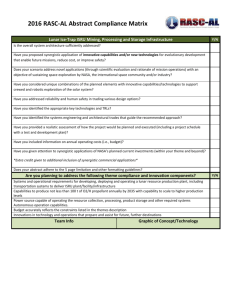

Space Resource Economic Analysis Toolkit:

advertisement