STK4510 - Mandatory Assignment

advertisement

STK4510 - Mandatory Assignment

Sindre Froyn

Exercise 1

(a)

Matlab code for calculating the expectation and volatility for the Dow Jones

index (using closing prices from 1. October 2005 to 2. October 2010).

1

2

3

% Input from the file 'data.txt'

[Date,Open,High,Low,Close,Volume,Adj] = ...

textread('data.txt', '%s %f %f %f %f %d %f');

4

5

6

% Storing the closing prices in the vector s

s = Close(end:−1:1); %(flipping the vector)

7

8

9

10

% Defining vectors

y = zeros(length(s),1);

x = zeros(length(s),1);

11

12

13

14

15

16

% Calculating the return y and logreturn x

for i=2:length(s)

y(i) = (s(i) − s(i−1))/s(i−1);

x(i) = log(s(i)) − log(s(i−1));

end

17

18

19

20

% Finding the expectations (mean) and volatility (std)

my = mean(y);

voly = std(y);

mx = mean(x);

volx = std(x);

After running this code, we get the results:

Matlab

>> my

my =

1.2440e-04

>> mx

mx =

2.1876e-05

>> voly

voly =

0.0143

>> volx

volx =

0.0143

1

(b)

1

2

3

4

5

[Date,Open,High,Low,Close,Volume,Adj] = ...

textread('data.txt', '%s %f %f %f %f %d %f');

s = Close(end:−1:1);

N =length(s);

i=1;

6

7

8

% Temporary storage vector

x = zeros(100,1);

9

10

11

12

% Mean and std for rolling average vector

meanravg = zeros((N−99),1);

stdravg = zeros((N−99),1);

13

14

15

16

17

18

% Running through 's' and retrieving subvectors of length 100

% For each subvector we calculate mean and std

while (i+99) ≤ N

sub = s(i:(i+99));

19

% Logarithmic return for each subvector

for j=2:length(sub)

x(j) = log(sub(j)) − log(sub(j−1));

end

20

21

22

23

24

%Caculating the rolling average mean and std

meanravg(i) = mean(x);

stdravg(i) = std(x);

i=i+1;

25

26

27

28

29

end

30

31

32

33

% Finding the expectation and std for the series of estimates

meanseries = mean(meanravg);

stdseries = std(stdravg);

>> meanseries

Matlab

meanseries =

-3.1656e-05

>> stdseries

stdseries =

0.0077

2

Closing Prices dji

4

1.5

x 10

Rolling Volatility

0.035

1.4

0.03

1.3

0.025

1.2

1.1

0.02

1

0.015

0.9

0.01

0.8

0.005

0.7

0.6

0

200

400

600

800

1000

1200

0

1400

0

200

400

600

800

1000

1200

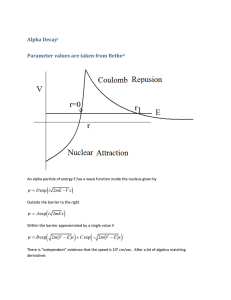

In the left plot we have the vector s, which are the closing prices for the dji

index, and in the right plot we have the rolling 100 day volatilities, stdravg.

On the left plot we can clearly see the effects of the 2009 financial crisis as the

index fell down beneath the 7000-mark. In our 100 day volatility estimations,

we can see how the the volatility peaks at the financial crisis.

Exercise 2

(a)

We are working with the Vasicek model,

drt = (µ − αrt )dt + σdBt .

Given rt , we are going to use Ito’s formula to compute rs . We set g(s, rs ) =

eαs rs , multiplying the process rs with the integrating factor. Calculating the

partial derivatives for g(s, x):

∂g

= αeαs x,

∂s

∂2g

= 0.

∂x2

∂g

= eαs ,

∂x

By Ito’s lemma,

∂g

∂g

1 ∂2g

(s, rs )ds +

(s, rs )drs + · 2 (s, rs )(drs )2

d g(s, rs ) =

∂x

2 ∂x

∂s

d g(s, rs ) = αeαs rs ds + eαs drs + 0

d g(s, rs ) = αeαs rs ds + eαs µds − αrs ds + σdBs

d g(s, rs ) = µeαs ds + σeαs dBs .

We rewrite in the differential form and use that g(s, rs ) = eαs rs ,

Z s

Z s

αs

αu

e rs = r0 +

µe du +

σeαu dBu .

0

(1)

0

The exact same calculations with t instead of s yields:

Z t

Z t

αt

αu

e rt = r0 +

µe du +

σeαu dBu .

0

0

3

(2)

We take expression (1) minus expression (2).

Z s

Z s

Z t

Z t

αs

αt

αu

αu

αu

e rs − e rt =

µe du +

σe dBu −

µe du −

σeαu dBu .

0

0

eαs rs = rt eαt +

Z

0

s

µeαu du +

t

Z

0

s

σeαu dBu .

t

Multiplying both sides with e−αs we get an expression for rs when rt is known.

Z s

Z s

−α(s−t)

−α(s−u)

rs = rt e

+

µe

du +

σe−α(s−u) dBu

t

t

To find the stationary distribution for rs we return to equation (1), and

calculate the deterministic integral.

Z s

Z s

αs

αu

e rs = r0 +

µe du +

σeαu dBu .

(1)

0

µ

Z

s

eαu du = µ

0

0

1 αu

e

α

s

0

=

µ αs µ

e − .

α

α

Replacing this in (1) and multiplying both sides with e−αs :

Z s

µ αs µ

αs

σeαu dBu .

e rs = r0 + e − +

α

α

0

Z s

µ µ −αs

−αs

−αs

rs = r0 e

+ − e

σeαu dBu

+e

α α

0

Z s

µ

µ

−αs

−αs

+e

r0 −

σeαu dBu

rs = + e

α

α

0

Taking the expectation: the expected value of a stochastic integral is 0.

µ

µ s→∞ µ

E[rs ] = + e−αs r0 −

−→

(3)

α

α

α

To calculate the variance we first calculate E[rs2 ], and we set A = µ/α,

B = e−αs (r0 − µ/α) and denote the stochastic integral as I. We use that all

the terms including I will have expectation 0 except I 2 . We use the linearity

of the expectation and that A and B are deterministic.

2 E[rs2 ] = E A + B + I

= E A2 + 2AB + B 2 + I 2 = A2 + 2AB + B 2 + E[I 2 ]

We use Ito isometry, and the expectation of the integrand is unchanged since

it is deterministic.

Z s

Z s

h

2 i

2

−αs

αu

−2αs

E[I ] = E e

σe dBu

=e

σ 2 e2αu du

0

0

4

σ2

σ 2 −2αs 2αs

1 − e−2αs .

e

e −1 =

0

2α

2α

2α

Now, when we let s → ∞ all the terms including B will tend to 0, and

E[I 2 ] → σ 2 /2α.

µ2

σ2

lim E[rs2 ] = A2 + E[I 2 ] = 2 +

.

s→∞

α

2α

We can now easily find the variance of rs , for s → ∞:

= e−2αs

h σ2

e2αu

Var[rs ] =

is

=

E[rs2 ]

µ2 σ 2

µ2

σ2

− E[rs ] = 2 +

−

=

2α α2

2α

α

2

These parameters

indicate rs has a normal stationary distribution, that is

µ σ2

rs ∼ N α , 2α .

(b)

From (a) we have:

rs = rt e

−α(s−t)

+

Z

s

µe

−α(s−u)

du +

t

Z

s

σe−α(s−u) dBu .

t

Calculating the deterministic integral

Z t

Z s

µ

−α(s−u)

−αs

eαu du = (1 − e−α(s−t) )

µe

du = µe

α

s

t

yields

Z s

µ

−α(s−t)

)+

σe−α(s−u) dBu .

rs = rt e

+ (1 − e

α

t

We integrate this expression for rs from t to T .

Z T

Z T

Z T

Z TZ s

µ µ −α(s−t)

−α(s−t)

rs ds =

rt e

ds +

− e

ds +

σe−α(s−u) dBu ds

α

t

t

t α

t

t

−α(s−t)

Calculating each term separately.

Z T

rt

rt e−α(s−t) ds = (1 − e−α(T −t) )

α

t

Z T

µ

µ

µ µ −α(s−t)

− e

ds = (T − t) + 2 (1 − e−α(T −t) )

α

α

α

t α

For the last term we use change of integral order and apply stochastic Fubini

so we can interchange the deterministic and stochastic integration variables.

Z TZ s

Z TZ T

−α(s−u)

σ

e

dBu ds = σ

e−α(s−u) dsdBu

t

t

t

5

u

We can calculate the inner, deterministic integral.

Z T

1

e−α(s−u) ds = (1 − e−α(T −u) )

α

u

Z T

Z

rt

µ

µ

σ T

−α(T −t)

−α(T −t)

rs ds = (1−e

(1−e−α(T −u) )dBu

)+ (T −t)+ 2 (1−e

)+

α

α

α

α t

t

Calculating the mean and variance. In the expectation the stochastic integral

is 0, and the rest of the expression is deterministic.

Z T

µ

µ

rt

E

rs ds = (1 − e−α(T −t) ) + (T − t) + 2 (1 − e−α(T −t) )

α

α

α

t

To calculate the variance we first square the expression. Denoting the

part as A and the integral as I we get the shorthand expression

Rdeterministic

T

rs ds = A + I. Hence (A + I)2 = A2 + 2I + I 2 . Taking the expectation of

t

RT

this gives E[( t rs ds)2 ] = E[A2 ] + E[I 2 ]. To calculate the variance, we use:

Var

Z

T

rs ds = E[(A + I)2 ] − E[A + I]2 = E[A]2 + E[I 2 ] − E[A]2 = E[I 2 ].

t

The variance is the expectation of the squared stochastic integral. To

calculate it we apply Ito isometry, and using that the expection of the

deterministic integrand is just the integrand:

" Z

2 #

Z

T

σ

σ2 T

2

−α(T −u)

E[I ] = E

(1 − e

)dBu

= 2

(1 − e−α(T −u) )2 du

α t

α t

Intermediate calculation:

Z T

Z

−α(T −u) 2

(1 − e

) du =

t

T

1 − 2e−α(T −u) + e−2α(T −u) du =

t

2

1

(T − t) − (1 − e−α(T −t) ) +

(1 − e−2α(T −t) ) =⇒

α

2α

Z T

σ2

Var

rs ds = E[I 2 ] = 3 2α(T − t) + 4e−α(T −t) − e−2α(T −t) − 3

2α

t

6

(c)

We are going to calculate

Z

P (t, T ) = 100E exp −

T

rs ds

t

Ft

RT

We use that t rs ds is normally distributed, so this expression equals the

exponential function of the conditional expectation and variance.

Z T

Z T

1

P (t, T ) = 100 exp −E

rs ds + Var

rs ds

2

t

t

The expectation and variance were found in b), and have the expression (with

b(t, T ) = (1 − e−α(T −t) ) and ignoring 100 for now).

µ

µ

σ2

rt

−α(T −t)

−2α(T −t)

−e

−3

exp − b(t, T ) − (T − t) − 2 b(t, T ) + 3 2α(T − t) + 4e

α

α

α

4α

−α(T −t)

After some algebra, and by defining B(t, T ) = ( 1−e α

), we get

σ2

σ2 µ

2

B(t, T ) − T + t −

−

B(t, T )

P (t, T ) = 100 exp −B(t, T )rt +

α 2α2

4α

(d)

Plotting for different values of µ, α, σ and rt .

1

2

3

4

5

6

T = 150; P = zeros(4,T);

r_t

= [0.03

0.52

0.2

mu

= [0.34

0.026

0.024

sigma = [0.63

0.025

0.36

alpha = [1.2

3

0.4

col

= ['r',

'k',

'b',

0.05];

0.022];

0.015];

0.9];

'g'];

7

8

9

10

11

12

13

14

15

16

17

18

19

20

for j=1:4

for i=1:T

B = (1 − exp(−alpha(j)*(1−(T−i)/T)))/(alpha(j));

f1 = (mu(j)/alpha(j) − sigma(j)^2/(2*alpha(j)^2));

f2 = sigma(j)^2/(4*alpha(j));

% This is the expression for P(t,T)

P(j,i) = 100*exp(−B*r_t(j) + f1*(B−1+(T−i)/T) − f2*B^2);

end

end

figure; hold on;

for i=1:4

plot(P(i,:), col(i))

end

7

100

98

96

94

92

90

88

86

84

0

50

100

150

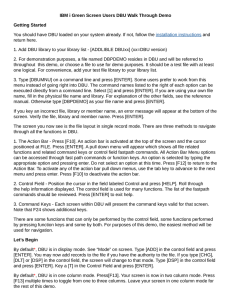

These are the plots for same arbitrarily chosen values. From the code r, k, b

and g correspond to red, black, blue and green, respectively.

(e)

We will consider the 6 month data for NST469: a Norwegian government

bond, downloaded from oslobors.no (from 26.4.10 to 25.10.10).

1

2

Q = textread('rente.txt', '%f');

R = Q/Q(1);

% P*−data

% Scaling down

3

4

5

6

7

8

T

P

sigma

r_t

min

=

=

=

=

=

length(R);

zeros(1,T);

(0.02:0.04:2);

0.03;

999;

Pm

= zeros(1,T);

mu

= (0.02:0.04:2);

alpha = (0.02:0.08:4);

% Assume r_t is set

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

for i=1:50

% Unelegant brute force method

for j=1:50

%

running time: ca. 3 min

for k=1:50

for t=1:T

B = (1 − exp(−alpha(k)*(1−(T−t)/T)))/(alpha(k));

f1 = (mu(i)/alpha(k) − sigma(j)^2/(2*alpha(k)^2));

f2 = sigma(j)^2/(4*alpha(k));

P(t) = exp(−B*r_t + f1*(B−1+(T−t)/T) − f2*B^2);

S=0;

% Finding the minimizing values

for n=1:T

S = S + abs(P(n) − R(n));

end

if S < min

min=S; Pm=P; par=[mu(i) sigma(j) alpha(k)];

end

end

end

end

end

8

1.005

NST469

Vasicek

1

0.995

0.99

0.985

0.98

0

10

20

30

40

50

60

70

80

90

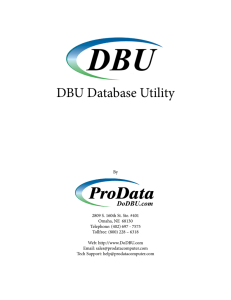

According to the plot, we can see that the Vasicek model catches the

general evolution of the bond, but it does not capture the short time

variations, and as we can see these differences can sometimes be significant.

However, a model that is more flexible would necessarily incorporate more

variables and would as a result be harder to work with.

Exercise 3

(a)

Using Ito’s formula, we are going to find the dynamics, dSt , of the Schwartz

model,

St = S0 eXt

where

dXt = µ − αXt dt + σdBt .

Using g(t, x) = ex , we find the partial derivatives,

∂g

= 0,

∂t

∂2g

= ex .

∂x2

∂g

= ex ,

∂x

Applying Ito’s integral.

1

d g(t, Xt) = S0 eXt dXt + S0 eXt (dXt )2 .

2

The expression for dXt is given.

2

1

= S0 eXt (µ − αXt dt + σdBt ) + S0 eXt (µ − αXt dt + σdBt

2

Using the calculation rules dt2 = dtdBt = dBt dt = 0 and dBt2 = dt,

(µ − αXt )dt + σdBt

9

2

= σ 2 dt.

By replacing this and collecting dt and dBt parts, we get

1

= S0 eXt (µ − αXt dt + σdBt ) + S0 eXt σ 2 dt, =⇒

2

1 dSt = S0 eXt µ − αXt + σ 2 dt + σdBt .

2

Xt

We can also use St = S0 e , which means Xt = ln St /S0 , so

dSt = µ − α ln

1 St

+ σ 2 St dt + σSt dBt .

S0 2

(b)

We are going to compute f (t, T ) = E[ST |Ft ].

1

XT

f (t, T ) = E S0 exp(XT ) Ft = S0 E[e |Ft ] = S0 exp E[XT |Ft ] + Var[XT |Ft ]

2

Now we observe that Xt is a Vasicek model, like we worked with in exercise

2. We derived the expectation and variance, but now we need the conditional

expectation and variance.

µ µ −α(T −t)

e

E[XT |Ft ] = + Xt −

α

α

σ2

(1 − e−2α(T −t) )

2α

Hence, we have an explicit expression for f (t, T ).

µ −α(T −t) σ 2

µ −2α(T −t)

e

+

+ Xt −

(1 − e

)

f (t, T ) = S0 exp

α

α

2α

µ

σ2

−α(T −t)

−2α(T −t)

−α(T −t)

.

= S0 exp

(1 − e

)+

(1 − e

) + Xt e

α

2α

Var[XT |Ft ] =

To calculate the dynamics, df (t, T ), we simply define g(t, Xt) = f (t, T ), and

by Ito’s formula:

df (t, T ) =

∂g

∂g

1 ∂2g

(t, Xt )dt +

(t, Xt )dXt + · 2 (t, Xt )(dXt )2 .

∂t

∂x

2 ∂x

Finding the partial derivatives for g(t, x).

∂g

1 2 −2α(T −t)

−α(T −t)

−α(T −t)

(t, x) = g(t, x) −µe

− σ e

+ αxe

∂t

2

10

(4)

∂2g

∂g

∂g

(t, x) = g(t, x)e−α(T −t) ,

(t, x) =

(t, x)e−α(T −t) = g(t, x)e−2α(T −t)

2

∂x

∂x

∂x

Now to shorten the notation, we define a = α(T − t) and g = g(t, Xt ).

Plugging the partial derivatives, the process dXt and (dXt )2 (which we found

in a) into (4):

σ 2 −2a

σ2

−a

−a

df (t, T ) = g −µe − e

dt+ge−a (µdt − αXt dt + σdBt )+ ge−2a

+ αXt e

2

2

Almost everything cancels out nicely, and we are left with:

df (t, T ) = ge−a σdBt = f (t, T )σe−α(T −t) dBt .

We can write this out in integral form (and define the integrand as A(u))

Z t

Z t

−α(T −u)

f (t, T ) =

f (u, T )σe

dBu =

A(u)dBu .

0

0

By corollary 3.26 in Øksendal all pure stochastic integrals are martingales,

so f (t, T ) is a martingale.

At time t = T , we get

f (T, T ) = E[S(T )|FT ] = S(T ).

The spot price S(T ) is measurable with respect to FT so we can factor it

out of the expectation, so the spot equals the price of the commodity when

t = T.

(c)

We are going to compute

p(t, τ, T, K) = exp(−r(τ − t))E max f (τ, T ) − K), 0 Ft

I ran out of time, so this part remains unanswered.

11