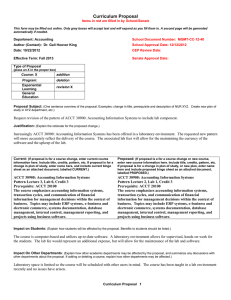

Document 11415663

advertisement

150 Hour Program: Example Course Schedule -­‐-­‐ Audit/ Financial Reporting Track Junior Year (Assumes completion of 60 hours pre-­‐business) Fall ACCT ACCT ACCT ISQS MGT BLAW 3101 3304 3307 3344 3373 3391 Spring # Meet the Firms # ACCT 3305 ACCT 3315 FIN 3320 MGT 3370 MKT 3350 Summer 1 ECON 3000 ELEC 3000 Summer 2 ACCT 3306 ELEC 3000 Senior Year (Assumes completing 102 hours prior to starting graduate coursework. See note below.) Fall Spring Summer 1 Summer 2 ACCT 5303 or ELEC ACCT 4301 ƚ ACCT 5382 *# ACCT 5320 or ACCT ƚƚ ƚƚƚ ACCT 5302 ƚ ACCT 5309 ^ 5327 5000 ACCT 5305 ƚ# ACCT 5332 or ACCT ƚƚ ELEC 3000 ^ ENG 3365 5327 ELEC 3000 Students may start the MSA program upon completion of 90 hours towards undergraduate degree requirement. However, students starting before completion of 102 hours will likely finish the MSA degree at a date later than indicated below. Fall ACCT 5319 BLAW 5392 ACCT 5332 or ACCT ƚƚ 5320 ACCT 5303 or ELEC ƚƚƚ 5000 # * ƚ ƚƚ ƚƚƚ ^ Graduate Year Spring Summer 1 ACCT 5334 Summer 2 Course must be taken in semester indicated. Other courses can be shifted between semesters. Internship Must be taken prior to Internship (ACCT 5382) Audit track students take one of three courses (ACCT 5332, 5327, and 5320) in Compressed Spring, Summer 1, and Fall. Audit track students take one of two courses (ACCT 5303 and ELEC 5000) in Summer 2 and Fall. Compressed courses in late-­‐Spring. Audit Track approved electives include, but are not limited to, the following: FIN 5325 Seminar in Security Analysis and Investments PFP 5322 Introduction to Applied Personal Finance MGT 5374 Negotiation and Conflict Management MKT 5364 Services Marketing Audit Track approved electives include, but are not limited to, the following: FIN 5325 Seminar in Security Analysis and Investments PFP 5322 Introduction to Applied Personal Finance MGT 5374 Negotiation and Conflict Management MKT 5364 Services Marketing Accounting Course Titles: ACCT ACCT ACCT ACCT ACCT ACCT 3304 3305 3306 3307 3315 4301 Intermediate Accounting I Intermediate Accounting II Principles of Cost and Managerial Accounting Income Tax Accounting Accounting Systems Principles of Auditing ACCT ACCT ACCT ACCT ACCT ACCT ACCT ACCT ACCT ACCT BLAW 5302 5303 5305 5309 5319 5320 5327 5332 5334 5382 5392 Current Accounting Theory Information Systems Auditing and Forensic Accounting Accounting Research & Communication Advanced Accounting Auditing Theory and Practice Financial Statement Analysis Advanced Income Tax Accounting Ethics in Accounting Professional Accountancy Capstone Internship in Accounting Advanced Business Law