o m e s to providing security against military applications or against

leakages that t h r e a t e n the e n v i r o n m e n t during extraction and

manufacture.

T h e French sub-system could b e c o m e a n o t h e r dynamic factor in

the uranium industry (Rydell & Mullins, 1981). France itself has

e x p a n d e d p r o d u c t i o n . M o r e importantly, French interests are

80

Global

resources

and

international

conflict

d o m i n a n t in what is a rapidly growing level of production in t h r e e

African countries with no domestic d e m a n d , but apparently with

considerable reserves: Niger, the Central African Republic, and

G a b o n . I n d e e d , m o r e than one-third of the national budget of

Niger now rests on its income from uranium (Rydcll & Mullins,

1981, page 34). Supplies to FR G e r m a n y arc provided through joint

ventures within the French s u b s y s t e m together with producers in

s o u t h e r n Africa and C a n a d a . Japan has organized its imports in

closely woven relations with producers in Australia and South

Africa.

A fear in the mid-1970s over supply shortages in the capitalist

world has led to a situation of world-wide over-supply. In 1983,

k n o w n stocks r e p r e s e n t e d more than t h r e e years of c o n s u m p t i o n .

T h e great g a p between forecasted and actual r e q u i r e m e n t s in the

recent past is a warning that future d e v e l o p m e n t s , even when

restricted to the capitalist world, can only be guessed very roughly.

F r o m a strategic point of view, the dynamic factors of i m p o r t a n c e

in relation to uranium are: (a) the evolution of the East-West

political climate and the arms race; (b) the extent to which the

policies of countries with a potential to d e v e l o p nuclear explosives

can be controlled or at least foreseen; and (c) the d e v e l o p m e n t s in

s o u t h e r n Africa. All of these factors can exert pressures on the

u r a n i u m industry and lead to conflicts over access to supplies or

over a t t e m p t s to deny such access.

VII.

Conclusion

This c h a p t e r shows the extent and importance of strategic considerations vis-d-vis those minerals which are seen as critical to

military as well as national e c o n o m i c interests. Although there are

few e x a m p l e s of direct violent intervention to control sources of

mineral supply, there is a clear potential for such conflict. T h e

volatile situation in s o u t h e r n Africa is pointed to as being especially

important in this regard. T h e military and political-ideological

competition b e t w e e n the U S A and USSR and the e c o n o m i c competition a m o n g the major powers are both additional factors of

great i m p o r t a n c e .

C h a n g e s in d e m a n d and the potential for adjustment domestically are a m o n g those factors which influence the strategic mineral

industries. H o w e v e r , all of the three minerals which are given

Minerals

81

special attention h e r e remain indispensible for military and civilian

p u r p o s e s , at least for the next 10 to 15 years. Technological

d e v e l o p m e n t s and m e a s u r e s of stockpiling can alleviate, but not

entirely eliminate, this d e p e n d e n c e . A n d , as most major p o w e r s are

d e p e n d e n t upon mineral imports, the crucial dimension in policym a k i n g is, and will continue to b e , foreign policy.

For mineral-producing countries in the Third W o r l d , it is of

particular importance that their exports continue in o r d e r to provide t h e m with highly necessary income. For mineral-poor

c o u n t r i e s , it is of particular i m p o r t a n c e that their imports continue

in o r d e r to maintain their industries. Multilateral a g r e e m e n t s to

m e e t both of these needs would reduce international tensions and

are thus a prerequisite for ultimate world d i s a r m a m e n t ( H v e e m &

M a l n e s . 1980).

If a t t e m p t s are m a d e to m a k e access to foreign sources of supply

m o r e difficult, c o u n t e r m e a s u r e s can be expected that could in time

lead to o p e n conflict. T h e possibility that this will h a p p e n is a

function of: (a) the E a s t - W e s t relationship; (b) policies of control

over natural resources in producing countries, (c) the extent and

form of c o r p o r a t e control o v e r p r o d u c t i o n , m a r k e t i n g , and distribution; and (d) the d e v e l o p m e n t of new sources of supply. In the

short- to m e d i u m - t e r m pespective, even the i m p o r t - d e p e n d e n l

countries a p p e a r to be in a good position to secure suppliers

because: (a) they maintain close diplomatic and e c o n o m i c relations

with many of the resource-surplus countries; (b) many of the

c o r p o r a t i o n s running the mineral industry are home-based in—and

to a considerable extent d e p e n d e n t upon the assistance of—the

countries which they mainly supply; ( r ) much of the international

t r a d e is tightly controlled in the form of long-term contracts or intrafirm t r a d e ; and (d) the probability is not great that an o p p o n e n t will

intervene in their transportation routes.

In closing, Iwo points stand out: (a) that the weak link in the

mineral supply chains is southern Africa; and (b) that the volatility

of mineral supply and d e m a n d could add to the competition a m o n g

the major powers and thus to the potential for international

conflict.

82

Global

resources

and

international conflict

Minerals

83

84

Global

resources

and

international conflict