AGENDA ITEM: C1 MEETING: RSSB Board Meeting

advertisement

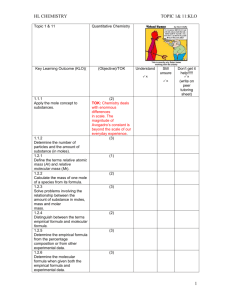

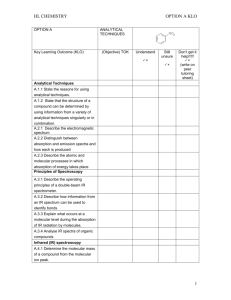

AGENDA ITEM: C1 MEETING: DATE: SUBJECT: RSSB Board Meeting 08 January 2015 Railway Industry Supplier Approval Scheme Stewardship Report Chris Fenton John Abbott SPONSOR: AUTHOR: 1. Purpose This paper is the 2014/15 stewardship report for the Railway Industry Supplier Approval Scheme (RISAS). The paper summarises the operational performance of the scheme over the past 12 months and identifies issues and opportunities to be addressed over the next year. 2. Background 2.1 RISAS was authorised by the RSSB board in May 2006 to undertake the assessment and certification of suppliers of critical products and services, initially for rolling stock. The scheme was set up by members in response to the Cullen Public Inquiry recommendation (see Annex A) and is consistent with International Accreditation and Conformance Certification requirements. The scheme is based on competent third party assessment bodies (RISABs Railway Industry Supplier Assessment Bodies) being appointed by RSSB to assess candidate suppliers’ capability to meet industry’s specification. The scheme also includes formal arrangements for monitoring, feedback, appeals and continuous improvement. An overview of the scheme is contained in Annex A. 3. Operational performance 3.1 Under the direction of the RISAS board, the scheme is designed to efficiently support Safety Management System (SMS) holder management of supply chain risk though the rigorous assessment of critical suppliers’ capability to reliably meet contractual requirements. The operational scheme management and accreditation of RISABs to deliver this, continues to be provided by RSSB, with the resulting assessment from this process recognised by all rail clients. This serves to reduce the need for duplicate audits and frees clients to focus on ‘added value’ supplier performance management, including measures to address culture, behaviour and teamwork. Today there are 61 RISAS certified suppliers against 128 modules, representing over 75% of the rolling stock heavy maintenance market, whilst 96% of suppliers whose certification was due to expire, have gone on to renew over this period. During the year the scheme has delivered the following: Agreement with the Rail Industry Supplier Qualification Scheme (RISQS) board to cease Link-up audits of traction and rolling stock components to avoid duplication Continuing engagement with TOCs through the ATOC Engineering Council and its Supply Chain Forum, with their intent expressed to mandate RISAS application, wider and deeper than at present RSSB Board Meeting Final: 08 January 2015 Page 1 of 5 AGENDA ITEM: C1 Commissioned an independent review of the scheme model to assess the fitness for purpose of its approach and application, whilst separately, opportunity has also been taken to learn from benchmarking with other industry sector representatives, e.g. Sellafield and JCB. Introduced scheme metrics on a pilot basis with a representative sample of RISAS suppliers, designed to enable on-going assessment and improvement of performance Developed a new module to respond to industry’s request to expand the scheme’s scope, notably in relation to GSM-R and its supply chain. Amended procedures to remove barriers to enable entry of new suppliers Further information on the development of the scheme can be found in Annex B and C. 3.2 Progress is broadly in line with the RISAS Business Plan which sets out milestone targets for development of the scheme by supplier and product module and the scheme has gone some way to meeting the intent of the Cullen Public Inquiry recommendation that led to the scheme’s creation. However, it is clear that much remains to be done and therefore the industry needs to move forward with implementation of the proposed strategic direction as explained in the separate board paper on today’s agenda. What is apparent is that the capability of RISAS is going to continue to be required to assess safety critical suppliers and that there is potential for it to take a wider role in this respect and already stakeholders are recognising this and seeking an extension of the scope of products and services it currently covers. 3.3 Following Railcare Limited, a key supplier to the industry, having entered into administration towards the end of 2013 and it being purchased by Knorr Bremse, the scheme was tested in terms of its ability to address this kind of challenge. Maintenance of RISAS certification had been stated by the Administrators as being key to the sale of the company as a going concern at that time, whilst going forward the scheme’s Accreditation Agency (AA) and the responsible RISAB ensured that the efficacy of this certification was maintained following the acquisition, despite significant redundancies being announced at that time. Following the transfer of responsibility on point of sale to the new owners and integration of the company into their organisation, formal RISAS re-assessment was completed early in 2014 and working with them, the RISAB continues to monitor the situation. 3.4 Concerns over the performance of another supplier were also investigated by the scheme’s Accreditation Agency (AA) during this period, with the role and performance of the responsible RISAB and their management of the supplier’s approval found to be a contributory factor in this instance. The situation was closely monitored and an action plan put in place with the RISAB to resolve this. The response from the RISAB, however, was ultimately deemed to be unsatisfactory and the AA took over direct involvement with the supplier in the role of ‘RISAB of last resort’. Working to address the issues of concern, the AA maintained the efficacy of the supplier’s approval throughout and following the expiry of the accreditation of that RISAB, the AA has overseen a new RISAB satisfactorily taking over this responsibility, enabling the AA to then stand down. 3.5 As reported to the board previously, the RISAS board initially led industry’s response to concerns raised by the BSI’s Axle Bearing Committee in relation to an increase in bearing failures recorded over the last 3 years. RSSB Board Meeting Final: 08 January 2015 Page 2 of 5 AGENDA ITEM: C1 The review that was undertaken stated that the RISAS assessment process was basically sound, but a number of improvement opportunities were identified which have been accepted by the RISAS board. These are now in the process of being addressed. 3.6 RSSB undertook an internal audit of the RISAS scheme during this period using an independent resource and whilst there were a number of relatively minor concerns raised, the overall conclusion reached was that the scheme is well managed. 3.7 The RSSB Scheme Management and Accreditation Agency budgets for RISAS delivery in 2014/15 was maintained at the 2013/14 level of £201k, a small cost relative to the overall cost to industry of assurance and the criticality of the equipment. 4. Issues and opportunities 4.1 Entities in Charge of Maintenance (ECM) and UKAS European legislation has been developed in the form of ECM to implement consistent procedural controls in each member state for the maintenance of freight vehicles which can be ‘touched’ by many parties during a single journey across Europe. ECM is being implemented in GB under the governance of the ORR and the board were previously advised that scope exists to use the RISAS approach both in this context and in the event its adoption is extended to passenger operations. The board are invited to note that RISAS scheme product group SO1 which has already been applied to ROSCOs, meets these requirements. Following the approach by the ORR in October 2013, UKAS is to take on the responsibility for ECM delivery, with the ORR confirming at that time that it would regard RISAS as providing suitable functionality to support UKAS in delivering this obligation. The scheme’s AA engaged with UKAS and the ORR in respect of this development and it has now been formally confirmed that RISAS will be the technical resource acting on behalf of UKAS in awarding certification under ECM requirements going forward. The AA is continuing to work with UKAS on agreeing the details of this arrangement. 4.2 Procurement and logistics suppliers Third party suppliers of procurement and logistics services play an important role in the provision of rolling stock spares. Many of the products and services they provide to industry are of a critical nature and can import significant risk. This has therefore been identified as a prime example of where RISAS has a part to play in assuring suppliers’ capability in meeting industry’s specification for this service. An assessment module has now been developed and its first application is to be used in the assessment of a key supplier early in 2015 and then extended to others offering this service to industry thereafter. 5. Stakeholder engagement and support 5.1 The RISAS board has been determined to enhance engagement and to make sure that the current capability of the scheme is understood and properly utilised by SMS holders. It has continued to work closely with all stakeholders in order to achieve this, continuing with the issue of quarterly RISAS newsletters to publicise scheme performance and developments. 5.2 Liaison has also continued to take place with ATOC’s Engineering Council (EC) and Supply Chain Forum (SCF) and the Freight Technical Committee (FTC) representing the buyer/supplier community membership in order to ensure their requirements are taken into account in scheme operations, delivery and future scoping of the scheme. RSSB Board Meeting Final: 08 January 2015 Page 3 of 5 AGENDA ITEM: C1 Whilst the FTC is looking for RISAS to consider assessment of wheel lathes, ATOC’s EC has recently confirmed its intent to: Work closer with and increase its engagement with the scheme Mandate RISAS wider and further than at present Support direct assessment of tier 2 suppliers Reinforce the need for improved supplier relationship management post RISAS certification See more transparent reporting of assessment findings 6. Business Plan for 2015/16 6.1 The RISAS board is developing a new business plan commencing in April 2015. The plan is expected to address the following: a) Maintenance of the effective operational delivery of the current scheme. b) To act on the recommendations of the independent scheme model review, which is currently underway. c) To action the recommendations of the wheelset axle bearing report. d) To progress with continuous improvement and maturity of the scheme model in accordance with the ORR’s RM3 model in this respect. e) To develop the functionality of the scheme to meet the additional requirements of stakeholders and an increased scope. f) To continue to work with ORR and UKAS to efficiently meet ECM requirements. g) To obtain UKAS accreditation. h) To work with the RISQS board and industry to develop and implement new supplier assurance arrangements for rail. i) To act as the ‘client group’ for the ‘T1070’ research project, working on the ‘enhanced quality standard’ for GB rail and the development of risk based assurance arrangements, designed for every commodity procured by GB rail. j) To continue with stakeholder engagement and support, targeting potential new RISAS suppliers. k) To maintain the scheme’s risk register and mitigation actions, including resource sustainability. 6.2 As referenced in a separate paper on today’s board agenda, the RISAS board recognise that coordinated plans are now required for the development and implementation of new supplier registration, qualification and assurance arrangements to efficiently and effectively support the modern rail industry. If supported by the board, work to develop these new arrangements as described therein will commence in conjunction with the RISQS board and is expected to see the 2 schemes converge to provide an integrated and risk based control framework to support both buyers and suppliers. These plans will include defining the role to be played by RSSB, resource requirements and the appropriate means of funding. 7. Recommendations 7.1 The board is asked to: NOTE the significant developments over the last 12 months and the intended direction of its new plan during 2015. SUPPORT the RISAS board’s approach to continue to work with the ORR and UKAS to define the role of RISAS within the ECM regime. RSSB Board Meeting Final: 08 January 2015 Page 4 of 5 AGENDA ITEM: C1 ENCOURAGE greater use of RISAS by duty holders. SUPPORT continued good engagement of duty holders with the RISAS board to ensure that needs are met in support of SMS compliance. RSSB Board Meeting Final: 08 January 2015 Page 5 of 5 AGENDA ITEM: C1 Annex A Cullen Recommendation 24 states that:“Suppliers of products or services of a safety-critical kind for use on, or in regard to, the railways of Great Britain should be required to hold an accreditation as a condition of being able to engage in that activity” RISAS is organised as follows:- RSSB Board Meeting Final: 08 January 2015 Page 1 of 1 AGENDA ITEM: C1 Annex B RISAS Business Plan Supplier Targets Chart 1: Growth of New Suppliers Chart 2: Growth Suppliers’ scope of approval (A description of Product Groups is contained in Table 1 of Annex C) RSSB Board Meeting Final: 08 January 2015 Page 1 of 1 AGENDA ITEM: C1 Annex C RISAS Certified Suppliers Table 1: Scheme Product Group Listing Code Product group name M01 M02 M03 M04 M05 M06 M07 M08 M09 S01B S01C S01D S01E S04B S04C S04D S04E Running Gear Brakes and Pneumatics T&RS Mechanical Equipment T&RS Electrical Equipment T&RS electric traction equipment T&RS diesel traction equipment T&RS Transmission Trainborne safety/ monitoring equipment Doors and Windscreen Equipment Procurement of Vehicle System Maintain & Overhaul Procurement of vehicle Mileage based overhaul Procurement of vehicle Time based overhaul Procurement of Vehicle System Modification Delivery of vehicle System Maintenance & Overhaul Delivery of vehicle Mileage Based Overhaul Delivery of vehicle Time Based Overhaul Delivery of vehicle System Modification Table 2: Suppliers newly certified in the past 12 months Suppliers Newly Certified (in the past 12 months) Company Northern Rail Ltd - Newton Heath TMD Progress Rail Services Railway Vehicle Engineering Ltd Vagonoremonten zavod-99 AD/Kolowag RSSB Board Meeting Final: 08 January 2015 Number of product groups Product Groups 3 S04B, S04D, S04C 2 M01, M07 3 M07, M05, M01 1 M01 Certification Start Date 05/12/2014 19/12/2013 10/11/2014 27/02/2014 Page 1 of 3 AGENDA ITEM: C1 Table 3: Suppliers re-certified in the past 12 months Company Alstom Transport UK Limited - Parts & Modernisation Axiom Rail Bochumer Verein Verkehrstechnik GmbH – Bochum Bombardier - Ilford Faiveley Transport Ltd - Birkenhead Faiveley Transport Ltd - Tamworth Firth Rixson Metals Limited Knorr-Bremse Rail Systems (UK) Ltd Knorr-Bremse RailServices (UK) Ltd Wolverton L H Group Services Ltd C Certification renewed in past 12 months Bombardier Transportation GmbH BONATRANS GROUP a.s. CAF, SA David Brown Gear Systems Ltd Eversholt Rail (UK) Ltd LUCCHINI RS S.p.A. Masteel Merseyrail Electrics 2002 Ltd Nippon Steel & Sumitomo Metal Corporation Northern Rail Ltd - Allerton TMD Pullman Rail Riley & Son (Electromec) Ltd Swasap pty ltd Taiyuan Heavy Industry Railway Transit Equipment Co.,Ltd Unipart Rail Voith Turbo GmbH & Co.KG Wabtec Rail Limited Wabtec Rail Scotland ZF Services UK Ltd RSSB Board Meeting Final: 08 January 2015 Number of product groups Product Groups Certification Start Date 1 M05 19/05/2014 1 M01 1 M01 31/03/2014 28/05/2014 4 M03, M09, S04C, S04D 1 M01 1 M01 1 M01 2 M01, M07 4 S01D, S01E, S01C, S01B 3 M02, M08, M03 6 S04E, M09, M08, M05, M04, M02 1 M01 3 M02, M09, M08 3 M07, M05, M01 27/06/2014 4 M01, M06, M05, M07 1 M01 1 M01 3 M01, M05, M02 1 M01 1 S04B 4 M07, M05, M02, M01 1 M01 1 M01 1 M01 24/10/2014 3 M02, M05, M01 2 M01, M07 6 S04D, S04C, M07, M02, M05, M01 4 M01, M07, S04C, S04D 2 M07, M01 30/05/2014 14/07/2014 31/10/2014 19/12/2013 31/03/2014 24/07/2014 29/09/2014 10/10/2014 29/03/2014 31/03/2014 01/10/2014 07/02/2014 30/04/2014 26/08/2014 31/01/2014 10/12/2014 19/12/2013 05/12/2014 09/12/2014 30/06/2014 30/09/2014 28/11/2013 27/06/2014 24/10/2014 Page 2 of 3 AGENDA ITEM: C1 Table 4: Suppliers with ongoing certification Company AKS Machining Ltd Alstom Transport UK Limited - Manchester Traincare Centre Angel Trains Limited Bahntechnik Brand-Erbisdorf GmbH Bochumer Verein Verkehrstechnik GmbH Ilsenburg Bombardier – Crewe DB Regio Tyne & Wear Ltd DCD Ringrollers Gutehoffnungshtte Radsatz GmbH KLW INTERPIPE NTRP Knorr-Bremse RailServices (UK) Ltd Springburn Lucchini UK MWL BRASIL RODAS & EIXOS LTDA Northern Rail Ltd - Heaton TMD Existing Suppliers Existing Suppliers Brush Traction Plasser & Theurer Porterbrook Leasing Co Ltd - & Porterbrook Maintenance Ltd Rail Door Solutions Ltd Robel - Bahnbaumaschinen GmbH Sabre Rail Services Ltd Siemens AG Austria - Graz South Devon Railway Engineering Tecforce Ltd Valdunes - Dunkerque Valdunes - Valenciennes Voith Turbo Limited - Croydon Voith Turbo Limited - Greenford Vossloh Kiepe UK Limited RSSB Board Meeting Final: 08 January 2015 Number of product groups Product Groups Certification Start Date 1 M01 3 M01, M02, M05 01/03/2012 27/03/2013 4 S01B, S01E, S01C, S01D 1 M01 1 M01 31/08/2012 4 M01, M02, M05, M07 6 M01, S04C, M07, M02, M04, M05 1 M01 1 M01 1 M01 1 M01 3 M07, M05, M01 12/07/2013 2 M01, M07 1 M01 3 M02, M03, S04C 1 M01 4 S01B, S01E, S01D, S01C 3 M09, S04E, S04B 1 M01 3 M01, M05, M02 1 M01 1 M01 1 M02 1 M01 1 M01 1 M07 1 M07 1 S04E 07/08/2013 28/11/2013 21/12/2012 11/11/2013 11/11/2013 10/01/2013 20/03/2013 30/10/2013 26/01/2013 30/08/2013 27/04/2013 30/08/2013 13/11/2013 07/08/2012 27/06/2013 31/01/2013 15/08/2013 15/12/2012 31/07/2013 06/05/2013 06/05/2013 24/04/2013 24/04/2013 26/10/2012 Page 3 of 3