Climate Policy Design with Correlated Uncertainties in Offset

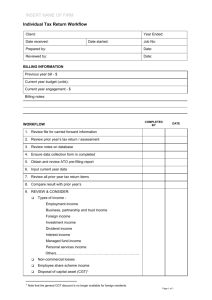

advertisement