CO PRICE IMPACT ON DELL'S SUPPLY CHAIN: A... ECONOMIC ANALYSIS By

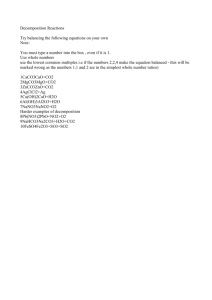

advertisement