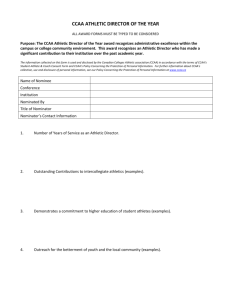

Raccoon and Squirrel Size CCAAs Albert Einstein

advertisement

Raccoon and Squirrel Size CCAAs In matters of truth and justice, there is no difference between large and small problems. Albert Einstein While they don’t build zoos for raccoons and squirrels, and safaris tend not to seek out these tree-climbing varmints, there is no doubt that they can lead interesting lives away from the attention of the madding crowds. As in wildlife, so too in law: while the crowds line up to watch Nortel and Indalex perform their circus acts, back on the proverbial suburban boulevards of CCAA practice important trends are being played out and new concepts are tested on a daily basis. We have selected six recent, smaller CCAA proceedings to highlight developments that might have escaped the focused attention of a majority of insolvency practitioners. From Critical Supplier concerns to the difficulties facing Monitors in meeting their burgeoning list of often irreconcilable duties, these cases demonstrate that many issues of practical significance can be found in small packages. In our view, these are all nuts worth storing away. Re Winalta Inc., 2011 ABQB 399 (“Winalta”) The CCAA Monitor as a Fiduciary Historically, Monitors were appointed in a purely watchdog role, and even then only in select proceedings. The role was codified in 1997, and then expanded through the 2009 CCAA amendments to the Companies’ Creditors Arrangements Act (“CCAA”). It is now not unusual to find a Monitor empowered with quasi-Receiver functions, responsible to effect a sale of the debtor’s assets, while concurrently serving as the Court’s trusted, objective observer. With this expansion of roles, the lines between a Monitor’s duties to the various stakeholders can become blurred. Recent calls for the appointment of more than one financial professional in complex proceedings – an advisor to the debtor, and a Monitor acting as an officer of the Court – highlight the difficult balancing act confronting a Monitor. Yet, even with the increased reliance upon Monitors and resulting enhanced potential for conflicts to arise, there has been limited specific judicial consideration of the Monitor’s role as a fiduciary. Courts have, of course, rendered broad pronouncements confirming that a Monitor is the Court’s officer and agent, and therefore responsible and accountable to the Court. They have cautioned that Monitors owe a fiduciary duty to all parties and an obligation to ensure that one creditor is not given an advantage over any other creditor. In United Used Auto & Truck Parts Ltd., Re (1999), 12 C.B.R. (4th) 144 (B.C.S.C. [In Chambers]), Tysoe J. observed that the Monitor has an obligation to act independently and to consider the interests of the debtor and its creditors. Other decisions have gone so far as to state that the Monitor’s sole responsibility is to the Court, and that the Monitor must avoid falling under the influence of the shareholders or the creditors. (Stokes Building Supplies Ltd., Re (1999), 13 C.B.R. (3d) 10 (Nfld. T.D.)). Sections 23 and 25 of the CCAA provide general guidance to Monitors, reminding them to act honestly and in good faith, and to report their observations in an even-handed manner. SDD/3381042.02 2 However, no Court has so directly addressed the conduct of a Monitor as the recent Alberta Court of Queen’s Bench decision in Winalta. The underlying facts of the case are unremarkable. Under the terms of a forbearance agreement made with HSBC Bank Canada (“HSBC”) in November 2009, the Winalta group of companies (“Winalta”) authorized HSBC to retain Deloitte & Touche Inc. (“Deloitte”) for a financial review. Under the terms of its loan agreements, Winalta was responsible to pay the accounts of Deloitte. In April 2010, with the support of HSBC (which included a commitment to fund ongoing operations under the existing credit facilities), Winalta obtained an initial Order under the CCAA, with Deloitte acting as Monitor and specifically authorized to provide to HSBC any financial reports generated by Winalta (these being conditions of HSBC’s support). Winalta also agreed that it would retire its indebtedness to HSBC by October 31, 2010. HSBC, the Court noted, was “clearly…in the position of power.” Winalta prepared regular cash flow statements, and as permitted under the Initial Order, the Monitor provided these to HSBC. However, the Monitor also utilized the information contained in these reports, coupled with its own analysis of projected liquidation values and disposition costs, to generate Net Realization Value Reports (referred to in the decision as “NVR”) for the exclusive benefit of HSBC. The purpose of these reports was to enable HSBC to determine whether to continue to support the CCAA proceedings, or to seek a Receivership Order. The NVR prepared in September 2010 was of specific concern to Winalta. By that point, Winalta had arranged conditional refinancing to take out HSBC, but was seeking funding from HSBC to defray the takeout financing costs. However, HSBC declined to provide such funding as a result of Deloitte’s comments in the September NVR. Fortunately, Winalta was able to secure funding from another source, and its plan of arrangement was implemented on October 22, 2010. When the Monitor sought Court approval of its fees, Winalta opposed the application, in part due to its assertion that Deloitte breached its fiduciary duty by preparing and delivering the September NVR to HSBC, without Winalta’s knowledge or consent. It also disputed the Monitor’s accounts as being unreasonable in relation to the services provided. In holding that it had breached its fiduciary duty to Winalta, the Court noted that the Monitor had exceeded its statutory and court-ordered authority, both in conducting the analysis resulting in the September NVR, and in providing that report to HSBC without Winalta’s approval. This, the Court ruled, was inconsistent with the Monitor’s duty to ensure that no creditor has an advantage over another. The Court also concluded that the Monitor did not conduct itself in an open and transparent manner, and that its actions in preparing the September NVR, and delivering it to HSBC, placed it into conflict with Winalta. SDD/3381042.02 3 In making its findings, the Court reflected upon the seriousness of the allegations, and provided a framework to be followed when such matters are raised against a Monitor. The process, which must involve a “careful investigation”, should include the following steps: 1. A review of the Monitor’s duties and powers as defined by the CCAA and court orders relevant to the allegation; 2. An assessment of the monitor’s actions in the contextual framework of the relevant provisions of the CCAA and court orders; 3. If the monitor failed to discharge its duties, or exceeded its powers, the court should then: a. Determine if damage is attributable to the monitor’s conduct, including damage to the integrity of the insolvency system; and b. Ascertain the appropriate fee reduction (bearing in mind that other bodies are charged with the responsibility of ethical concerns arising from a CCAA monitor’s conduct). In this case, the Court observed that the Monitor “lost sight of the bright line separating its duties as an impartial court officer and a private consultant to HSBC…”, giving rise to an appearance of bias. In the circumstances, the Court was of the view that the Monitor should have had concerns, and should have sought direction from the Court, before preparing and delivering the September NVR. While the Court had no evidence before it of specific damage resulting from the Monitor’s breach, and therefore was not in a position to make an award to Winalta, it did not reject the prospect out of hand. The Court was, however, able to conclude that the Monitor’s breach had injured the reputation of the insolvency system, and relied upon that conclusion to deprive the Monitor of any fees related to the September NVR. The court also canvassed the compensation claimed by the Monitor; this is discussed in the next section of this paper. Conclusions: With the increasing scope of Monitors’ duties being authorized by Courts seeking creative resolutions to complex restructuring problems, there is a growing risk that a Monitor will unwittingly step into a conflict or innocently breach its fiduciary obligations. As the Court in Winalta observed, a Monitor must ensure that it understands the true nature of its powers, and this begins with the drafting of the Initial Order. If the Monitor is to assume additional powers as the proceeding progresses, it and its counsel must carefully consider the language of the empowering Order, and ensure that all the pieces fit within the overriding requirement that the Monitor act as a fiduciary in relation to all stakeholders. At each point where the Monitor decides to act, it must question where its authority lies, and who might be impacted by any proposed course. Where that self-analysis suggests that the express authority may not exist, or that the intended course may prejudice a stakeholder, the Monitor should consider taking another course, or seek directions before acting. SDD/3381042.02 4 Re Winalta Inc (supra) Re Tepper Holdings Inc. (2011) Carswell NB672 (N.B.Q.B.) (“Re Tepper”) Compensation of Professionals in CCAA Proceedings – Rubber Stamp No More In their article “A ‘Cost’-Benefit Analysis – Examining Professional Fees in CCAA Proceedings”, (2009) Ann. Rev. Insol. L. 5 (edited by J. Sarra), Stephanie Ben-Ishai and Virginia Torrie noted the paucity of judicial notice paid to the substantial fees paid to professionals in restructuring proceedings under the CCAA. The authors raised the alarm, and some judges have been persuaded to answer the bell. Two recent decisions – one involving the fees of a Monitor, another involving the fees claimed by the debtor’s counsel – suggest a changing landscape and a renewed focus by Courts on the bottom line. In Winalta, a Monitor applied to have its accounts approved following the successful implementation of a plan of arrangement. The debtor opposed the application, seeking a reduction of $275,000 for alleged overcharging and a further $75,000 reduction for the Monitor’s breach of its fiduciary duties (referred to above). In a thoughtful and comprehensive analysis of the factors to be considered on such an application, the Court drew from the jurisprudence applicable to bankruptcy and receivership proceedings, and concluded that the model applicable in CCAA practice should require no less integrity. The standard considerations set out in Federal Business Development Bank v. Belyea (1983) 46 C.B.R. (NS) 244 (N.B.C.A.) were accepted as being appropriate in CCAA proceedings. The Court rejected the Monitor’s submission that the opposing party must establish that the fees claimed are not appropriate (a “presumption of regularity”), and ruled that the onus would rest with the applicant Monitor to provide sufficient, cogent evidence to permit the determination of whether the fees claimed are fair and reasonable in all the circumstances. In particular, the Court would require evidence to establish that the Monitor’s insolvency practice billings are consistent with the industry standard, that the rates charged are appropriate in all instances, the value of the assets involved, the time spent, the difficulties encountered, the degree of knowledge, experience and skill demonstrated, the responsibilities assumed, and the results obtained. While noting that this process would not place the Monitor’s accounts under a microscope, the Court considered the evidence produced by the Monitor to have been completely inadequate – labeling service descriptions as “singularly laconic” – and directed the Monitor to return within 60 days with a more fulsome reckoning of its services. In Re Tepper, the debtors’ legal counsel suffered the indignity of having secured creditors’ consent to a continuation of a CCAA stay on the condition that the debtors’ law firm be removed, and its fees capped. The firm initially resisted its ouster, but ultimately the debtors SDD/3381042.02 5 retained new counsel, the extension was granted, and the secured creditors (supported by the Monitor) sought an Order capping the firm’s fees. The Court noted that the CCAA does not specifically authorize the assessment of remuneration claimed by professionals. However, relying upon the broad discretion inherent in s. 11, the Court concluded that it has the authority to assess any accounts in CCAA proceedings, where it is just and equitable to do so. The analysis of the firm’s accounts proceeded in the absence of evidence in support of its position – the report does not explain why the firm chose not to respond to the specific concerns raised by the applicants. The Court found that the firm had achieved some limited success for the debtors through the services it provided. However, it had failed in several material respects to advance the interests of the debtors, and was found to have misled the Court on the initial hearing, which proceeded ex parte, and in subsequent reports and submissions used to extend the stay of proceedings. In the result, the Court concluded that the firm’s conduct amounted to a serious dereliction of the duty it owed to the Court, and a disregard of the interests of justice. Its claim for fees was consequently reduced from the $506,686.06 claimed to $150,000.00. It should be noted that on a subsequent application by secured creditors and the Monitor, the firm was ordered to pay costs totalling $94,000.00 to compensate such parties for unnecessary costs incurred as a result of its misconduct. Conclusions: While these two cases are extreme examples, they do illustrate the need for insolvency professionals to carefully review and document their charges, and be prepared to explain them in a cogent and clear manner. We suspect that, given the substance of professional charges that can accrue in these proceedings, issues with respect to the scope and nature of those charges may be raised more frequently by Monitors and creditors. It would appear that Courts in CCAA proceedings are clearly armed with the necessary tools to address overly vigorous billing practices, and to hold counsel accountable for any misconduct that may be proven. Cow Harbour Construction Ltd. (“Cow Harbour”) Critical Suppliers Charges - Business as Usual? The concept of a critical supplier charge in the restructuring process was codified in the CCAA through the addition of section 11.4 in September 2009. This section provides: 11.4 (1) On application by a debtor company, the court may make an order declaring a person to be a critical supplier to the company if the court is satisfied that the person is a supplier of goods or services to the company and that those goods or services are critical to the company's continued operation. (2) If the court declares a person to be a critical supplier, the court may make an order requiring the person to supply any goods or services specified by the court to the SDD/3381042.02 6 company on any terms and conditions that are consistent with the supply relationship or that the court considers appropriate. (3) If the court makes an order under subsection (2), the court shall, in the order, declare that the property of the company is subject to a security or charge in favour of the person declared to be a critical supplier, in an amount equal to the value of the goods or services supplied under the terms of the order. (4) The court may specify in the order that the security or charge ranks in priority over the claim of any secured creditor of the company. Under subsection (1), the Court must be satisfied (on evidence, presumably) that goods or services provided to the debtor are “critical to the company’s continued operation” before it can declare a supplier to be a critical supplier. Use of this provision would not generally appear to be necessary in the case of a supplier bound under a continuing supply agreement, as such supplier would be precluded from terminating (by the initial Order, and by s. 34 of the CCAA). Accordingly, while it is not expressed in the Act, this provision would seem to be generally applicable only to suppliers who are not contractually bound to provide an ongoing supply of products or services, or circumstances of necessity (such as an inability to continue to provide services or supply without the charge). Subsection (2) provides that once a supplier has been declared by the Court to be critical, the Court is given a broad discretion to compel that supplier to continue to supply during the restructuring, under the existing contractual terms, or upon terms that the Court considers appropriate. There is no imperative that pre-filing claims be paid, and with the express authority to compel a critical supplier continue with its supply on terms “consistent” with the existing supply relationship, there is in law no need to pay pre-filing amounts. Moreover, subsection (3) limits the Court’s authority to grant security to a critical supplier to an “amount equal to the value of the goods or services provided under the terms of the order” – clearly suggesting a prospective, not retrospective, approach. This interpretation is consistent with the rationale for the inclusion of s. 11.4, as explained in the Industry Canada Briefing Book: Rationale Companies undergoing a restructuring must be able to continue to operate during the period. On the other hand, suppliers will attempt to restrict their exposure to credit risk by denying credit or refusing services to those debtor companies. To balance the conflicting interests, the court will be given the authority to designate certain key suppliers as "critical suppliers". The designation will mean that the supplier will be required to continue its business relationship with the debtor company but, in return, the critical supplier will be given security for payment. Subsection (1) provides that a court may designate a supplier to the debtor company to be a critical supplier. The designation should not be lightly granted but should only be made where the supplier is of such a nature that the debtor company would not be able to continue to operate without a continuing business relationship. SDD/3381042.02 7 Subsection (2) provides that a court may require a critical supplier to continue to supply goods and services to the debtor company. The court will have the authority to determine the appropriate terms and conditions of the business relationship, however, the court should look to the existing terms or, if necessary, the prevailing market terms. Subsection (3) stipulates that the court must provide the critical supplier with a security charge for the value of the goods or services supplied as a critical supplier. The provision is to ensure that the critical supplier is paid for its goods or services. Subsection (4) provides the court with the ability to determine the priority of the security charge. It is expected that the court will recognize the uniqueness of this situation and grant the critical supplier a high priority. There have been few instances to date where section 11.4 has been judicially considered, but in the Cow Harbour decision, the Alberta Court of Queen’s Bench approved a Critical Supplier Charge totalling $8 Million to avoid the filing of Builders’ Lien Claims by suppliers without, it appears, an analysis of the services being provided, or whether such services were, in fact, critical to the debtor’s continued operation. As events unfolded, the use of this broad definition, which was adopted to simplify the administration and facilitate a fast restructuring process, has resulted in serial litigation that continues despite the failure of Cow Harbour’s restructuring efforts. Cow Harbour provided overburden removal services to Alberta oil producers and, on April 7, 2010, it obtained an Initial Order under the CCAA. The Initial Order contained the usual provisions staying creditor claims, and the requirement that suppliers continue to provide goods and services in accordance with existing agreements. The Initial Order also contained provisions defining certain suppliers as “critical suppliers”, and establishing a Critical Supplier Charge totalling $8 Million. That Charge was given priority over all existing security interests, and was subordinate only to the Administrative Charge and the DIP Lender’s Charge. Despite the creation of the Critical Supplier Charge, it was expected by the debtor that all qualifying pre-filing claims would be paid out of anticipated cash flow. As matters developed, this expectation was not met, and any payments to Critical Suppliers for pre-filing claims will result only through the Critical Supplier Charge. The removal of overburden is preparatory to the removal of oil, and in Alberta is the type of work that is lienable. Persons who supplied material or provided services to Cow Harbour would qualify as lien claimants, and would be entitled to file lien claims. Cow Harbour was concerned to avoid the filing of liens against lands owned by its major customer, Syncrude, as they feared this would constitute a default under Cow Harbour’s agreement with Syncrude, potentially compelling Syncrude to shift its work to another contractor. For that reason, the Initial Order defined Critical Suppliers to mean persons who, but for the Order, would be entitled to file a valid enforceable builders’ lien under the laws of the Province SDD/3381042.02 8 of Alberta on any of the lands upon which Cow Harbour worked or furnished material in respect of any improvement. This definition, it appears, was adopted without any evidence or analysis as to whether: the individual suppliers having lienable claims were, in each case, in fact “critical” to the ongoing operations of Cow Harbour; or the individual suppliers were contractually obligated to continue with their supply agreements in the absence of the Critical Supplier Charge. The Court accepted the debtor’s assertion that if the creditors with lienable claims were to file liens, Cow Harbour’s cash flow would cease and Cow Harbour’s continued existence would be threatened, and accepted the proposed use of a Critical Suppliers Charge to remove that threat. The use of s. 11.4 to deal with potential lien filings in this way was certainly novel and arguably inconsistent with the origins and objectives of the 2009 amendments. In addition, the definition of Critical Supplier adopted by the Court was itself problematic. In particular, there was no contemplation that the definition of Critical Supplier could include lessors under capital leases, and that rather than simplifying the issue, the determination as to who would qualify by establishing a valid lien claim under Alberta Builders’ Lien legislation would become a time consuming, complex and costly affair. Ultimately, the value of potential claims vastly exceeded the Critical Suppliers’ Charge of $8 Million, with submitted claims exceeding $50 Million. Cow Harbour was ultimately unable to present a Plan, and on August 25, 2010 the CCAA stay was terminated, and PricewaterhouseCoopers Inc. was appointed as Receiver. Upon the application of the Receiver, a Critical Trade Suppliers Claims Process Order was issued on January 12, 2011. To address the preliminary question of whether any of the capital or financing lease claims would qualify as lien claims (and therefore as Critical Supplier claims), the Court also issued a Critical Equipment Suppliers Claims Process Order. For each potential lessor claim, this issue was determined through the Receiver’s assessment as to whether the leases were “true leases”, or equipment financing agreements. Through that process, the number and quantum of qualifying lessor claims was significantly reduced. Several lessors appealed the Receiver’s determination that their leases are not “true leases”; the appeals were heard in November 2011, and as of the date of writing, decisions are pending. The Receiver concurrently administered a claims process in relation to the Critical Supplier claims of trade creditors, and claims totalling $5,372,098.79 were accepted by the Receiver. As of the date of writing, one partially disallowed claim, totalling $645,956.03, remains under appeal. Conclusion: Quite apart from the quagmire created by the use of the lien claim definition (a useful reminder that unintended consequences can undermine even the best of intentions), the Cow Harbour case offers an interesting example of the potential use of the critical supplier SDD/3381042.02 9 provisions. In particular, it is questionable whether the Critical Supplier Charge was an appropriate way to deal with the looming lien issue, or whether the Court should have granted the Charge without requiring specific evidence on whether each supplier who benefitted from the Charge was critical in fact. Additionally, we suggest that the payment of pre-filing claims without any analysis of each supplier’s contractual obligation to provide materials/services misses the point of the 2009 amendments to the CCAA. Re: Blackburn Developments Ltd., 2001 BCSC 1671 (“Blackburn”) Assembling of Creditor Claims in CCAA Proceedings The acquisition of unsecured creditor claims for the purpose of blocking a restructuring plan in CCAA proceedings was found to be acceptable in a recent decision of the Supreme Court of British Columbia. In the Blackburn case, the debtor was a real estate developer that had undertaken a large residential development near Chilliwack, B.C. When it filed for CCAA protection, it had liabilities exceeding $80 Million. Blackburn had two potential refinancing sources: its real property holdings, and potentially valuable losses that could be monetized through a corporate reorganization. However, it was far behind in preparing its financial statements and filing its required income tax returns, and it was therefore impossible to value its tax attributes. By July 2011, the financial, tax and accounting records of Blackburn had been brought up to date, giving a clearer picture of the value of its tax attributes. The Monitor, which had been authorized to carry out a sales process, began the process of negotiating and finalizing an asset sale agreement, and entered into a Restructuring Term Sheet (the “Pinnacle RTS”) with Pinnacle International Lands Inc. (“Pinnacle”) in September 2011. A restructuring was an essential part of the Pinnacle RTS, in which Pinnacle agreed to provide sufficient funds to Blackburn to pay senior secured debt and, through a corporate arrangement, ultimately become the sole shareholder of Blackburn. An essential step in the process was approval by Blackburn’s creditors of a plan of arrangement implementing the Pinnacle RTS. Streetwise Capital Partners Inc. (“Streetwise”), a self-described “vulture fund”, was concurrently involved in direct negotiations with Blackburn in an effort to conclude a restructuring. By August 30, 2011, discussions between management of Blackburn and Streetwise had advanced to the point that the directors of Blackburn had concluded that Streetwise’s restructuring proposal offered the best recovery for creditors. The Monitor rejected the Streetwise proposal, and applied to the Court for approval of the Pinnacle RTS. Based upon the Monitor’s recommendation, the Pinnacle RTS was approved, and the Monitor was authorized to take the steps necessary to bring the a plan of arrangement implementing the Pinnacle RTS (the “Pinnacle Plan”) to a meeting of creditors for approval. Streetwise subsequently acquired a majority of the claims of a unsecured creditors, confident it could recover more than its acquisition costs, either through an enhanced offer from Pinnacle, or through some other arrangement, if the Pinnacle Plan was not approved. It then proceeded SDD/3381042.02 10 to vote down the Pinnacle Plan at the creditors’ meeting. The Monitor, who accepted that the Streetwise claims would be valid for distribution purposes, applied to have them disallowed for voting purposes, and the Pinnacle Plan approved. The essence of the Monitor’s position was that Streetwise had acquired the claims for the improper purpose of forcing the other parties to reconsider its unsuccessful offer. In dismissing the Monitor’s application, the Court assumed, without analysis, that it has under the CCAA the jurisdiction to disallow the votes of a creditor while at the same time recognizing that the creditor has a valid claim for the purposes of distribution of proceeds. However, relying upon the decision of the Nova Scotia Court of Appeal in Re Laserworks Computer Services Inc. (1997), 6 C.B.R. (4th) 69 (decided under the Bankruptcy and Insolvency Act), it observed that this discretion should be exercised only where the conduct of the acquiring party is unlawful or would result in a substantial injustice. In Blackburn, the fact that Streetwise was acting in its own financial interests, and not for the benefit of the general class of unsecured creditors, was not itself considered improper. Indeed, the fact that its blocking position had resulted in an enhanced proposal from the successful bidder was held to demonstrate the benefit of an open market for creditor claims. While the Court did not directly address the issue, inherent in its decision is the conclusion that unsecured creditors would undoubtedly benefit from market forces where control over the plan approval process is contested. Conclusion: While the practice of assembling creditor claims is not new to the Canadian restructuring scene, the Blackburn case is the first to specifically sanction the practice in a CCAA proceeding. It is striking for its acceptance of the self-interested involvement of an unsuccessful bidder in the plan approval process, and serves notice that a more aggressive, U.S.-style approach can yield results in Canada, as well. This judgment, and the willingness of vulture funds to enter the Canadian process, will now force plan proponents to consider acquiring creditor claims as a matter of course. The position of unsecured creditors, in many cases an afterthought in the restructuring process, can no longer be so easily dismissed. Kerr Interior Systems Ltd., Re [2011] A.J. 360 (“Kerr”) Another kick at the can? Post sanction creditors’ meetings to reconsider the plan In the Kerr decision, Madam Justice Topolniski of the Court of Queen’s Bench of Alberta considered the court’s jurisdiction to authorize a debtor to call a further creditors’ meeting to consider substantive amendments to a plan of arrangement under the CCAA after the plan has been voted on and sanctioned by the court. The Court found that it had the discretion to order a further creditors meeting post sanction to reconsider the plan, but concluded that the debtor failed to meet the high threshold for the court to exercise that discretion. The plan originally presented to creditors in Kerr contemplated a global payment of $2,600,000 (a little over 50 cents on the dollar) to be paid in four installments in varying amounts. The plan received a favorable creditor vote and was subsequently sanctioned by the Court. The debtors SDD/3381042.02 11 made the first installment payment under the plan of $260,000, but failed to make the second installment of $720,000. The debtors then applied for leave of the Court to call a further creditors meeting to present a revised offer, claiming that an unexpected downturn in the economy, difficulty collecting accounts receivable, the strain of servicing secured debt, and the obligations of a related entity (that was not part of the CCAA proceedings) created insurmountable impediments to its ability to carry on in business and to satisfy its obligations under the plan. The proposed amendment to the plan was to reduce the debtor’s obligation by eighty percent to $520,000, including the first payment already made. Two creditors opposed the application, arguing that the court did not have jurisdiction to call a further meeting of creditors at the post sanction stage of the proceedings and that, in any event, the relief sought was a collateral attack on the order sanctioning the plan. They further submitted that to authorize a further creditors’ meeting would open the floodgates to such applications and result in uncertainty in CCAA proceedings. There were no reported cases on point. The Court turned to an analysis of the legislative context and the relevant authorities to assess whether it had the discretion to grant the relief sought and if so, whether the Court should exercise that discretion in the circumstances of the case before it. The Court’s review of the legislative context included an examination of section 7 of the CCAA which concerns the adjournment of meeting of creditors when amendments to a compromise or plan of arrangement are proposed. It reads: 7. Where an alteration or a modification of any compromise or arrangement is proposed at any time after the court has directed a meeting or meetings to be summoned, the meeting or meetings may be adjourned on such term as to notice and otherwise as the court may direct, and those directions may be given after as well as before adjournment of any meeting or meetings, and the court may in its discretion direct that it is not necessary to adjourn any meeting or to convene any further meeting of any class of creditors or shareholders that in the opinion of the court is not adversely affected by the alteration or modification proposed, and any compromise or arrangement so altered or modified may be sanctioned by the court and have effect under section 6. [Section 6 expressly permits court sanction of a compromise or plan of arrangement amended at the creditors’ meeting, so long as the required majority of those voting in person or by proxy at the creditors’ meeting agreed to the amended plan.] Section 7 does not address whether the court can convene a further meeting of creditors to consider a proposed substantive amendment once the creditors’ meeting and vote have taken place. Further, the section is silent as to whether the court can convene a further meeting of the creditors to consider such a proposal once the plan has received court sanction. The Court reviewed a number of authorities where orders have been made altering or modifying a plan after it has been sanctioned. Of greatest relevance perhaps is the decision in Ontario v. Canadian Airlines Corp., 2001 ABQB 983, 306, a case involving an application for a nonprejudicial amendment to a plan in which Madam Justice Romaine expressed in obiter dicta that SDD/3381042.02 12 the court retains jurisdiction at the post sanction stage to direct amendment to the plan, reasoning that: “[w]hile the circumstances justifying an amendment after a sanction hearing ought to be truly exceptional, in recognition of the potential violence done to the laudable goal of commercial certainty, there is no reason why subsequent amendments should be conclusively foreclosed in every case, without examination of the particular circumstances” (para. 61). The Court also referred to the decision of the Supreme Court of Canada in Century Services Inc., and in particular the instruction of Deschamps J. that while the CCAA explicitly provides for certain orders, the general language of the Act should not be read as being restricted by the availability of more specific orders. The Court found ultimately that it did have jurisdiction to order a creditors meeting post-sanction, relying on the court’s general discretionary power found in section 11 of the CCAA. The Court concluded, at paragraph 51, that: (a) the courts' supervisory function ends only when the plan has been fully implemented or has failed. Parliament must have intended that the court retain jurisdiction to address issues that could arise during implementation of the plan, including whether to summon a further creditors’ meeting after the creditors’ vote or court sanction. The court’s discretionary authority under section 11 is broad enough to encompass such a direction; (b) The court’s general discretionary authority under s. 11 should not be interpreted as being restricted by the more specific authority set out in s. 7; (c) When exercising its authority under s. 11, the court must consider the good faith of the applicant, whether due diligence has been exercised and the appropriateness of making the order sought, including whether the relief sought advances the objectives of the CCAA and all relevant policy concerns; (d) Parliament’s intention could not have been to introduce uncertainty and instability to the process. While calling a further meeting of the creditors should remain an option at any stage of the proceedings, once the creditors have voted and the plan has been sanctioned, the court should do so only in exceptional circumstances - circumstances well beyond foreseeable risks such as ordinary business risks; and (e) While each case must be determined on its unique facts, at a minimum, the court should consider a non-exhaustive list of considerations (many of which overlap and all of which rest on the applicant to establish) before summoning a further meeting of the creditors at the post-sanction stage to vote on a proposed amendment to the plan. These considerations include: SDD/3381042.02 (i) Is the plea for relief made in good faith? (ii) Has it been made in a timely fashion? 13 (iii) Would granting the relief advance the policy objectives underlying the CCAA? (iv) Would granting the relief enhance the public's confidence in the CCAA process? (v) Would granting the relief otherwise serve the ends of justice? (vi) What is the level of creditor support?” Applying the above considerations to the facts of the case, the Court found that the debtors had not met the high threshold required for the court to exercise its discretion and order a further meeting of creditors for a number of reasons, including a concern as to whether the debtors were acting in good faith, and a failure to take all reasonable steps to fund the plan including downsizing and selling non-essential assets. Noting that the public’s confidence in the CCAA process is necessarily grounded in fairness and stability for all of the stakeholders, the court also concluded that allowing the debtors an opportunity for what would be a “second kick at the can” after defaulting on their obligations would not further this objective. Finally, there was no evidence of creditor support for the proposed amendment. With respect to the policy objectives of the CCAA, the Court viewed the proposed amendment to the plan as so radical that it “is more reasonably viewed a completely new deal rather than an amendment.” There was no evidence that the debtors’ demise was a certainty if the relief was not granted, and it was noted that the debtors were at liberty to attempt to make another deal with its creditors in alternate bankruptcy proceedings. The Court was also of the view that whilst such proceedings come at a price, that price would likely be less than might otherwise be incurred in view of work done to date on the proposed amendment to the plan. On the basis of these findings the Court concluded that the policy objectives underlying the CCAA would not be advanced if the relief sought was granted. Conclusion: as the Court noted (at para. 58), the circumstances of this case revealed a tension between the objectives of facilitating restructuring and providing stability, certainty and fairness for all of the stakeholders. The decision of the Court serves to balance these two important policy objectives underlying the CCAA by establishing that a court may order a meeting of creditors to reconsider the plan after plan has been voted on and sanctioned by the court, but to succeed the debtor must establish truly exceptional circumstances. Worldspan Marine Inc. (“Worldspan”) The Worldspan CCAA proceedings before Mr. Justice Pearlman of the B.C. Supreme Court offered two decisions of note in 2011. The first decision examined the jurisdiction of the court to make an Initial Order in circumstances where the Federal Court had already exercised its maritime law jurisdiction. The second considered the jurisdiction of the Court to set aside an entered order of the Court pronounced in the CCAA proceedings. SDD/3381042.02 14 In February 2008, Worldspan entered into a vessel construction agreement (“VCA”) with Harry Sargeant III for the construction of a 142-foot motor yacht at Worldspan’s shipyard located in Maple Ridge, B.C. Construction of the yacht commenced in March 2008, but ceased in May 2010 as the result of a dispute over the cost of construction. In May 2011, Worldspan and its affiliated companies commenced proceedings in the B.C. Supreme Court seeking relief pursuant to the CCAA. At the time of filing, the yacht had been arrested in Federal Court and an in rem judgment had been granted to a maritime lien claimant, Offshore Interiors Inc. Sargeant v. Worldspan Marine Inc. 2011 BCSC 767 CCAA vs. Federal Court Jurisdiction The threshold issue on the first day hearing on June 6, 2011 was whether the court had jurisdiction to make an initial order when the Federal Court had already exercised its maritime law jurisdiction in respect of the vessel through the vessel arrest and the in rem judgment awarded to Offshore. Offshore argued that its claims were claims within Canadian maritime law under the Federal Courts Act (“FCA”), and that the relevant provisions of the FCA were enacted in the exercise of Parliament’s exclusive legislative authority in relation to navigation and shipping. Pearlman J. recognized Offshore’s position as being uncontroversial, but noted that the court was not dealing with a situation where one court by exercising its jurisdiction entirely occupies the field to the exclusion of the jurisdiction of the court, since the B.C. Supreme Court also has jurisdiction over maritime matters. In other words, the jurisdiction of the Federal Court with respect to matters of maritime law, once it has been invoked, does not automatically preclude the exercise by the B.C. Supreme Court of its jurisdiction under the CCAA. The court also took particular notice of the fact that the Federal Court proceedings were at a preliminary stage and no application for an order for sale of the vessel had been made, concluding that the appropriate course was to, as a matter of comity, request the recognition and aid of the Federal Court with respect to an initial order. Pearlman J. went on to conclude that Worldspan should be given the opportunity to present a viable plan for restructuring, and granted the initial order. Included as a term of the initial order was a specific request for the aid of the Federal Court in carrying out the terms of the order where required. Worldspan also sought a term of the initial order that would specifically provide that the proceedings in the Federal Court were stayed. Pearlman J. ruled that, as a matter of comity, such an order was neither necessary or appropriate. In so doing, the court referred to the decision in Always Travel v. Air Canada, 2003 F.C.J. No. 953 in which Hugessen J. of the Federal Court expressed the view that whilst superior courts do not order each other about or make orders interfering with each other’s process, cooperation is essential and as a matter of course, in virtually every case where an order is given by a provincial superior court in the exercise of its CCAA jurisdiction, and that order requests the Federal Court’s aid, the Federal Court will give such aid on proper application being made. Conclusion: a provincial superior court is not automatically precluded from granting CCAA relief where the Federal Court has exercised its maritime jurisdiction with respect to a vessel SDD/3381042.02 15 owned by the debtor; rather, comity will be an important consideration. This decision serves as a reminder that the principle of comity, most often considered in the context of cross-border insolvencies, has equal application to dealings between and among superior courts in Canada where there is concurrent jurisdiction. Worldspan Marine Inc., Re (22 August 2011), Vancouver S113550 (BCSC) Here today, gone tomorrow? Setting aside entered orders appointing Court officers At the come-back hearing on July 22, 2011, Sargeant applied for the appointment of a Vessel Construction Officer (“VCO”) with a preliminary mandate of undertaking an analysis to determine the cost to complete the vessel. Worldspan opposed the application, but the order was granted. One month later, and prior to the VCO completing its mandate, Worldspan applied to set aside the entered order appointing the VCO. The issue raised by those opposing the application was whether the court was functus and consequently had no jurisdiction to set aside the order appointing the VCO once entered. In oral reasons for judgment, Pearlman J. examined the purpose of the CCAA, citing Cliffs Over Maple Bay Investments Ltd. v. Fisgard Capital Corp., 2008 BCCA 327, Hong Kong Bank v Chef Ready Foods (1990), 4 C.B.R. (3d) 311 Re United Used Auto & Truck Parts Ltd., 2000 BCCA 146, and Re Stelco Inc. 2005, 15 C.B.R. (5th) 288 among other decisions, and concluded that section 11 of the CCAA is to be given a large and liberal interpretation “bearing in mind Parliament’s intention to confer upon the court in CCAA proceedings the flexibility to make orders that are responsive to changing circumstances” (para. 35). He found that the court’s broad power under section 11 to make any order it considers appropriate in the circumstances confers the power to vary or set aside a previous order for the appointment of an officer intended to facilitate the restructuring process where the officer’s appointment no longer serves the intended purpose, even where the order appointing the officer has been entered: “that degree of flexibility is required, given the fluidity of CCAA proceedings, and must have been intended by Parliament” (para. 36). In the event, Pearlman J. concluded that that the court ought not to set aside the VCO Order, as he was not persuaded that the additional information adduced by Worldspan on the application made any material change from the information that was before the Court when the application was first heard and decided. Conclusion: where the appointment of an officer of the court no longer serves to advance the intended purpose of the appointment, the Court has the discretion to set aside the order making the appointment, even where the order has been entered. This decision serves as yet another example of the exercise of the court’s general discretionary power conferred by s. 11 of the CCAA, allowing the court the flexibility to make orders that are responsive to changing circumstances while it seeks to facilitate the restructuring of an insolvent company. SDD/3381042.02