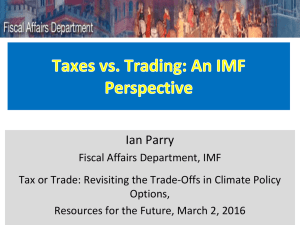

Carbon Taxes

advertisement

Carbon Taxes Ian Parry, Fiscal Affairs Department International Monetary Fund Roberton Williams, University of Maryland, RFF Disclaimer: The views expressed herein are those of the author and should not be attributed to the IMF, its Executive Board, or its management. Overview • Provide broad sense of how costs of carbon tax depend on how revenues are used (Ian) • Discuss revenue recycling options in more detail (Rob) Focus on carbon tax on fossil fuel emissions scaled to projected emissions prices under capand-trade proposals (intermediate assumption about offsets). Focus on 2020. According to RRF-NEPI study • CO2 price: $33 per ton • Fossil fuel CO2 emissions reduction: 8.5% (0.5 billion tons) • Revenues: $180 billion Figure 1. Carbon Tax Revenue as % of Projected Federal Budget Deficit 30 25 20 15 10 5 0 2012 2014 2016 Source. CBO (2010), RFF-NEPI (2010). 2018 2020 Within the energy sector, the average cost in 2020 would be approximately $16 per ton. Cost also depends on how it affects distortions from broader tax system. US Tax System Causes 3 Large Distortions 1. In labor market income/payroll taxes reduce hours worked. Increases/decreases in employment generate economic benefit/cost. 2. Taxes on savings/investment reduce capital accumulation. 3. Tax preferences causes excessive spending on e.g., employer medical insurance, home ownership. Implications Large economic benefits from using carbon tax revenues to reduce personal income taxes (directly or indirectly). Recycling $180 billion in produces benefits of approx. $50 billion, or $100 per ton of CO2 reduced. But offsetting effect Carbon taxes → higher energy prices → contract economic activity → reduction in employment Effects of Carbon Taxes on Work Effort Approximately 0.3% reduction if revenues not used to cut income taxes. Approximately a wash if revenues used to cut income taxes. But ‘Double Dividend’ Costs of reduced employment from higher energy prices may be less than Benefits from cutting income taxes--increased employment and reduced distortions from tax preferences Average Cost of Carbon Tax per ton of CO2 Reduced 100 Carbon tax/cap-and-trade with no revenue recycling benefit 80 $/ton 60 40 20 0 Carbon tax/cap-and-trade with revenue recycling benefit -20 Source. Parry and Williams (2011). Average Cost of Carbon Tax per ton of CO2 Reduced 100 80 $/ton 60 40 20 0 -20 Source. Parry and Williams (2011). CO2 per kWh standard