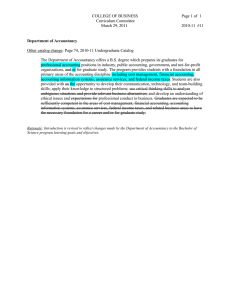

Document 11359026

advertisement

dire of 2 COLLEGE OF BUSINESS Curriculum Committee January 16, 2007 Page 1 2006-07 #7 Department of Accountancy Course Revision: Page 60, 2006-07 Graduate Catalog 633. ADVANCED FINANCIAL REPORTING (3). … PRQ: ACCY 432 with a grade of a C or better. Rationale: Course lacked a prerequisite and now reflects the required background needed to successfully complete the course. Other Catalog Change: Page 72, 2006-07 Undergraduate Catalog Internships in Accountancy The internship (ACCY 473) consists of full-time work experience in an accounting function for ten to thirteen weeks and completion of written and oral reports. … Rationale: To clarify information about the internship experience. Other Catalog Change: Pages 57-58, 2006-07 Graduate Catalog Department of Accountancy (ACCY) The Department of Accountancy offers two graduate programs. The Master of Accounting Science (M.A.S.) is a broad-based degree, integrating accounting knowledge with other business disciplines to prepare candidates for a professional accountancy career. The Master of Science in Taxation (M.S.T.) is an evening program that provides advanced study in taxation to prepare professionals for a career in taxation. Internships in Accountancy The internship (ACCY 673) consists of full-time work experience in an accounting function for 10 to 13 weeks and the completion of written and oral reports. Applications are reviewed by the internship coordinator and approved on the basis of professional promise, instructor recommendation, and credit in specified courses. Permanent employment may not be used for ACCY 673, and ACCY 673 may not be taken as the last course in the program. The Department of Accountancy coordinates all academic internships. More detailed information is available in the departmental office. Chair: James C. Young Graduate Faculty Natalie T. Churyk, assistant professor, C.P.A., Ph.D., University of South Carolina ↓ COLLEGE OF BUSINESS Curriculum Committee January 16, 2007 Page 2 of 2 2006-07 #7 Master of Accounting Science ↓ Phase One See Phase One Requirements listed under “Graduate Study in Business.” The Phase One foundation courses will be included in a student’s program of study unless she or he has earned a C or better in corresponding undergraduate courses or a B or better in equivalent graduate courses elsewhere, or has passed the first and only attempt of the Phase One exemption examination. The M.A.S. program director will determine which Phase One graduate courses will be included in each student’s program of courses. Phase One courses must be completed before enrolling in Phase Two M.A.S. requirements. Phase One courses may not be used as Phase Two electives or requirements. ↓ Internships in Accountancy The internship (ACCY 673) consists of work experience in an accounting function for 10 to 13 weeks and the completion of written and oral reports. Applications are reviewed by the internship coordinator and approved on the basis of professional promise, instructor recommendation, and credit in specified courses. Permanent employment may not be used for ACCY 673, and ACCY 673 may not be taken as the last course in the program. The Department of Accountancy coordinates all academic internships. More detailed information is available in the departmental office. Master of Science in Taxation ↓ Rationale: Adding a general introduction to the department’s graduate programs and moving the internship information (with revision) before the faculty listing improves the website catalog presentation. Regarding the Phase One addition, although the M.A.S. program does have specific requirements for the Phase One Business core, they were not previously published. Department of Management Course Deletion: Page 64, 2006-07 Graduate Catalog Only 412. BUSINESS LAW (3). Rationale: Course no longer offered for graduate credit.