Working Paper # 15 Remittances To Cuba: An Evaluation of Cuban

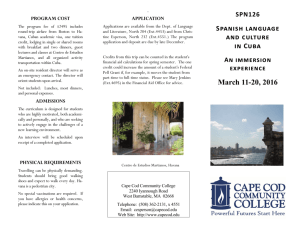

advertisement