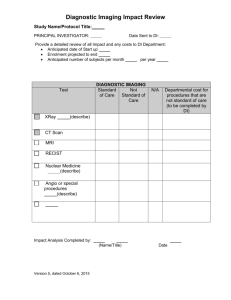

EQUIPMENT (1979)

advertisement