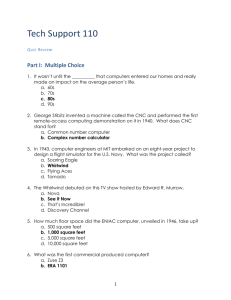

Document 11362596

advertisement