1

advertisement

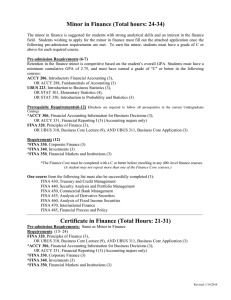

COLLEGE OF BUSINESS Curriculum Committee September 27, 2011 Page 1 of 4 2011-12 #3 Department of Finance New course: Page 61, 2011-12 Graduate Catalog CIP: 52.08 674. FINANCIAL RISK MANAGEMENT I (3). This course provides an introduction to financial risk management including an overview of the purpose and function of financial risk management within varying financial contexts. Topics include the basic types of financial risk management and an understanding of how financial risk management creates value. PRQ: Consent of department. CRQ: FINA 575. Rationale: Over the last several years we have witnessed seismic shifts in the finance industry. Years of ever increasing asset prices and greater and greater risk-taking supported by the engineering of ever more complex financial derivatives have given way to plunging asset values and unprecedented timidity and trepidation. Thoughtful investors and decision makers have always been mindful of the need to assess and address the risks associated with their actions and positions, but in the aftermath of the (continuing?) financial crisis, business entities of all types are increasingly emphasizing and analyzing the financial risks to which they are exposed. This course could provide additional training in risk management for those in the MBA program and potentially other Master’s level programs. Duplication Note: We have reviewed the graduate catalogs and have found two courses with similar wording to the course we are proposing. PSPA 653, “Intermediate Public and Nonprofit Financial Management,” lists financial risk management as a topic. We contacted Kurt Thurmaier, Director of the Division of Public Administration, via email on 9/28/2011. He replied on 9/29/2011 indicating the Division of Public Administration saw no duplication between PSPA 653 and the proposed FINA 674. TECH 638, “Risk Management,” addresses risk management in an occupational safety context. We contacted Cliff Mirman, Chair of the Department of Engineering Technology, via email on 9/28/2011. He replied on 10/6/2011 indicating the Department of Technology saw no duplication between TECH 638 and the proposed FINA 674. New course: Page 61, 2011-12 Graduate Catalog CIP: 52.08 688. FINANCIAL RISK MANAGEMENT II (3). This course provides an in-depth examination of advanced financial risk management issues including operational risk, risk adjusted returns, and the effects of banking and other financial regulation. PRQ: FINA 674 or consent of department. Rationale: While the proposed course “FINA 674: Financial Risk Management I” introduces the concept of the financial risk manager and the manner in which financial risk management is a value-added activity, FINA 688 delves deeper into the subject, examining specific, advanced, financial risk management criteria, and regulations related to risk management. This course could provide additional training in risk management for those in the MBA program and potentially other Master’s level programs. Duplication Note: We have reviewed the graduate catalogs and have found two courses with similar wording to the course we are proposing. PSPA 653, “Intermediate Public and Nonprofit Financial Management,” lists financial risk management as a topic. We contacted Kurt Thurmaier, Director of the Division of Public Administration, via COLLEGE OF BUSINESS Curriculum Committee September 27, 2011 Page 2 of 4 2011-12 #3 email on 9/28/2011. He replied on 9/29/2011 indicating the Division of Public Administration saw no duplication between PSPA 653 and the proposed FINA 674. TECH 638, “Risk Management,” addresses risk management in an occupational safety context. We contacted Cliff Mirman, Chair of the Department of Engineering Technology, via email on 9/28/2011. He replied on 10/6/2011 indicating the Department of Technology saw no duplication between TECH 638 and the proposed FINA 688. Other catalog change: Page 60, 2011-12 Graduate Catalog Department of Finance (FINA) Chair: Marc W. Simpson Graduate Faculty ↓ Master of Science in Financial Risk Management The MS in financial risk management program provides advanced study to prepare students for careers in risk management in banks, investment firms, and in corporate treasury departments. The program is designed for full-time students. It focuses on the latest advances in hedging and risk mitigation techniques incorporating the use of complex financial instruments, including swaps, futures, forwards, and options. Admission In addition to the College of Business standards listed under “Graduate Study in Business,” an applicant is required to have a baccalaureate degree from an accredited institution with at least 15 semester hours in finance or department approval. Phase One See Phase One Requirements listed under “Graduate Study in Business.” AND The Phase One foundation courses will be included in a student’s program of study unless she or he has earned a C or better in corresponding undergraduate courses or a B or better in equivalent graduate courses elsewhere, or has passed the first and only attempt of the Phase One exemption examination. In addition, those students who do not have 15 undergraduate semester hours in finance must complete FINA 607, FINA 620 and FINA 650 (or their equivalent) with a grade of B or better in each course. Requirements FINA 555 - Analysis of Derivative Securities FINA 560 - Financial Markets and Investments FINA 575 - Financial Data Analysis COLLEGE OF BUSINESS Curriculum Committee September 27, 2011 Page 3 of 4 2011-12 #3 FINA 603 - Seminar in Financial Research FINA 622 - Security Analysis FINA 623 - Investment Management FINA 630 - Analysis of Fixed Income Securities FINA 662 - Financial Management Strategies FINA 674 – Financial Risk Management I FINA 688 – Financial Risk Management II ↓ Course List (FINA) ↓ Rationale: Over the last several years we have witnessed seismic shifts in the finance industry. Years of ever increasing asset prices and greater and greater risk-taking supported by the engineering of ever more complex financial derivatives have given way to plunging asset values and unprecedented timidity and trepidation. Thoughtful investors and decision makers have always been mindful of the need to assess and address the risks associated with their actions and positions, but in the aftermath of the (continuing?) financial crisis, business entities of all types are increasingly emphasizing and analyzing the financial risks to which they are exposed. NIU Department of Finance Board of Executive Advisors Identifies Shift towards Hiring graduates trained in Risk Management Discussions with financial executives from banking, corporate treasury, and investments (many of whom serve on the NIU Department of Finance Board of Executive Advisors) have shown that while the level of hiring for entry level finance positions has been increasing in recent years, there has also been a shift in emphasis in terms of the types of positions firms are trying to fill, with many more firms specifically seeking candidates with training in financial risk management. “Financial risk management is the process by which financial risks are identified, assessed, measured, and managed in order to create economic value,” (Jorion, 2011). Growth in Risk Management Certification: increasing demand for focused professionals The MS in FRM program would prepare students for careers in risk management by providing them an in-depth understanding of the latest risk management techniques and a grounding in the use of sophisticated hedging instruments and financial derivatives, including swaps, futures, and options. In addition, students who successfully complete the curriculum will be fully prepared to take and pass the exams leading to the professional certification known as the Financial Risk Manager (or FRM). The FRM designation is recognized, globally, as the premier certification for those in the Financial Risk Management Profession. There are over 26,000 professionals who hold the FRM designation, many of whom work in the top banking and financial institutions in the United States. The program for receiving the designation is considered rigorous and pass rates, over the last three years, for the two required exams range from only 39% to 53%. We fully expect that a graduating MS FRM student would not only have the MS degree, but would also be well prepared to acquire the FRM designation. Bureau of Labor Statistics Highlights Forecasts Growth in Demand for Risk Management Positions that involve financial risk management, profiled in the Occupation Outlook Handbook, 2010-2011 edition (OOH), published by the Bureau of Labor Statistics (BLS), include financial managers and financial analysts. The entries note the following in regard to risk management. COLLEGE OF BUSINESS Curriculum Committee September 27, 2011 Page 4 of 4 2011-12 #3 The OOH entry for Financial Analysts notes, “Risk analysts evaluate the risk of portfolio decisions, project potential losses, and determine how to limit potential losses and volatility using diversification, currency futures, derivatives, short selling, and other investment decisions.” It goes on to note, “Many positions require master’s degrees in finance… Positions may also require professional licenses and certifications.” Further, “…a master’s degree in finance is often required. Advanced courses or knowledge of option pricing, bond valuation, and risk management are important.” The OOH further notes that for financial analysts, “certifications enhance professional standing and are recommended by employers. Certifications are becoming increasingly common.” And more specifically, “Additional certifications are helpful for financial analysts who specialize in specific areas, such as risk management.” Finally, the OOH entry for financial analysts goes on to note, “overall employment of financial analysts is expected to increase by 20 percent during the 2008-2018 decade, which is much faster than the average for all occupations…Certifications and graduate degrees…significantly improve an applicant’s prospects.” The OOH entry for Financial Managers echoes that for Financial Analysts, and notes the following, “Many [financial managers] have a master’s degree or professional certification…many employers now seek graduates with a master’s degree, preferably in business administration, finance, or economics. These academic programs develop analytical skills and teach financial analysis methods and technology… Financial managers may broaden their skills and exhibit their competency by attaining professional certifications… [financial mangers] must cope with the growing complexity of global trade, changes in Federal and state laws and regulations, and the proliferation of new and complex financial instruments.” With regard to employment prospects, the OOH entry for financial managers notes the following, “Employment growth for financial managers is expected to be as fast as the average for all occupations. However, applicants will likely face keen competition for jobs. Those with a master’s degree and certification will have the best opportunities (emphasis added).” Furthermore, “employment of risk managers, who assess risk for insurance and investment purposes, also will grow.” And, “candidates with expertise in accounting and finance—particularly those with a master’s degree and certification—should enjoy the best job prospects. An understanding of international finance, derivatives, and complex financial instruments is important (emphasis added).” Thus, a master’s program focused on financial risk management that entails a deep grounding in the latest hedging techniques and an understanding of the increasingly complex financial instruments used in risk mitigation, which also prepares students for a professional certification as a Financial Risk Manager, would seem to best position our students for those jobs for which there is the greatest demand in the financial sector.