TEXAS TECH UNIVERSITY RAWLS COLLEGE OF BUSINESS

advertisement

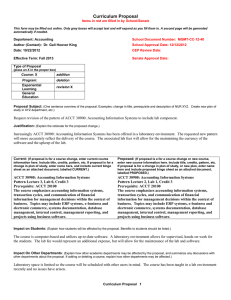

TEXAS TECH UNIVERSITY RAWLS COLLEGE OF BUSINESS MASTER OF SCIENCE IN ACCOUNTING MSA (Taxation)/ JD (Doctor of Jurisprudence) Degree Joint Program Name: SID: Degree: Institution: Year: Graduation Date: TOOL COURSES (41 Hours) ACCT 2300 Financial Accounting ACCT 2301 Managerial Accounting ACCT 3304 Intermediate Accounting I ACCT 3305 Intermediate Accounting II ACCT 3306 Prin. Of Cost and Managerial Accounting ACCT 3307 Income Tax Accounting ACCT 3315 Accounting Systems ACCT 4301 Principles of Auditing FIN 5219 Financial Management Tools FIN 5320 Financial Management Concepts ISQS 5345 Statistical Concepts for Business Mgt. MKT 5360 Marketing Concepts and Strategies MGT 5371 Managing Org. Behavior & Org. Design ECO 5310 Price and Income Theory SEM GRADE CORE COURSES (24 Hours) ACCT 5302 Current Accounting Theory ACCT 5308 Fed. Income Tax Law for Partnerships ACCT 5309 Advanced Accounting ACCT 5315 Estate & Gift Taxation ACCT 5318 Income Tax Research & Planning ACCT 5320 Analysis of Financial Accounting Information ACCT 5327 Advanced Income Taxation Accounting ACCT 5332 Ethics in Accounting SEM GRADE CR SEM GRADE LAW ELECTIVES (12 Hours) LAW 6420 Commercial Law 4 LAW LAW 6434 6435 Income Taxation Business Entities 4 4 CAPSTONE COURSE REQUIREMENT (3 Hours) ACCT 5334 Professional Accountancy SEM GRADE Must earn a grade of "B" or better. Must be taken in the last semester available prior to graduation. Deviation from the original filed form must be approved by the faculty advisor. Signature of Graduate Advisor/Date Signature of Faculty Advisor/Date Signature of Student/Date Name: Dr. John Masselli Room: BA W365 Phone: 834-2392 Course requirements subject to change. To graduate, you must have at least a 3.00 graduate GPA. Updated Oct 2013