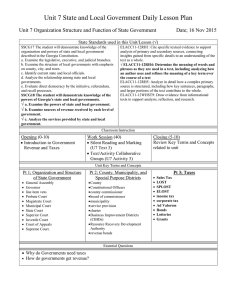

PP RS The Impact of the Special Purpose Local Option Sales Tax

advertisement