COLLEGE OF BUSINESS ... Curriculum Committee

advertisement

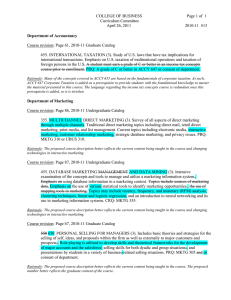

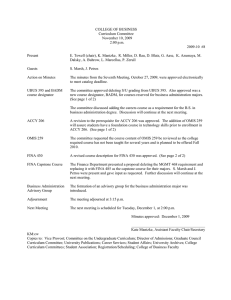

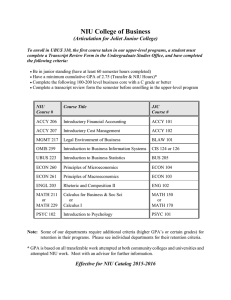

COLLEGE OF BUSINESS Curriculum Committee April 14, 2009 Page 1 of 5 2008-09 #13 College of Business Other catalog change: Page 55, 2008-2009 Graduate Catalog Professional Master of Business Administration The one-year professional M.B.A. is designed for working professionals who desire to earn the degree in an accelerated evening format while continuing to work full time in an organization. Students must have completed an undergraduate degree in business and have had five or more years of post-undergraduate work experience prior to starting the professional M.B.A. Courses are offered in the evening, meeting two nights per week. Students may begin the professional M.B.A. only in the spring semester. For further information contact the office of M.B.A. programs at (866) 648-6221. Rationale: Since the PMBA courses are taught in an accelerated format and requires students to have an undergraduate degree in business, or have completed the Phase One courses; this change allows students to draw more quickly from their previous course work. Department of Accountancy New course: Page 58, 2008-2009 Graduate Catalog CIP Code: 52.03 510S. ACCOUNTING INFORMATION SYSTEMS LABORATORY (1). Basic instruction in skills and techniques necessary to identify, collect, analyze and report accounting information. Must be taken concurrently with ACCY 510A. A student may not receive credit for both ACCY 310S and ACCY510S. A student must earn a grade of C or better in both a financial accounting concepts course and a managerial accounting concepts course prior to enrollment. Rationale: Phase One MAS students take 300-400 level Accountancy courses to complete deficiencies. The department wishes to offer a 500-level equivalent course so graduate students may receive graduate student loans. Regarding duplication: A review of the Graduate Catalog indicated the content of this course is not being taught by any other department. New course: Page 58, 2008-2009 Graduate Catalog CIP Code: 52.03 520. INTERMEDIATE COST MANAGEMENT (3). Continuation of the study of the information required in management planning and control systems. Theory and application of product costing, operational control, cost allocation, and performance evaluation for manufacturing, merchandising, and service organizations. Topics include budgeting, cost management for factory automation and just-in-time environments, activity-based costing, ethics, cost of quality, target costing, and life-cycle costing. A student may not receive credit for both ACCY 320 and ACCY 520. A student must earn a C or better in a managerial accounting concepts course prior to enrollment. COLLEGE OF BUSINESS Curriculum Committee April 14, 2009 Page 2 of 5 2008-09 #13 Rationale: Phase One MAS students take 300-400 level Accountancy courses to complete deficiencies. The department wishes to offer a 500-level equivalent course so graduate students may receive graduate student loans. Regarding duplication: A review of the Graduate Catalog indicated the content of this course is not being taught by any other department. New course: Page 59, 2008-2009 Graduate Catalog CIP Code: 52.16 653. ACCOUNTING FOR INCOME TAXES (3). Study of the accounting for and reporting of income taxes in financial statements. Discussions focus on issues that arise in practice due to uncertainty in the underlying tax law as it relates to domestic, international, multistate, and acquisition-related activities. A framework for exercising judgment to appropriately address such uncertainties is also provided. A student must earn a grade of C or better in an income tax concepts course prior to enrollment. Rationale: This class has been offered on a regular basis as ACCY 654 – Special Tax Topics. The department wants to create a course dedicated to this topic area to free up ACCY 654 for use in other topic areas. Regarding duplication: A review of the Graduate Catalog indicated the content of this course is not being taught by any other department. New course: Page 60, 2008-2009 Graduate Catalog CIP Code: 52.16 661. ADVANCED STATE AND LOCAL TAXATION (3). Study of advanced state and local tax issues affecting business organizations. Topics include nexus, constitutional standards, computation of state taxable income, sales tax base and exemptions, and credits and incentives, with a focus on identifying issues and opportunities for the reduction of state taxes. PRQ: A grade of C or better in a graduate state and local taxation course. Rationale: This class has been offered on a regular basis as ACCY 654 – Special Tax Topics. The department wants to create a course dedicated to this topic area to free up ACCY 654 for use in other topic areas. Regarding duplication: A review of the Graduate Catalog indicated the content of this course is not being taught by any other department. COLLEGE OF BUSINESS Curriculum Committee April 14, 2009 Page 3 of 5 2008-09 #13 Course revision: Page 58, 2008-2009 Graduate Catalog 510 510A. ACCOUNTING INFORMATION SYSTEMS (3). Handling of accounting data within the modern enterprise with focus on maintaining the integrity of the data as well as developing relevant and reliable accounting information for use in decision making. Emphasis on systems development, internal control, and the use of technology to enhance and improve the flow of accounting information. Projects required in the area of accounting cycles, accounting documentation, and accounting application software. Examination of organizational accounting information systems that capture information from the major business processes and transaction cycles. Emphasis on how these information systems serve as the basis for the functional areas of accounting and business. Internal controls, information technologies including databases, and reporting methodologies are stressed through applied projects and case studies. Must be taken concurrently with ACCY 501S. Not available for Phase Two credit in the M.A.S., M.B.A., or M.S.T. programs. A student may not receive credit for both ACCY 310A/ACCY 310S and ACCY 510 510A/ACCY 510S. A student must earn a grade of C or better in both a financial accounting concepts course and a managerial accounting concepts course prior to enrollment. Rationale: Catalog language for ACCY 510 is revised to be consistent with catalog language for ACCY 310A, the undergraduate course that is equivalent to this graduate Phase One deficiency course. Other catalog change: Pages 56-57, 2008-2009 Graduate Catalog Master of Accounting Science ↓ Phase One ↓ Required Accountancy Courses ACCY 510A – Accounting Information Systems (3) OR ACCY 310A – Accounting Information Systems (3) and ACCY 310S – Accounting Information Systems Laboratory (1) ACCY 510S – Accounting Information Systems Laboratory (1) ACCY 5202 – Intermediate Cost Management (3) ACCY 531 – Financial Reporting I (4) OR ACCY 331 – Financial Reporting I (4) ACCY 532 – Financial Reporting II (3) OR ACCY 432 – Financial Reporting II (3) ACCY 550 – Principles of Taxation (3) OR ACCY 450 – Taxation of Business Entities and Individuals (3) ACCY 560 – Assurance Services (3) OR ACCY 360 – Assurance Services (3) ACCY 630 – Managerial Accounting Concepts OR ACCY 3202 – Intermediate Cost Management (3) ↓ Phase Two ↓ COLLEGE OF BUSINESS Curriculum Committee April 14, 2009 Page 4 of 5 2008-09 #13 The student is required to complete a minimum of 30 semester hours of work beyond Phase One and the baccalaureate degree. Of these 30 semester hours, at least 15 semester hours must be in accounting. At least six of the 30 semester hours must be in graduate-level courses in related areas outside the Department of Accountancy with the approval of the adviser. The total Phase Two credits accepted in transfer from other institutions may not exceed 9 semester hours. The student must maintain a minimum of 3.00 in all graduate course work completed in Phase Two. ↓ Footnote: 2ACCY 207 is a prerequisite for ACCY 320 520. Rationale: The Accountancy Department will be offering the 500-level courses for M.A.S. students. In the past only 300- and 400-level courses were offered for Phase One deficiencies. The added sentence is included in the ACCY section of the Graduate Catalog to more clearly communicate to M.A.S. students the NIU Graduate School GPA requirements to remain in good academic standing [p.25, 20082009 Graduate Catalog] and for graduation [p.30, 2008-2009 Graduate Catalog]. This reiteration of Graduate School standards is similar to what other departments have included in the catalog for their degree programs. Other catalog change: Page 58, 2008-2009 Graduate Catalog Master of Science in Taxation ↓ Requirements ACCY 645 – Professional Tax Research (3) ACCY 647 – Corporate Taxation (3) ACCY 649 – Partnership Taxation (3) ACCY 651 – Federal Estate and Gift Taxation (3) ACCY 656 – Tax Concepts and Property Transactions (3) Course work from the following (15) ACCY 605 – Independent Study in Taxation (1-3) ACCY 646 – Tax Administration and Practice (3) ACCY 648 – Advanced Corporate Taxation (3) ACCY 652 – Taxation of Estates and Trusts (3) ACCY 653 – Accounting for Income Taxes (3) ACCY 654 – Special Tax Topics (1-6) ACCY 655 – International Taxation (3) ACCY 657 – Taxation of Compensation and Benefits (3) ACCY 658 – State and Local Taxation (3) ACCY 659 – Tax Accounting Methods and Periods (3) ACCY 660 – Advanced Partnership Taxation (3) ACCY 661 – Advanced State and Local Taxation (3) ACCY 673 – Internship in Accountancy (3) Rationale: Added two new tax classes to the elective list for the M.S.T. program. COLLEGE OF BUSINESS Curriculum Committee April 14, 2009 Page 5 of 5 2008-09 #13 Department of Management Course revision: Page 78, 2008-2009 Undergraduate Catalog 468. STRATEGIC MANAGEMENT (3). … PRQ: Senior standing and ACCY 331 (for ACCY majors); FINA 330, FINA 340, and FINA 350 (for FINA majors); MGMT 335 and MGMT 355 (for MGMT and business administration majors). CRQ: OMIS 498 (for OMIS majors); MKTG 495 (for MKTG majors); or consent of department. PRQ: (1) Senior standing and (2) ACCY 331 (for ACCY majors); OMIS 450 or OMIS 452 or FINA 410 (for business administration majors); FINA 330, FINA 340, and FINA 350 (for FINA majors); MGMT 335 and MGMT 355 (for MGMT majors). CRQ: MKTG 495 (for MKTG majors); OMIS 498 (for OMIS majors); or consent of department. Rationale: This change will help ensure that business administration majors who enroll for this course are in their final two semesters in the college. The prerequisites for other majors have not been changed, except to be reordered alphabetically.