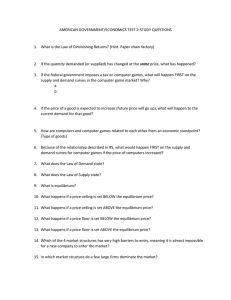

ASYMMETRIC INFORMATION ECON 4820 Strategic Competition Lecture notes 29.03.04

advertisement

ECON 4820 Strategic Competition ASYMMETRIC INFORMATION Lecture notes 29.03.04 Introduction Asymmetric information Information exchange Signalling in order to influence expectations Static price competition with uncertainty Two firms, 1 and 2. Differentiated products: Di ( pi , p j ) = 1 − pi + p j ; i , j = 1,2; i ≠ j Constant unit costs: c1 = c1L with probability E c1 = xc + [1 − x ] c ; L 1 x and c2 = c1H with probability 1-x, H 1 c2 given. Ex post profits: Π i ( pi , p j ) = [ pi − ci ] ⎡⎣1 − pi + p j ⎤⎦ We look for the Bertrand equilibrium in a game in which firms choose prices simultaneously: p2* , p1* = p1L if c1 = c1L and p1* = p1H if c1 = c1H . Reaction functions Firm 1: R1 = 1 2 [1 + p2 + c1 ], E R1 = 21 [1 + p2 + E c1 ] ; Firm 2: R2 = 1 2 [1 + E p1 + c2 ] Figure (reaction functions: R1L , R1H ,E R1, R2 Equilibrium: 3 + 2c1s + c2 , s = L, H, 3 3 + 2c2 + E c1 p2* = 3 p1s = Conclusion: prices decreasing in the probability x of low costs; ‘as if’ Firm 1 has costs E c1 Information exchange Assume Firm 1 can provide verifiable information about its costs before competition in prices take place. Note that it would always be in Firm 1’s interest that Firm 2 chooses a high price. Therefore: if c1 = c1H , Firm 1 would inform about this; if c1 = c1L , Firm 1 would like to conceal this information. However, realising what the incentives of Firm 1 are, Firm 2 would treat no information as evidence that costs are low (because, if costs were high, Firm 1 would have provided information about this). We consequently have a ‘separating equilibrium’; the informed party’s strategic choice depends on the realisation of events. If it is not possible to provide verifiable information, Firm 1 may try to ‘signal’ via its choice of strategy. Signalling Milgrom-Roberts (Econometrica, 1982). Two firms. Three stages: 1) Firm 1 chooses its price p1 . 2) Firm 2 chooses whether to enter the market or not. 3) Firm 1 and (possibly) Firm 2 choose prices simultaneously. 2 Firm 1’s costs are low with probability x and high with probability 1-x. Firm 1’s costs are private information ex ante, but become known to Firm 2 ex post upon entry. Firm 2’s costs are given (and common knowledge). Define M1t ( p1 ) is Firm 1’s monopoly profits at price p1 , t = L,H, pmt is Firm 1’s profit-maximising (static) monopoly price, t = L,H, M mt = M1t pmt is Firm 1’s maximum (static) monopoly profits, t = L,H, Dit is Firm i’s duopoly profits, i = 1,2, t = L,H. ( ) Note: due to the assumption that Firm 2 learns Firm 1’s costs upon entry ex post price competition is independent of the price charged ex ante. Assume D2H > 0 > D2L ; that is, entry is profitable only if Firm 2 has high costs. The discount factor is δ . Note: Firm 1 will want to give the impression that its costs are low in order to keep Firm 2 out of the market. It can do so by charging a low price also when costs are in fact high; this will lead to a loss in ex ante profits (since price does not maximise static monopoly profits) but this is compensated for by a monopoly market position, and hence higher profits, ex post. Firm 2 will, to the extent that it understands Firm 1’s strategy, take this into account and hence will not necessarily be ‘fooled’. Firm 1 understands this, and so on. Two kinds of equilibria: separating: the informed party’s strategy depends on its information (here p1L ≠ p1H ). Hence, the uninformed party can infer the underlying information from observing the informed party’s strategic choice; pooling: the informed party’s strategy does not depend on its information (here p1L = p1H = p1 ). Hence the uninformed party does not learn from observing the strategic choice of the informed party. Separating equilibrium Equilibrium conditions include Firm 1, when it has low costs, must not benefit from choosing price p1H instead of p1L , and vice versa; 3 Expectations upon out-of-equilibrium moves must be specified (here: what Firm 2 believes if observing a price different from either p1L or p1H ). Since Firm 2 will enter when believing that Firm 1 has high costs, Firm 1 may as well choose p1H = pmH in this case. Firm 1’s equilibrium profits is consequently MmH + δ D1H . Suppose Firm 1 where to choose p1L when its costs are high. Given that Firm 2 would not enter (believing that Firm 1 does have low costs), Firm 1’s profits would be M1H ( p1L ) + δ M mH . A necessary condition for equilibrium is therefore ( ) M mH + δ D1H ≥ M1H p1L + δ M mH To make the problem interesting, we assume this condition is not satisfied for p1L = pmL ; in other words, the low-cost type must charge an ex ante price below the (static) monopoly price in order to signal convincingly that costs are low. Note that Firm 1, when having low costs, could ensure a profit of MmL + δ D1L , and hence we must have ( ) M1L p1L + δ M mL ≥ M mL + δ D1L . Under reasonable assumptions, these two conditions define an interval ⎤ with p < pL . i ,p ⎡p m 1 ⎣ 1 1⎦ Example: Linear specification Let demand be Q m ( p1 ) = 3 − p1 in the duopoly case and Qi ( p1, p2 ) = 1 − pi + pi in the duopoly case; costs be c1L = 0, c1H = 1 and c2 = 0 ; entry costs be f = 1; and discount factor be δ = 1 . Then we have pmL = 1.5, pmH = 2, MmL = 9 4 and M mH = 1; D1L = 1 and D1H = 4 9 ; 4 D2L = 0 and D2H = 7 9 . Furthermore, we have ( ) ; D1H ≥ M1H p1L ⇒ p1L ≤ 1.25 = p 1 i . M1L p1L ≥ D1L ⇒ p1L ≥ 0.38 = p 1 ( ) Returning to the general model, the following set of strategies and beliefs constitutes an equilibrium: Firm 1: in the first period, choose p1H = pmH if costs are high and p1L = pˆ1 , otherwise. Firm 2: if p1 ≤ p1L expect entry to be unprofitable and stay out; otherwise, enter. Note: out-of-equilibrium expectations is that entry is profitable if a high price is observed (this is what deters Firm 1 from deviating from p1L when costs are low); there exists a continuum of similar separating equilibria, with p1L ∈ ⎡⎣ p1, pˆ1 ⎤⎦ . Conclusion: ‘limit-pricing’, but Firm 2 becomes ‘perfectly informed’; limit-pricing is necessary in order for Firm 1 not to be considered a highcost firm; welfare is greater than in the case of full information (since price is lower in the low-cost event). Pooling equilibrium A pooling equilibrium does not exist if xD2L + [1 − x ] D2H > 0 . To see this, note that Firm 2 would enter if Firm 1 played a pooling strategy (no information revealed). However, given this, Firm 1 would rather want to charge the relevant (cost dependent) monopoly price. Assume xD2L + [1 − x ] D2H ≤ 0 . For pooling to be part of an equilibrium we require 5 M1H ( p1 ) + δ MmH ≥ MmH + δ D1H M1L ( p1 ) + δ MmL ≥ MmL + δ D1L There generally exists an interval of prices p1 that satisfies these conditions. If Firm 2 believes, upon observing (out-of-equilibrium) prices different from the equilibrium (pooling) price p1 , that entry is profitable a pooling equilibrium can be supported. Conclusion: Firm 2 remains uninformed; there is less entry than with symmetric information; implications for welfare are not obvious. Variations on the model Alternative formulations: if Firm 2’s costs are not known to Firm 2, but correlated with the costs of Firm 1, Firm 1 will want to choose a high price in order to signal that costs are high; if demand, rather than costs, are unobservable to Firm 2, Firm 1 will want to choose a low price to signal that demand is low. 6