COLLEGE OF BUSINESS ... Curriculum Committee

advertisement

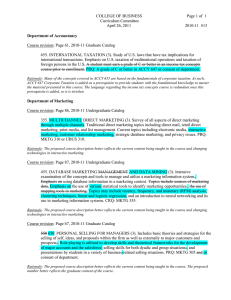

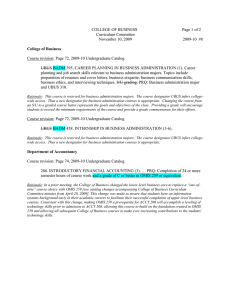

COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 1 of 9 2008-09 #4 Department of Accountancy Course Revision: Page 72, 2008-2009 Undergraduate Catalog 473. INTERNSHIP IN ACCOUNTANCY (3-6) (3). Rationale: The variable credit notation is deleted to reflect original faculty intent that students can earn only three credit hours for each internship experience. Course Revisions: Pages 58-60, 2008-2009 Graduate Catalog 505. FINANCIAL ACCOUNTING CONCEPTS (2). Introduction to the nature, uses, and limitations of financial accounting information. Financial accounting concepts presented from the viewpoint of the user. Problems and cases used to emphasize the kinds of financial accounting information relevant for decision making. Open to students with fewer than 6 semester hours in accounting or by consent of department. Students may not receive credit for both ACCY 206 and ACCY 505. 509. FEDERAL TAXATION: PLANNING AND CONTROL (3). … PRQ: ACCY 505 or equivalent A grade of B or better in a Financial Accounting Concepts course completed within the past five years with a grade of A or B, or consent of department. 510. ACCOUNTING INFORMATION SYSTEMS (3). Handling of accounting data within the modern enterprise with focus on maintaining the integrity of the data as well as developing relevant and reliable accounting information for use in decision making. Emphasis on systems development, internal control, and the use of technology to enhance and improve the flow of accounting information. Projects required in the area of accounting cycles, accounting documentation, and accounting application software. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. Students may not receive credit for both ACCY 310A/310S and ACCY 510. PRQ: A grade of C or better in a Financial Accounting Concepts course and a Managerial Accounting Concepts course, or consent of department. 521. ADVANCED COST MANAGEMENT (3). Advanced study of the information required in management planning and control systems. Theory and application of product costing, operational control, cost allocation, and performance evaluation for manufacturing and service organizations. Topics include transfer pricing, competitive costing, division performance measurement, regression analysis, statistical quality control, activity-based costing, automation and cost management, target costing, and Japanese cost management. Students may not receive credit for both ACCY 421 and ACCY 521. PRQ: A grade of C or better in an Intermediate Cost Management course ACCY 320 with a grade of C or better and MGMT 346, or consent of department. CRQ: UBUS 311 or consent of department. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 2 of 9 2008-09 #4 531. FINANCIAL REPORTING I (4). In-depth study of financial reporting standards including the contemporary economic and political forces that lead to the development of standards relating to statement of cash flows, financial statement analysis, foreign currency translation, conceptual framework, revenue recognition, conversion from cash to accrual basis, time value of money, monetary assets, inventories, plant assets, research and development costs, current liabilities, and long-term debt. Use of databases in researching accounting issues and in analyzing and preparing financial statement disclosures. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. Students may not receive credit for both ACCY 331 and ACCY 531. PRQ: A grade of C or better in a Financial Accounting Concepts course or consent of department. 532. FINANCIAL REPORTING II (3). In-depth study of financial reporting standards including the contemporary economic and political forces that lead to the development of standards relating to accounting for income taxes, pension and other benefit plans, leases, earnings per share, accounting changes, stockholders' equity, and investments including equity method; and an introduction to consolidated financial statements. Use of databases in researching accounting issues and in analyzing and preparing financial statement disclosures. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. Students may not receive credit for both ACCY 432 and ACCY 532. PRQ: A grade of C or better in an Intermediate Financial Reporting I course ACCY 531 or consent of department. 533. FINANCIAL REPORTING III (3). In-depth study of financial reporting standards including the contemporary economic and political forces that lead to the development of standards relating to business combinations and for consolidated financial statements, for companies operating internationally, for interim financial reporting, and the disclosure standards for disaggregated operations. Study and evaluation of the special accounting and reporting required for entities going through corporate insolvency, including the restructuring and impairment of financial instruments, for partnership forms of business entities, for publicly held companies that must meet SEC reporting standards, and for specialized industrial reporting. Research projects include the use of accounting data and literature bases; electronic bases such as the Internet. Team projects used throughout the course. Students may not receive credit for only one of the following: both ACCY 433, and ACCY 533, ACCY 633. PRQ: A grade of C or better in an Intermediate Financial Reporting II course ACCY 532 or consent of department. 550. PRINCIPLES OF TAXATION (3). Study of the principles of federal income taxation with focus on learning taxation concepts related to income, deductions, and property transactions for businesses and individuals. These concepts applied to common transactions and issues encountered by individuals, corporations, partnerships, S corporations, and limited liability companies. Not available for Phase Two credit in the M.A.S., M.B.A., and M.S.T. programs. Students may not receive credit for both ACCY 450 and ACCY 550. PRQ: A grade of C or better in an Intermediate Financial Reporting I course ACCY 531 or consent of department. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 3 of 9 2008-09 #4 555. INDIVIDUAL TAXATION (3). Comprehensive study of the concepts of federal income taxation and the tax rules that apply to individuals. Examination of the principles that provide the framework for the federal income tax system, including income, deductions, basic business operations, and property transactions. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. Students may not receive credit for both ACCY 455 and ACCY 555. PRQ: A grade of C or better in an Intermediate Financial Reporting I course ACCY 531 or consent of department. 556. ADVANCED FEDERAL TAXES (3). Study of federal taxes imposed on business entities with emphasis on corporations, partnerships, and S corporations. Also includes an overview of tax research techniques. Students may not receive credit for both ACCY 556 and ACCY 644. receive credit for only one of the following: ACCY 456, ACCY 556, ACCY 644, ACCY 650. PRQ: A grade of C of better in an Income Tax Concepts course ACCY 455 or consent of department. 557. ACCOUNTING FOR PUBLIC ADMINISTRATION (3). … PRQ: Consent of Division of Public Administration or Department of Accountancy. 560. ASSURANCE SERVICES (3). Study of the accumulation and evaluation of information and data in order to provide assurance to decision-makers. Overview of the variety of assurance services including auditing, attestation, operational, and compliance services. Practices and procedures of assurance services including planning, assessing risk, testing controls, and obtaining and documenting evidence. Focus on analysis of business processes and decisions (both financial and nonfinancial) and analytical skills needed to evaluate evidence, develop recommendations, and communicate findings. Not available for Phase Two credit in the M.A.S., M.B.A., and M.S.T. programs. Students may not receive credit for both ACCY 360 and ACCY 560. PRQ: A grade of C or better in an Accounting Information Systems course ACCY 510 or consent of department. 562. INTERNAL AUDITING (3). Topics include internal audit standards, internal controls, risk assessment, evidence and documentation, and communications. Auditing techniques including sampling and use of systems-based audit techniques. Review of ethics, emerging issues, and industry specific matters. Students may not receive credit for both ACCY 462 and ACCY 562. PRQ: A grade of C or better in an Assurance Services course ACCY 360 with a grade of C or better and MGMT 346, or consent of department. 565. FORENSIC ACCOUNTING/FRAUD EXAMINATION (3). Focus on fraud detection and control from the perspective of public, internal, and private accountants. This course covers areas such as principles and standards for fraud-specific examination; fraud-specific internal control systems; and proactive and reactive investigative techniques. Implications for further research are also considered. Students may not receive credit for both ACCY 465 and ACCY 565. PRQ: A grade of C or better in an Intermediate Financial Reporting I course ACCY 331 with a grade of C or better, and ACCY 360 an Assurance Services course with a grade of C or better, and MGMT 346, or consent of department. 580. GOVERNMENTAL AND NOT-FOR-PROFIT ACCOUNTING (3). … PRQ: A grade of C or better in an Intermediate Financial Reporting I course ACCY 531 or consent of department. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 4 of 9 2008-09 #4 604. INDEPENDENT STUDY IN ACCOUNTING (1-3). … PRQ: A grade of C or better in a Graduate Accounting Research course, 21 semester hours of accounting, and consent of department. 605. INDEPENDENT STUDY IN TAXATION (1-3). … PRQ: A grade of C or better in a Graduate Professional Tax Research course ACCY 645 and consent of department. 611. ADVANCED ACCOUNTING INFORMATION SYSTEMS (3). … PRQ: A grade of C or better in an Accounting Information Systems course Both ACCY 310A and ACCY 310S with at least a C or consent of department. 622. MANAGERIAL ACCOUNTING INFORMATION SYSTEMS (3). … PRQ: A grade of C or better in an Intermediate Cost Management course ACCY 320 and 6 semester hours of accounting course work, or consent of department. 630. MANAGERIAL ACCOUNTING CONCEPTS (3). … PRQ: A grade of C or better in a Financial Accounting Concepts course ACCY 505 or consent of department. 633. ADVANCED FINANCIAL REPORTING (3). Study and evaluation of special accounting and reporting requirements for entities going through business combinations and restructurings, and of financial reporting relating to consolidated entities, international operations, interim financial reporting, and disaggregated disclosures. Analysis of effect of financial instruments and hedging activities on financial statements. Research and team projects requiring use of literature databases and the Internet. Students may not receive credit for ACCY 433/ACCY 533 and ACCY 633 receive credit for only one of the following: ACCY 433, ACCY 533, ACCY 633. PRQ: A grade of C or better in an Intermediate Financial Reporting II course ACCY 432 with a grade of a C or better or consent of department. 640. FINANCIAL STATEMENTS ANALYSIS (3). … PRQ: A grade of C or better in a Managerial Accounting Concepts course ACCY 630 or consent of department. 644. ADVANCED TAXATION (3 Study of the federal income taxation of business entities. Emphasis on corporations, partnerships, and S corporations and includes an introduction to tax research. Students may receive credit for only one of the following: ACCY 456, ACCY 556, ACCY 644, ACCY 650. not receive credit for both ACCY 556 and ACCY 644. Not available for credit in the M.A.S. area of study in taxation track. PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 645. PROFESSIONAL TAX RESEARCH (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 646. TAX ADMINISTRATION AND PRACTICE (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 647. CORPORATE TAXATION (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 5 of 9 2008-09 #4 648. ADVANCED CORPORATE TAXATION (3). … PRQ: A grade of C or better in a Graduate Corporate Taxation course ACCY 647 or consent of department. 649. PARTNERSHIP TAXATION (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 650. ADVANCED ISSUES IN TAXATION (3). Continuation of ACCY 450. Study of advanced concepts of federal taxation as it applies to a broad range of taxpayers. Application of advanced concepts of taxation to individuals and business entities including corporations, partnerships, and S corporations. Introduction to international and state tax issues, gift and estate tax, fiduciary tax accounting, and tax issues for not-for-profit organizations. Students may receive credit for only one of the following: ACCY 456, ACCY 556, ACCY 644, ACCY 650. PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 651. FEDERAL ESTATE AND GIFT TAXATION (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 652. TAXATION OF ESTATES AND TRUSTS (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 654. SPECIAL TAX TOPICS (1-3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 655. INTERNATIONAL TAXATION (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 656. TAX CONCEPTS AND PROPERTY TRANSACTIONS (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 657. TAXATION OF COMPENSATION AND BENEFITS (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 658. STATE AND LOCAL TAXATION (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 659. TAX ACCOUNTING METHODS AND PERIODS (3). … PRQ: A grade of C or better in an Income Tax Concepts course ACCY 450 or consent of department. 660. ADVANCED PARTNERSHIP TAXATION (3). … PRQ: A grade of C or better in a Graduate Partnership Taxation course ACCY 649 or consent of department. 664. FINANCIAL STATEMENT AUDITING (3). … PRQ: A grade of C or better in an Intermediate Financial Reporting I course ACCY 331, an Assurance Services course, ACCY 360, and an Intermediate Financial Reporting II course; ACCY 432 or consent of department. 667. INFORMATION SYSTEMS AUDITING (3). … PRQ: A grade of C or better in an Assurance Services course ACCY 360 or consent of department. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 6 of 9 2008-09 #4 680. ADVANCED GOVERNMENTAL AND NOT-FOR-PROFIT ACCOUNTING (3). … PRQ: A grade of C or better in a Governmental and Not-For-Profit Accounting course ACCY 480 or consent of department. 682. INTERNATIONAL ACCOUNTING (3). … PRQ: A grade of C or better in an Intermediate Cost Management course ACCY 320 and an Intermediate Financial Reporting II course, 432 or consent of department. 690. ACCOUNTANCY CAPSTONE/FINANCIAL STATEMENT ANALYSIS AND BUSINESS VALUATION (3). … PRQ: ACCY 310A, ACCY 310S, ACCY 320, ACCY 331, ACCY 360, ACCY 432, and ACCY 450. Completion of both college and department Phase One requirements or consent of department. Rationale: Changes from NIU course numbers to text descriptions were made to ensure that ACCY graduate students are able to automatically register for classes in MyNIU. The system’s hold for course-number prerequisites would prevent graduate students who did not graduate from our undergraduate program or take their Phase One requirements at NIU from registering on their own. Program advisors would be required to manually override the system to register these students in their desired classes. Consistent with past practice under the former registration system, ACCY advisors will review class rosters to verify that students have met prerequisite requirements. Other revisions were made to achieve consistent language in course descriptions. Other catalog change: Page 56, 2008-2009 Graduate Catalog Master of Accounting Science ↓ Phase One ↓ Required Accountancy Courses ACCY 510 – Accounting Information Systems (3) OR ACCY 310A – Accounting Information Systems (3) AND ACCY 310S – Accounting Information Systems Laboratory (1) ACCY 531 – Financial Reporting I (4) OR ACCY 331 – Financial Reporting I (4) ACCY 532 – Financial Reporting II (3) OR ACCY 432 – Financial Reporting II (3) ACCY 550 – Principles of Taxation (3) OR ACCY 450 – Taxation of Business Entities and Individuals (3) ACCY 560 – Assurance Services (3) OR ACCY 360 – Assurance Services (3) ACCY 630 – Managerial Accounting Concepts (3) OR ACCY 320 – Intermediate Cost Management2 (3) ___________________________________ ↓ 2 ACCY 207 is a prerequisite for ACCY 320. Rationale: Since the majority of students in the M.A.S. program take the undergraduate equivalent courses to satisfy the Phase One Accountancy core, these courses are partnered with the required Phase One graduate courses to accommodate MyNIU’s automation of the check for prerequisites. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 7 of 9 2008-09 #4 Department of Management New course: Page 77, 2008-2009 Undergraduate Catalog CIP: 52.01 327. CREATIVITY, INNOVATION, AND ENTREPRENEURSHIP (3). Study of methods used and development of skills needed to identify entrepreneurial opportunities and construct innovative solutions. Topics include theories of creativity, enterprise idea generation and evaluation, and other concepts, models and techniques used in practice. CRQ: UBUS 310 or consent of department. Rationale: The course will provide business students with the critical skills necessary to develop their creativity in order to identify new venture opportunities and create innovative, “breakthrough” solutions to business problems. Enhancing creativity is the key focus, with the intent to develop capitalist creativity, in which the ideas and solutions generated must be profitable and reflect bottom-line practicality. With an in-depth understanding of the techniques and methods of creativity, opportunity identification and idea generation, students will be able to strengthen their creativity, identify and critically assess potential opportunities, and produce and evaluate innovative ideas and solutions around which a new venture can be based. Departments that have been contacted with regard to duplication of content: Department of Leadership, Educational Psychology and Foundations Course revisions: Pages 77-78, 2008-2009 Undergraduate Catalog 436. COMPENSATION AND BENEFITS ADMINISTRATION (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. 438. HUMAN RESOURCE PLANNING AND STAFFING (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. 444. TRAINING AND DEVELOPMENT (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. 447. LEADERSHIP (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. 448. EMPLOYMENT LAW (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. 457. MANAGERIAL DECISION MAKING AND NEGOTIATION (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. 477. MANAGING ORGANIZATIONS IN COMPETITIVE ENVIRONMENTS (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. CRQ: MGMT 468. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 8 of 9 2008-09 #4 487. MULTINATIONAL MANAGEMENT (3). … PRQ: Management major and a g Grade of C or better in MGMT 335 and MGMT 355. Rationale: To make any open seats available to other majors. The previous registration system made it necessary to restrict enrollment to Management majors to assure seats in these required MGMT courses were available for Management majors. MyNIU makes it possible to reserve seats and open any remaining seats to other majors who meet the course prerequisites. Other catalog change: Page 76, 2008-2009 Undergraduate Catalog Major in Management (B.S.) ↓ Emphasis 1. Organizational Management ↓ Requirements in Department (25) ↓ One of the following (3) ACCY 306 – Financial Accounting Information for Business Decisions (3) MGMT 301 – Business and Society (3) MGMT 327 – Creativity, Innovation, and Entrepreneurship (3) MGMT 437 – Entrepreneurship (3) ↓ Rationale: MGMT 327 is a new course being added and is appropriate for the career and academic goals of organizational management students. Department of Marketing Other catalog change: Page 80, 2008-2009 Undergraduate Catalog Certificates of Undergraduate Study Professional Selling (12) ↓ Service Management (12) A Certificate of Undergraduate Study in Service Management, which has a marketing component, is available. See a description of this certificate in the Department of Operations Management and Information Systems section of the catalog. Rationale: Since this certificate is offered by the Department of Operations Management & Information Systems and has a marketing component, this notation references the certificate in the Marketing Department section of the catalog—it is currently listed under OM&IS. The certificate was approved by CUC on 4-12-07 and UCC on 5-3-07. COLLEGE OF BUSINESS Curriculum Committee October 14, 2008 Page 9 of 9 2008-09 #4 Department of Operations Management and Information Systems Course revision: Page 83, 2008-2009 Undergraduate Catalog 338. PRINCIPLES OF OPERATIONS MANAGEMENT (3). … PRQ: Junior standing, MATH 210 or MATH 211 or MATH 229, STAT 301 or STAT 350 or UBUS 223. Rationale: The course has been changed over time to also accommodate non-business majors, and the prerequisites are no longer needed.