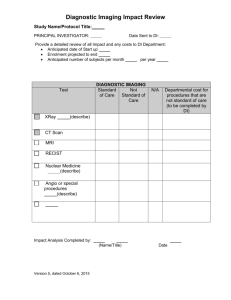

EQUIPMENT (1979)

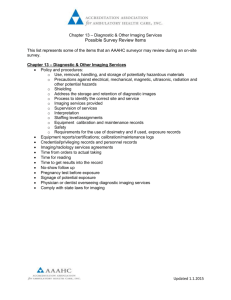

advertisement