COLLEGE OF BUSINESS ... Curriculum Committee

advertisement

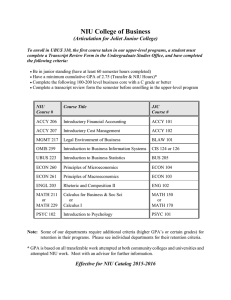

COLLEGE OF BUSINESS Curriculum Committee March 2, 2010 Page 1 of 7 2009-10 #13 Department of Accountancy New course: Page 75, 2009-10 Undergraduate Catalog CIP code: 52.03 467. AUDITING OF ACCOUNTING INFORMATION SYSTEMS (3). Study of the auditing of computer-based accounting information systems with a focus on control and security. Topics include information technology as it relates to assurance services, internal control assessments, and evidencegathering activities. A student may not receive credit for both ACCY 467 and 667. PRQ: ACCY 360 with a grade of C or better and MGMT 346, or consent of department. Rationale: Auditors devote a significant portion of their time to the assessment of computer-based accounting information systems that generate financial reports. Increasingly, our graduates have career opportunities to work in this area of accounting – both at the entry level and as their careers progress. This course will provide our students with the skills required to perform an effective audit of computer-based accounting information systems. Duplication Note: This course content is not being delivered by any other NIU department. New course: Page 75, 2009-10 Undergraduate Catalog CIP code: 52.03 470. ACCOUNTING CAREER SKILLS SEMINAR (1). Continuation of ACCY 370. Study of interpersonal skills necessary for a successful accounting career. Explores a variety of situations that accounting professionals experience in their careers and discusses the necessary skills and appropriate behaviors in those situations. PRQ: ACCY 370 and MGMT 346. Rationale: Accountancy majors entering the workforce are facing increased expectations to use their understanding of accounting information to assist organizations in complying with various reporting requirements and to facilitate users’ understanding of that accounting information. This one-hour seminar will allow students to develop skills to this end and build on topics introduced in ACCY 370, MGMT 346, and UBUS 311, including: (1) preparing an agenda; (2) running a meeting; (3) listening skills; (4) impression management; (5) business etiquette; and (6) resume maintenance. Duplication Note: This course content is not being delivered by any other NIU department. Course revisions: Pages 74-75, 2009-10 Undergraduate Catalog 206. Introductory Financial Accounting (3). Presentation of accounting as an information discipline. Introduction to financial accounting as a means for recording transactions and preparing financial statements for external reporting purposes. Examines the nNature of accounting, basic accounting concepts, financial statements, accrual and cash basesbasis of accounting, the accounting cycle, data accumulation with manual and electronic data processing systems, monetary assets, current liabilities, inventories, fixed assets, long-term liabilities, and owner’s equity and internal control. Topics include corporate accounting for assets, liabilities and stockholders’ equity, and the corporate income statement. Emphasis on usefulness of accounting information for business decision making. Not open to students with credit in ACCY 288. PRQ: Completion of 24 or more semester hours of course work and a grade of C or better in OMIS 259 or equivalent. COLLEGE OF BUSINESS Curriculum Committee March 2, 2010 Page 2 of 7 2009-10 #13 Note: Course prerequisite reflects catalog changes approved by College of Business Curriculum Committee in November 2009. 207. Introductory Cost Management (3). Introduction to the study of the information required for decision making in management planning and control systems. Theory and application of product costing, operational control, cost allocation, and performance evaluation for manufacturing, merchandising, and service organizations. Topics include cost-volume-profit analysis, standard costing, budgeting, job order costing, activity based costing, and process costing. PRQ: ACCY 206 or equivalent. 307. Managerial Accounting Information for Decisions and Control (3). Evaluation and analysis of managerial accounting concepts relevant for management planning and control. In-depth analysis of the use of accounting information such as budgets, standard costs, cost-volume-profit data, relevant costs, and product costs in decision making. Study of managers’ use of accounting information for decision making. Topics include budgeting, forecasting, cost estimation, cost allocation, cost-volume-profit analysis, product pricing, income statement analysis, performance measurement, and non-routine decision making. Not open to accountancy majors. CRQ: UBUS 310. 310A. Accounting Information Systems (3). Examination Study of organizational accounting information systems that capture information from the major business processes and transaction cycles. Emphasis on how these information systems serve as the basis for the functional areas of accounting and business., including i Internal controls, databases, and other information technologies including databases, and reporting methodologies are stressed through applied projects and case studies through a case study approach. Must be taken concurrently with ACCY 310S. PRQ: Acceptable score on the Accountancy Qualifying Examination or consent of department. CRQ: UBUS 310. 310S. Accounting Information Systems Laboratory (1). Basic instruction in Development of skills and techniques necessary to identify, collect, analyze and report accounting information are stressed through applied projects. Must be taken concurrently with ACCY 310A. PRQ: Acceptable score on the Accountancy Qualifying Examination or consent of the department. CRQ: UBUS 310. 320. Intermediate Cost Management (3). Continuation of the study of the information required in management planning and control systems. Theory and application of product costing, operational control, cost allocation, and performance evaluation for manufacturing, merchandising, and service organizations. Topics include budgeting, cost management for factory automation and just-in- time environments, activity-based costing, ethics, cost of quality, target costing, and life-cycle costing. Study of managers’ use of accounting information for decision making in manufacturing and service organizations. Topics include budgeting, cost estimation, cost allocation, cost-volume-profit analysis, non-routine decision making, transfer pricing, performance measurement, and the use of Excel for modeling business decisions. PRQ: Acceptable score on the Accountancy Qualifying Examination or consent of department. CRQ: UBUS 310 and ACCY 310A. COLLEGE OF BUSINESS Curriculum Committee March 2, 2010 Page 3 of 7 2009-10 #13 331. Financial Reporting I (4) (3). Study of accounting theory and practice relating to statement of cash flows, financial statement analysis, foreign currency translation, financial accounting and reporting issues, including the conceptual framework, balance sheet and income statement preparation, revenue recognition, conversion from cash to accrual basis, time value of money, monetary assets, inventories, plant assets, research and development costs, current liabilities, and long-term debt. Use of databases Employ authoritative sources in researching accounting issues and in analyzing and preparing financial statement disclosures. Must be taken concurrently with UBUS 311. PRQ: ACCY 310A with a grade of C or better. CRQ: UBUS 310. 360. Assurance Services (3). Introduction and investigation of various types Study of assurance services, including auditing and, attestation, operational, and compliance services. Emphasis on underlying concepts, standards, and procedures associated with assurance services, including engagement planning, risk assessment, internal control testing, evidence gathering and documentation, and communication of findings. Practices and procedures of assurance services including planning, assessing risk, testing controls, and obtaining and documenting evidence. Focus on identification and review of business processes and decisions (both financial and nonfinancial), and skills needed to analyze evidence, develop recommendations, and communicate findings. PRQ: ACCY 310A with a grade of C or better and ACCY 320 with a grade of C or better, or consent of department. CRQ: UBUS 310. 370. Accounting Career Planning Seminar (1). Explores the various career paths available to accountants. Assists in identifying and developing career goals, job search strategies and skills, and interpersonal skills. Activities include self-assessment and career goal planning, resume writing, mock interviews, role-playing networking, and information interviews. PRQ: Acceptable score on the Accountancy Qualifying Examination or consent of department. 421. Advanced Cost Management (3). Advanced study of the information required in management planning and control systems. Theory and application of product costing, operational control, cost allocation, and performance evaluation for manufacturing and service organizations. Topics include transfer pricing, competitive costing, division performance measurement, regression analysis, statistical quality control, activity-based costing, automation and cost management, target costing, and Japanese cost management. Study of advanced topics related to managers’ use of accounting information for management planning and control systems. Topics include advanced costing techniques, division performance measurement, customer profitability analysis, incentive systems, and other contemporary cost management issues. PRQ: ACCY 320 with a grade of C or better and MGMT 346. CRQ: UBUS 311. 432. Financial Reporting II (3). Study of financial accounting theory and practice relating to and reporting issues, including accounting for income taxes, pension and other benefit plans, leases, earnings per share, accounting changes, stockholders’ equity, and investments including equity method, and statement of cash flows.; and an introduction to consolidated financial statements. Use of databases Employ authoritative sources in researching accounting issues and in analyzing and preparing financial statement disclosures. PRQ: ACCY 331 with a grade of C or better. COLLEGE OF BUSINESS Curriculum Committee March 2, 2010 Page 4 of 7 2009-10 #13 433. Financial Reporting III (3). Study of financial accounting theory and practice relating to and reporting issues, including accounting for business combinations under the purchase and pooling methods, consolidated financial statements, international operations, segment and interim reporting standards, debt restructure, corporate insolvency, partnership accounting, and accounting for specialized industries such as banking, construction, franchising, and real estate. Coverage of SEC reporting standards. Use of databases in researching accounting issues and in analyzing and preparing disclosures. Extensive use of group projects. conversion of foreign financial statements, foreign currency denominated transactions, and derivatives and hedging activities. Employ authoritative sources in researching accounting issues. PRQ: ACCY 432 with a grade of C or better and MGMT 346. 439. Contemporary Issues in Financial Accounting (3). Analysis of present generally accepted accounting principles. Investigation of the historical, economic, and political influences upon accounting principles and the application of these principles in accounting practice. Study of select topics in financial accounting and reporting to supplement knowledge attained in required financial reporting courses. PRQ: 15 semester hours of accounting and at least a B average in accounting above the elementary courses and MGMT 346, or consent of department. ACCY 432 with a grade of C or better and MGMT 346. 450. Taxation of Business Entities and Individuals (3). Study of basic concepts of federal income taxation related to income, deductions, and property transactions for a broad range of taxpayers applied to the taxation of individuals and business entities, including corporations, partnerships, S corporations, and limited liability companies business entities and individuals. Includes the study of property transactions. PRQ: ACCY 331 with a grade of C or better. 462. Internal Auditing (3). Study of internal audit objectives, processes and reporting. Topics include internal audit standards, internal controls, risk assessment, evidence and risk-based audit procedures, documentation, and communications. Auditing techniques including sampling and use of systems -based audit techniques. Review of ethics, Employ authoritative sources to examine ethical issues, emerging issues, and industry specific matters issues. PRQ: ACCY 360 with a grade of C or better and MGMT 346, or consent of department. 465. Forensic Accounting/Fraud Examination (3). This course focuses on Study of fraud detection and control from the perspective of public, internal, and private accountants. This course covers areas such as Topics include principles and standards for fraud-specific examination;, fraud-specific internal control systems;, and proactive and reactive investigative techniques. PRQ: ACCY 331 with a grade of C or better, and ACCY 360 with a grade of C or better, and MGMT 346, or consent of department. 472. Independent Study in Accountancy (1-3). Individually arranged study in of an accounting topic or topics that are not part of our regular course offerings. May be repeated once to a maximum of 3 semester hours. May not be used as an accountancy elective. PRQ: Senior standing with B average in accounting and consent of department ACCY 331 with a grade of B or better and ACCY 360 with a grade of B or better and MGMT 346 and subject to a faculty member’s discretion and availability and consent of department. COLLEGE OF BUSINESS Curriculum Committee March 2, 2010 Page 5 of 7 2009-10 #13 473. Internship in Accountancy (3). Full-time work for at least ten weeks during the fall or spring semester, or during the summer, in the accountancy/financial function of a sponsoring organization. Students submit periodic reports and deliver an oral presentation to the Department of Accountancy internship coordinator for grading. May be repeated to a maximum of 6 semester hours. PRQ: ACCY 310A and ACCY 310S, and ACCY 320, and ACCY 331, and ACCY 360, and ACCY 370 and MGMT 346, and junior standing, and consent of department. 475. C.P.A. Problems I (3). Analysis and review Study of accounting principles and practices as developed and illustrated in complex selected problems for issuers, nonissuers, and governmental entities. Discussion of selected problems and theory related theory and completion of relevant, complex problems. Laboratory Computer-based practice in the solution of typical problems encountered in the C.P.A. examination. May not be used as an accountancy elective. PRQ: Senior standing or cConsent of department. 476. C.P.A. Problems II (3). Continuation of ACCY 475. Further analysis and review of accounting principles and practices, and the continuation of laboratory practice. Study of auditing principles and practices for issuers, nonissuers, and governmental entities. Discussion of related theory and completion of relevant, complex problems. Computer-based practice in the solution of typical problems encountered in the C.P.A. exam. May not be used as an accountancy elective. CRQ PRQ: ACCY 475 or c Consent of department. 480. Governmental and Not-For-Profit Accounting (3). Basic introduction to Study of state and local government accounting, federal government accounting, not-for-profit organization accounting; GAO audit standards and the single audit act, and not-for-profit tax issues ; not-forprofit organization accounting including tax issues and industry specific issues in healthcare and colleges and universities; Government Auditing Standards and the Single Audit Act; and federal government accounting. PRQ: ACCY 331 with a grade of C or better and MGMT 346. 490. Current Topics in Accountancy (1-3). Study of new developments in accountancy including current topics and issues. May be repeated to a maximum of 6 semester hours when topic varies topics vary. PRQ: Consent of department. 499H. Honors Directed Research in Accountancy (3). Open only to students participating in the University Honors Program or in the Department of Accountancy Honors Program. Individually arranged research in an accountancy topic of the student’s selection which must be approved by the student’s Honors adviser, the faculty member supervising the research, and by the department chair. PRQ: MGMT 346 and consent of department. Rationale: Course descriptions are changed to more clearly reflect current course content and to achieve consistency in wording throughout. Other catalog change: Page 73, 2009-10 Undergraduate Catalog Department Requirements ↓ COLLEGE OF BUSINESS Curriculum Committee March 2, 2010 Page 6 of 7 2009-10 #13 Applied/Diversified Study To graduate with a B.S. in accountancy, students are required to complete 12 semester hours of applied or diversified study. This requirement does not preclude an accountancy student from pursuing a formal minor offered by a department outside the College of Business, which can be used to fulfill this requirement. Applied Study Applied study requires 12 semester hours taken in a single department outside the College of Business. Suggested study includes courses offered by departments in the Colleges of Engineering and Engineering Technology, Liberal Arts and Sciences, and Visual and Performing Arts. Diversified Study As an alternative to the applied study of course work taken in a single department, a student may elect diversified study, under which the 12 semester hours are selected in consultation with the department adviser. These courses should be selected so that the student gains opportunities to develop intellectual and analytical skills and/or interpersonal, leadership, and communication skills. Rationale: The accrediting body for the Department of Accountancy (AACSB) no longer requires accountancy majors to take at least 50 percent of total hours for the baccalaureate degree in subjects other than business and economics. As such, the Applied/Diversified Study requirements are deleted to facilitate other changes to the undergraduate Accountancy curriculum. This change brings the Department of Accountancy in line with the College of Business, which has already changed similar college requirements in light of AACSB changes in college-level guidelines. Other catalog change: Page 73, 2009-10 Undergraduate Catalog Major in Accountancy (B.S.) Business Core (45-50) Requirements in Departments (35) (26) ACCY 320 - Intermediate Cost Management (3) ACCY 331 - Financial Reporting I (4) (3) ACCY 360 - Assurance Services (3) ACCY 370 - Accounting Career Planning Seminar (1) ACCY 432 - Financial Reporting II (3) ACCY 450 - Taxation of Business Entities and Individuals (3) ACCY 470 – Accounting Career Skills Seminar (1) One Two of the following (3) (6) ACCY 411 - Advanced Accounting Information Systems (3) ACCY 421 - Advanced Cost Management (3) ACCY 433 - Financial Reporting III (3) ACCY 439 - Contemporary Issues in Financial Accounting (3) ACCY 462 - Internal Auditing (3) ACCY 465 - Forensic Accounting/Fraud Examination (3) ACCY 467 - Auditing of Accounting Information Systems (3) ACCY 480 - Governmental and Not-For-Profit Accounting (3) ACCY 490 - Current Topics in Accountancy (3) COLLEGE OF BUSINESS Curriculum Committee March 2, 2010 Page 7 of 7 2009-10 #13 One of the following (3) ACCY 4111 - Advanced Accounting Information Systems (3) ACCY 4211 - Advanced Cost Management (3) ACCY 4331 - Financial Reporting III (3) ACCY 4391 - Contemporary Issues in Financial Accounting (3) ACCY 4621 - Internal Auditing (3) ACCY 4651 - Forensic Accounting/Fraud Examination (3) ACCY 4671 - Auditing of Accounting Information Systems (3) ACCY 472 - Independent Study in Accountancy (3) ACCY 473 - Internship in Accountancy (3) ACCY 4801 - Governmental and Not-For-Profit Accounting (3) ACCY 4901 - Current Topics in Accountancy (3) ACCY 499H - Honors Directed Research in Accountancy (3) Applied or diversified study (12) Requirements outside Department (6) (15) FINA 410 - Financial Markets and Investments (3) MGMT 346 - Business Communication (3) One 300- or 400-level non-accountancy College of Business course Electives outside of Accountancy excluding FINA 320, MGMT 333, MKTG 310, and OMIS 338, and OMIS 351 (3) (9) Total Hours for a Major in Accountancy: 86-91 1 If not used to fulfill requirement above. Rationale: The undergraduate Accountancy curriculum is revised to improve the program. These revisions close the feedback loop in the Department’s assessment efforts and are corroborated by feedback from Department faculty, students, and the Accountancy Executive Advisory Council. Specifically, the revisions: [1] update the financial reporting courses for changes in professional standards; [2] modify the program to provide students with opportunities to acquire knowledge and skills that are highly valued by employers by (a) adding a senior-level career skills development course, (b) increasing the number of required advanced accountancy courses from two to three, (c) adding a required finance course, and (d) adding new choices to the list of required accountancy courses; and finally, [3] provide students with increased flexibility with respect to electives.