Document 11388754

advertisement

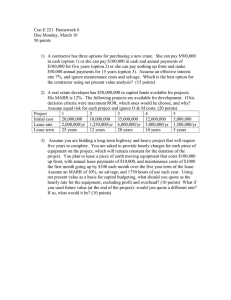

OMB Circular No. A-94 TABLE 2 -- COSTS ASSOCIATED WITH PURCHASE ALTERNATIVE TABLE 1 -- BASIC DATA User completes shaded portions as appropriate. Project: MISSOULA T & D CENTER Location: MISSOULA MONTANA Mar-97 Date: Purchase Price- Building Land Imputed Costs Ancillary Costs/yr To determine the time period to use in an analysis, choose Lease Period + Lease Renewal Option Period if it is of shorter duration than the economic life of the other alternatives (Remember, the analysis must be for 10 years or longer). In this example, the time period is 20 years. $6,000,000 $123,500 $178,500 These numbers should be available from your engineer or architect. 10 years Lease Period: Gross Sq. ft. 53,150 Net Usable sq. ft.(about 80-70% of gross) 43,000 Lease Rate sq. ft. $15.00 Lease Rate Renewal Period Ancillary Costs Us e OM B Cir cular No. A -9 4 , S ect ion 13 f or guidance in det er mining appr opr iat e cos t s f or each of t hes e Pur chas e A lt er nat ive f igur es . It is impor t ant t o include imput ed cos t s f or buildings and/ or land t hat is alr eady gover nment - 10 years $16.00 Local GSA rates or Lease Purchase Rate sq. ft. private sector rates. Lease/Pur Renewal Period Interest Rates: Nom U.S. Treasury Rate (See OMB A-94, App C) Any costs associated with preparing the lease property that WASN'T included in the lease. Typically, these costs are a one-time occurrence. $3,000.00 This Alternative is not allowed at this time, but could be a feasible option in the future. Rather than eliminate it from the spreadsheet, just plug in rates high enough to assure that it wouldn't be chosen. $20.00 $20.00 20 Yr 6.20% 3 Yr 5.80% 3 Design & Construction period (years) Economic Life (Construction) 50 Economic Life (Purchase) 30 LEGEND OMB Circular A-94 has Appendices attached with current nominal interest rates to be used for analyses of this type; (Note: For a 20-year nominal Treasury rate, take an average of the 10-year and 30year rates). 20 Analysis Period (in Years) Table 4 -- ANNUAL EXPENDITURES AND REVENUES TABLE 3 -- CONSTRUCTION AND INTEREST DURING CONSTRUCTION (ESTIMATED) LEGEND User completes shaded portions as appropriate. Interest Rate Construction $5,599,107 Design Costs (6—10% of construction $) $335,946 Contract Supervision (4—8% of construction $335,946 $) Land Cost $0 Land Value $200,000 Total Construction $6,271,000 All design + land purchased in Yr 1 % Constr & Supv in Yr 2: % Constr & Supv in Yr 3: 60.00% 40.00% 5.80% Even if you build on gov't land there is a land cost. This would be an "imputed" cost as described in OMB A-94, Section 13. Federal Appropriation $335,946 $3,561,032 $2,374,021 Year 1 2 3 Total One-Half Annual Funding $168,000 $1,781,000 $1,187,000 $6,271,000 Your Forest Engineer or Architect should be able to provide estimates of these percentages. Typically, design costs are 6—10% of construction costs, while COR and contract supervision costs are 4—8% of construction, depending generally on the size of the project . If the project is relatively small (several hundred thousand dollars), use a percentage at the higher end of the range. If the project is larger (millions of dollars), use a lower percentage. In this example, each was estimated to be 6% of construction costs, but any percentage can be easily used. The formula used in cells C44 and C45 is "=0.06*$C$43", so editing the percentage can be accomplished by changing the "0.06" to the desired decimal. However, if the actual costs are known, those figures should be used (Simply delete the formulas in cells C44 and C45, then enter the actual figures). Prior Years Funding $0 $335,946 $3,896,978 User completes shaded portions as appropriate. These are included in the Lease payment, so they Lease must be considered when Lease Construction Purchase calculating the costs Borrowing Term or associated with 20 3 20 Lease Term (yrs) construction or purchase alternatives. If they aren't $797,250 $1,063,000 Lease payment included, they must be $1,063,000 Renewal Period added to the yearly cost of $850,400 * $5,000 * Real Estate Taxes Bldg Maintenance is * $10,000 * Insurance * $111,982 * Building Maintenance typically 1-3% of Construction or * $22,500 * Utilities Purchase cost. 2% * $11,500 * Operations Costs $1,750.00 N/A $1,750.00 Lease Administration was used for these $799,000 $160,982 $1,064,750 Total Annual Costs costs. Residual Value Federal Amount for Interest Computing During Interest Construction $0 $168,000 $9,740 $9,740 $2,126,686 $123,350 $133,090 $5,217,068 $302,590 Prior Years Interest Total: $435,680 These yearly totals can be thought of as the "opportunity cost" of using Federal funds. For the purpose of this analysis, these costs are factored into the Net Present Value formula used in the Summary below in Table 6. $5,000,000 * =Included in Lease Contract By listing items that are included in the Lease and Lease/Purchase alternatives, the user can ensure that comparable ancillary services are addressed for the Build and Purchase alternatives. Remember, the validity of this analysis rests on the user's ability to compare "apples to apples" and "oranges to oranges". $5,000,000 Purchase N/A $5,000 These may be "imputed" costs. Refer to OMB A94, Section 13.c for further clarification. $13,500 $120,000 $25,000 $15,000 N/A $178,500 $7,500,000 OMB A-94, Section 13.c.7 provides several options for determining Residual Value. Important: The Residual Value can greatly influence the net present value, so give it careful consideration. A-94 Spreadsheet This PowerPoint demo is a quick overview of how to: Answer common questions about the spreadsheet model A-94 Now onto the Spread Sheet Remember… Sheets can be changed. . . on purpose or accidentally. Please be aware you can change the formulas To determine the time period to use in an analysis, choose Lease Period + Lease Renewal Option Period if it is of shorter User completes shaded portions as appropriate. duration than the economic life of the other alternatives (Remember, the analysis must be M ISSOULA T & D CENTER for 10 years or longer). In this example, the M ISSOULA M ONTANA time period is 20 years. M ar- 97 TABLE 1 -- BASIC DATA Project: Location: Date: These numbers should be available from your engineer or architect. Lease Period: 10 years Gross Sq. ft. 53,150 Net Usable sq. ft.(about 80-70% of gross) 43,000 Lease Rate sq. ft. $15.00 Lease Rate Renewal Period 10 years Ancillary Costs Local GSA rates or Lease Purchase Rate sq. ft. private sector rates. Lease/Pur Renewal Period $16.00 $3,000.00 $20.00 $20.00 Interest Rates: Nom U.S. Treasury Rate (See OMB A-94, App C) 20 Yr 6.20% 3 Yr 5.80% Analysis Period (in Years) Design & Construction period (years) 20 3 Economic Life (Construction) 50 Economic Life (Purchase) 30 Any costs associated with preparing the lease property that WASN'T included in the lease. Typically, these costs are a onetime occurrence. This Alternative is not allowed at this time, but could be a feasible option in the future. Rather than eliminate it from the spreadsheet, just plug in rates high enough to assure that it wouldn't be chosen. OMB Circular A-94 has Appendices attached with current nominal interest rates to be used for analyses of this type; (Note: For a 20-year nominal Treasury rate, take an average of the 10-year and 30-year rates). TABLE 2 -- COSTS ASSOCIATED W ITH PURCHASE ALTERNATIVE Purchase Price- Building Land Imputed Costs Ancillary Costs/yr $6,000,000 $123,500 $178,500 Use OMB Circular No. A-94, Section 13.c.(6), for guidance in determining appropriate costs for each of these Purchase Alternative figures. It is important to include imputed costs for buildings and/or land that is already government-owned for the purpose of this analysis. TABLE 3 -- CONSTRUCTION AND INTEREST DURING CONSTRUCTION (ESTIMATED) LEGEND User completes shaded portions as appropriate. Even if you build on gov't land there is a 5.80% landInterest cost. Rate This would be an "imputed" cost as described in OMB A-94, Section 13. Construction $5,599,107 Design Costs (6—10% of construction $) $335,946 Contract Supervision (4—8% of construction $335,946 $) Land Cost $0 Land Value $200,000 Total Construction $6,271,000 All design + land purchased in Yr 1 % Constr & Supv in Yr 2: % Constr & Supv in Yr 3: 60.00% 40.00% Year 1 2 3 Federal Amount for Interest Computing During Interest Construction $0 $168,000 $9,740 $9,740 $2,126,686 $123,350 $133,090 $5,217,068 $302,590 Your Forest Engineer or Architect should be able Federal to provide estimates of these percentages. Appropriation $335,946 $3,561,032 $2,374,021 Total One-Half Annual Funding $168,000 $1,781,000 $1,187,000 $6,271,000 Typically, design costs are 6—10% of construction costs, while COR and contract supervision costs are 4—8% of construction, depending generally on the size of the project. If the project is relatively small (several hundred thousand dollars), use a percentage at the higher end of the range. If the project is larger (millions of dollars), use a lower percentage. In this example, each was estimated to be 6% of construction costs, but any percentage can be easily used. The formula used in cells C44 and C45 is "=0.06*$C$43", so editing the percentage can be accomplished by changing the "0.06" to the desired decimal. However, if the actual costs are known, those figures should be used (Simply delete the formulas in cells C44 and C45, then enter the actual figures). Prior Years Funding $0 $335,946 $3,896,978 Prior Years Interest Total: $435,680 These yearly totals can be thought of as the "opportunity cost" of using Federal funds. For the purpose of this analysis, these costs are factored into the Net Present Value formula used in the Summary below in Table 5. Table 4 -- ANNUAL EXPENDITURES AND REVENUES These may be "imputed" costs. LEGEND User completes shaded portions as appropriate. Refer to OMB AThese are included in the Lease 94, Section 13.c.(6) payment, so they must be considered for further Lease when calculating the costs clarification. Lease Construction Purchase Purchase associated with construction or Borrowingalternatives. Term or purchase If they aren't 20 3 20 N/A Lease Term (yrs) included, they must be added to the yearly cost of the lease. Lease payment Renewal Period Real Estate Taxes Insurance Building Maintenance Utilities Operations Costs Bldg Maintenance is Lease Administration typically 1-3% of Total Annual Construction Costs or Residual Value Purchase cost. 2% was $797,250 $1,063,000 $850,400 $1,063,000 * $5,000 * $5,000 * $10,000 * $13,500 * $111,982 * $120,000 * $22,500 * $25,000 * $11,500 * $15,000 $1,750.00 $799,000 N/A $1,750.00 N/A $160,982 $1,064,750 $178,500 $5,000,000 $5,000,000 $7,500,000 used for these costs. * =Included in Lease Contract By listing thatincluded are included the Lease By listing itemsitems that are in theinLease and Lease/Purchase and Lease/Purchase alternatives, the user can alternatives, the user can ensure that comparable ancillary services ensure that comparable ancillary services are are addressed for the Build and Purchase alternatives. Remember, addressed for the Build and Purchase the validity of this analysis rests on the user's ability to compare alternatives. Remember, the validity of this "apples to apples" and "oranges to oranges". analysis rests on the user's ability to compare "apples to apples" and "oranges to oranges". OMB A-94, Section 13.c.(7) provides several options for determining Residual Value. Important: The Residual Value can greatly influence the net present value, so give it careful consideration. TABLE 5 -- CASH FLOW AND NET PRESENT VALUE annual payments Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Lease ConstructionLease PurchasePurchase Totals From Table 4 The accompanying "User's Guide" explains how these summary net present values were calculated. Net Usable X Lease Rate ($802,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($799,000) ($160,982) ($1,064,750) ($799,000) ($160,982) ($1,064,750) Net Present Value: ($9,110,657) Lease ($178,500) Construction ($7,395,420) ($178,500) ($10,515,419) Lease / Purchase ($178,500) ($5,886,037) Purchase ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($799,000) ($160,982) ($1,064,750) ($178,500) ($852,150) ($160,982) ($1,064,750) ($178,500) ($852,150) ($160,982) ($1,064,750) ($178,500) ($852,150) ($160,982) ($1,064,750) ($178,500) ($852,150) ($160,982) ($1,064,750) ($178,500) ($852,150) ($160,982) ($1,064,750) ($178,500) SUMMARY PREFERRED OPTION: PURCHASE Option years' rate change is reflected here. Conclusions Technology needs to be simple…. We hope this power point demo has helped you. Please send us any comments to us through our main web page. Thanks