Retrospective Analysis of U.S. Climate Policy: Distributional Impacts of a Carbon Tax

advertisement

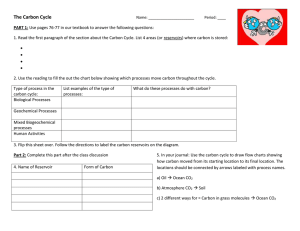

Retrospective Analysis of U.S. Climate Policy: Distributional Impacts of a Carbon Tax Resources For the Future September 19, 2013 Gilbert E. Metcalf Department of Economics Tufts University 1 Questions for a Retrospective Analysis • Positive Questions What is the framework for the incidence analysis? Who bears the burden of carbon tax? • Normative Questions What is the appropriate trade-off between efficiency and equity? What redistributional goals should be achieved? 2 Setting the Parameters of Analysis • • • • Type of distributional analysis? Distribution over what? Measurement issues? Areas for further study? 3 What Do We Mean By “Burden”? $/ton CO2e MAC Carbon tax revenue Cost of reductions 0 25 100 Emission Reduction (%) 4 Distributional Heterogeneity • • • • Income classes Intergenerational Geographic regions Industry groups 5 Incidence Analysis • Absolute Incidence – Views tax in isolation • Balanced Budget Incidence – Revenue used for new spending programs (RGGI, AB32) • Differential Tax Incidence – Revenue neutral reform • (Distributional allocation of benefits) 6 Absolute Analysis 4.0 3.6 3.1 3.0 2.4 2.5 Differential Analysis 2.0 1.8 2.0 1.5 1.5 1.4 1.2 4.0 1.0 1.0 0.8 0.5 0.0 1 2 3 4 5 6 7 8 9 10 Decile 3.0 Percentage of Income Percentage of Income 3.5 2.0 1.0 0.0 1 2 3 4 5 6 7 8 9 10 -1.0 4.0 -2.0 Percentage of Income 3.0 Decile Explicit rebate to Social Security beneficiaries 2.0 1.0 Tax Reform: 0.0 1 2 3 4 5 6 7 8 -1.0 9 10 • Carbon tax revenue used to provide a capped reduction in payroll taxes -2.0 Decile Balanced Budget Analysis Source: Metcalf (2007) Intergenerational Effects Intergenerational impacts of a debt reduction $30/ton CO2 tax by birth year 100 50 CO2 tax in lieu of a capital tax hike 2030 2025 2020 2015 2010 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 1950 1945 $/year NPV 0 CO2 tax in lieu of a labor tax hike -50 CO2 tax in lieu of VAT tax hike -100 CO2 tax with lump sum transfer -150 -200 Birth Year Carbone, Morgenstern, Williams, and Burtraw (2013) Geographic Incidence in MRIO new york new york california new england pacific mountain north east south east florida north central texas south central california new england pacific mountain north east south east florida north central texas south central 0 .2 .4 .6 .8 CO2 intensity of consumption (kg/$) 0 .1 .2 .3 .4 Indirect non-energy CO2 intensity of cons. (kg/$) Direct fossil fuel Indirect fossil fuel Electricity Indirect non-energy Caron, Metcalf, and Reilly (2013) 9 MI TX NY IL PA CA KY FL NC VA NJ WI GA TN MD WV MO AL LA MN SC MA WA KS IA AZ CO OK CT UT OR IN MS NV DE AR NE ND NM ME NH RI MT VT SD AK WY HI ID DC Trade Flows From Ohio 0.08 0.07 0.06 0.05 0.04 0.03 0.02 0.01 0.00 Caron, Metcalf, and Reilly (2013) 10 State Level Policy new england new york mid-atlantic south east florida midwest north central south central texas mountain pacific california -500 0 500 Embodied CO2 (Mt) 1,000 in exports in cons. from local prod. in imports Caron, Metcalf, and Reilly (2013) 11 Industry Impacts • Bovenberg and Goulder (2001) find that partial allocation of free permits preserves equity values – Coal: 4.3% – Oil and Gas: 15.0% – Note that this is a permanent allocation • Metcalf (2013) finds that corporate tax reductions financed by carbon tax disproportionately benefit EITE sectors 12 Methodological Considerations • Metric for ranking households • Measuring burden (changes in: tax payments, after-tax income, welfare?) • Incorporating intergenerational analysis into official methodologies • Subnational policy and tax and emission exporting • Baseline counterfactual • Forward and backward shifting – Impacts on old and new capital 13 Areas for Methodological Advance • Richer treatment of shifting assumptions for carbon pricing • Tax exporting at the national and sub-national level • Integration of carbon policy in broader discussion of intergenerational burden analysis • Consideration of how burdens will be tracked in the case of sub-national policies 14