COLLEGE OF BUSINESS Curriculum Committee September 27, 2011 2:00 p.m.

Present

COLLEGE OF BUSINESS

Curriculum Committee

September 27, 2011

2:00 p.m.

2011-12 #3

E. Towell (chair), L. Matuszewski, J. Johnson, J. Burton, V. Krishnan, J. Marchewka, J.

Bruce, L. O’Connell, A. Buhrow, L. Marcellus, M. Salmon, P. Zerull

S. Marsh, D. Rau, B. Sharp, M. Simpson, L. Zhou Guests

Action on Minutes

BS Bus Admin

Finance Tool Kit

The minutes of the Second Meeting, dated September 13, 2011, were approved as presented.

It was announced the BS in Business Administration major will be housed in the

Department of Management beginning January 2012.

J. Johnson presented the Finance Tool Kit he created which will be accessible to all students and faculty. The study guide will refamiliarize students with financial statements, financial analysis, financing, and break-even analysis—topics which are presented initially in UBUS 310.

Two new graduate finance courses were approved with revisions: FINA 674 and FINA

688. (See pages 1-2 of 4)

Finance New Course

Proposals

MS in Financial Risk

Management

Adjournment

M. Simpson discussed a revised proposal for the new degree program MS in Financial

Risk Management which would include the two new finance courses as part of the degree requirements. After discussion, the committee approved the proposal as revised.

(See pages 2-4 of 4)

The meeting adjourned at 3:04 p.m.

Minutes approved: ______________________

_______________________________________

James Burton, Assistant Faculty Chair/Secretary

JB:cw

Copies to: Vice Provost; Committee on the Undergraduate Curriculum; Director of Admissions; Graduate Council

Curriculum Committee; University Publications; Career Services; Student Affairs; University Archives; College

Curriculum Committees; Student Association; Registration/Scheduling; College of Business Faculty

9/27/2011

NORTHERN ILLINOIS UNIVERSITY

Office of the Provost

REQUEST FOR APPROVAL OF A NEW DEGREE PROGRAM

†

1. Responsible department or administrative unit: The Department of Finance

2. Date of provost’s approval of degree request:

3. Level of degree program:

_____ Baccalaureate

___X_ Master’s

_____ Doctoral

_____ Ph.D.

_____ Ed.D.

4. Title of degree program: Masters of Science in Financial Risk Management (MS in FRM)

5. Rationale for program development:

Economy-wide Push for Enhanced Risk Management at the Firm Level

Over the last several years we have witnessed seismic shifts in the finance industry. Years of ever increasing asset prices and greater and greater risk-taking supported by the engineering of ever more complex financial derivatives have given way to plunging asset values and unprecedented timidity and trepidation. Thoughtful investors and decision makers have always been mindful of the need to assess and address the risks associated with their actions and positions, but in the aftermath of the (continuing?) financial crisis, business entities of all types are increasingly emphasizing and analyzing the financial risks to which they are exposed.

Pressures to enhance Risk Management at the firm level arise from multiple sources. Financial price volatility has increased over time, leading many to believe we have experienced a permanent upward shift in the risk associated with this volatility. At the same time, expectations of Boards of Directors have increased with respect to their risk management responsibilities.

Boards must understand firm risks, put risk management policies in place, assure that competent personnel are put in charge of effecting compliance with these risk management policies, and follow up and evaluate the risk management team’s performance. Executives and Boards are increasingly being considered culpable when there is a break down in risk management.

Governmental and industry regulators are increasingly emphasizing the need for risk management at the firm level in an effort to reduce system-wide catastrophes. Bond rating agencies are beginning to directly examine the firm’s risk management activities as part of the bond rating process. The current environment in which firms are exposed to numerous risks, and in which regulators and investors are increasingly interested in a firm’s risk management

policies, appears to be stabilizing as the “new normal,” leading to a concerted effort to find competent professionals trained in risk management.

NIU Department of Finance Board of Executive Advisors Identifies Shift towards Hiring graduates trained in Risk Management

Discussions with financial executives from banking, corporate treasury, and investments (many of whom serve on the NIU Department of Finance Board of Executive Advisors) have shown that while the level of hiring for entry level finance positions has been increasing in recent years, there has also been a shift in emphasis in terms of the types of positions firms are trying to fill, with many more firms specifically seeking candidates with training in financial risk management.

“Financial risk management is the process by which financial risks are identified, assessed, measured, and managed in order to create economic value,” (Jorion, 2011).

Growth in Risk Management Certification: increasing demand for focused professionals

The MS in FRM program would prepare students for careers in risk management by providing them an in-depth understanding of the latest risk management techniques and a grounding in the use of sophisticated hedging instruments and financial derivatives, including swaps, futures, and options. In addition, students who successfully complete the curriculum will be fully prepared to take and pass the exams leading to the professional certification known as the Financial Risk

Manager (or FRM).

The FRM designation is recognized, globally, as the premier certification for those in the

Financial Risk Management Profession. There are over 26,000 professionals who hold the FRM designation, many of whom work in the top banking and financial institutions in the United

States. The program for receiving the designation is considered rigorous and pass rates, over the last three years, for the two required exams range from only 39% to 53%.

We fully expect that a graduating MS FRM student would not only have the MS degree, but would also be well prepared to acquire the FRM designation.

Bureau of Labor Statistics Highlights Forecasts Growth in Demand for Risk Management

Positions that involve financial risk management, profiled in the Occupation Outlook Handbook,

2010-2011 edition (OOH), published by the Bureau of Labor Statistics (BLS), include financial managers and financial analysts. The complete OOH entries for Financial Analysts and

Financial Managers are attached to this request. The entries note the following in regard to risk management.

The OOH entry for Financial Analysts notes, “Risk analysts evaluate the risk of portfolio decisions, project potential losses, and determine how to limit potential losses and volatility using diversification, currency futures, derivatives, short selling, and other investment decisions.” It goes on to note, “Many positions require master’s degrees in finance… Positions

may also require professional licenses and certifications.” Further, “…a master’s degree in finance is often required. Advanced courses or knowledge of option pricing, bond valuation, and risk management are important.” The OOH further notes that for financial analysts,

“certifications enhance professional standing and are recommended by employers. Certifications are becoming increasingly common.” And more specifically, “Additional certifications are helpful for financial analysts who specialize in specific areas, such as risk management.”

Finally, the OOH entry for financial analysts goes on to note, “overall employment of financial analysts is expected to increase by 20 percent during the 2008-2018 decade, which is much faster than the average for all occupations…Certifications and graduate degrees…significantly improve an applicant’s prospects.”

The OOH entry for Financial Managers echoes that for Financial Analysts, and notes the following, “Many [financial managers] have a master’s degree or professional certification…many employers now seek graduates with a master’s degree, preferably in business administration, finance, or economics. These academic programs develop analytical skills and teach financial analysis methods and technology… Financial managers may broaden their skills and exhibit their competency by attaining professional certifications… [financial mangers] must cope with the growing complexity of global trade, changes in Federal and state laws and regulations, and the proliferation of new and complex financial instruments.”

With regard to employment prospects, the OOH entry for financial managers notes the following,

“Employment growth for financial managers is expected to be as fast as the average for all occupations. However, applicants will likely face keen competition for jobs.

Those with a master’s degree and certification will have the best opportunities

(emphasis added).”

Furthermore,

“employment of risk managers, who assess risk for insurance and investment purposes, also will grow.”

And,

“candidates with expertise in accounting and finance— particularly those with a master’s degree and certification —should enjoy the best job prospects. An understanding of international finance, derivatives, and complex financial instruments is important (emphasis added).”

Thus, a master’s program focused on financial risk management that entails a deep grounding in the latest hedging techniques and an understanding of the increasingly complex financial instruments used in risk mitigation, which also prepares students for a professional certification as a Financial Risk Manager, would seem to best position our students for those jobs for which there is the greatest demand in the financial sector.

6. Evidence of student demand for the program (needs analysis):

In the Spring semester of 2011, a survey of 475 Finance Juniors, Seniors, and recent Alumni was conducted. 79 students/alumni or 16.63% responded. The survey measured interest in an MS in

FRM program. The results are summarized as follows:

Question 1: How likely is it that you will pursue a master's degree?

Response

# of respondents

Very Unlikely Unlikely Neutral

1 0 9

Likely Very Likely

33 35

Question 2: If you are thinking about pursing a master's degree, which of the following areas would you find attractive?

Response

# of respondents

MBA

55

MS FRM

65

MAS

20

MIS

6

Question 3: How interested would you be in an MS in Financial Risk Management offered by the

Finance Department at NIU if you could get the degree with just 30 credit hours in addition to your undergraduate degree (30 credit hours would be two regular semesters and one summer semester)?

Response Not Interested at All

1

Not Very

Interested

3

Indifferent

2

Somewhat

Interested

35

Very

Interested

38 # of respondents

Question 4: If you are interested in an MS in Financial Risk Management, please indicate your preferences for the location where the courses would be offered.

DeKalb Campus

Response

# of respondents

Completely

Unacceptable

Location

2

Less

Preferable

Location

10

Indifferent

13

Acceptable

Location

19

Extremely

Desirable

Location

34

Naperville Campus

Response

# of respondents

Completely

Unacceptable

Location

3

Less

Preferable

Location

11

Indifferent

9

Acceptable

Location

31

Extremely

Desirable

Location

24

Question 5: If an MS in Financial Risk Management were available at NIU, please indicate your level of interest given the possible prices for the program listed below.

$18,630

Response Not Interested at All

1

Not Very

Interested

5

Indifferent

8

Somewhat

Interested

32

Very

Interested

33 # of respondents

In summary, 55 to 65 respondents indicated that they would be somewhat interested or very interested in a one-year, MS in FRM program, on the Naperville Campus, costing $18,630 .

7. Proposed date of implementation: Fall 2013

8. Site(s) of program delivery:

_____ On campus

__X__ Off campus in Region(s): Naperville Campus

9. Description of proposed program:

The program will consist of 10, 3-credit hour, courses covering the following topics:

FINA 555: Analysis of Derivative Securities a) Mechanics of OTC and exchange markets b) Forwards, futures, swaps and options

Mechanics

Pricing and factors that affect it

Uses in hedging and hedging strategies

Delivery options c) Interest rates and measures of interest rate sensitivity d) Derivatives on fixed-income securities, interest rates, foreign exchange, and equities e) Commodity derivatives f) Foreign exchange risk g) Corporate bonds

FINA 560: Financial Markets and Investments a) Subprime mortgages and securitization b) Counterparty risk and OTC derivatives c) Credit risk concentration d) Credit derivatives

Types and uses

Mechanics and structure

Valuation e) Structured finance and securitization

The structuring and securitization process

Agency problems and moral hazard in the securitization process

Tranching, subordination, and support f) Default risk

Quantitative methodologies

Loss given default and recovery rates

Estimating defaults and recoveries from market prices and spreads

The use of historical default rates and credit risk migration g) Expected and unexpected losses

FINA 575: Financial Data Analysis a) Discrete and continuous probability distributions of adverse financial outcomes. b) Population and sample statistics c) Statistical inference and hypothesis testing of the financial hazards faced by firms and individuals d) Estimating the parameters of distributions the outcomes of financial events e) Graphical representations of statistical relationships among financial variables f) Linear regressions involving financial variables

FINA 603: Seminar in Financial Research a) The use of Monte Carlo methods for modeling financial events. b) Estimating correlation and volatility (GARCH and other techniques) c) Volatility term structures d) Quantifying volatility in VaR models

FINA 622: Security Analysis a) Portfolio construction b) Portfolio-based performance analysis c) Tests of the Capital Asset Pricing Model (CAPM) d) Portfolio and component VaR e) Risk budgeting f) Risk monitoring and performance measurement g) Hedge funds

Hedge fund strategies

Due diligence and fraud detection

Liquidity

Risk management of hedge funds h) Private equity

FINA 623: Investment Management a) Value-at-Risk (VaR)

Applied to stock, currencies, and commodities

Applied to linear and non-linear derivatives

Applied to fixed income securities with embedded options

Structured Monte Carlo, stress testing, and scenario analysis

Extending VaR to operational risk

Limitations as a risk measure

Coherent risk measures

b) Expected and unexpected losses c) Operational risk d) Stress testing and scenario analysis e) VaR and other risk measures

VaR mapping

Backtesting VaR

Expected shortfall (ES) and other coherent risk measures

Parametric and non-parametric methods of estimation

Modeling dependence: correlations and copulas

Extreme value theory (EVT)

FINA 630: Analysis of Fixed Income Securities a) Fixed income valuation

Discount factors, spot rates, forward rates, and yield to maturity

Arbitrage and the Law of One Price

One factor measures of price sensitivity b) Country and sovereign risk models and management

Fundamental analysis

Contingent claims approach c) External and internal credit ratings d) Fixed Income Securities

Duration, DV01, and convexity

Key rate exposures

Hedging and immunization

Risk neutral pricing

Mortgage-backed securities: structure and valuation

FINA 662: Financial Management Strategies a) Option valuation

Pricing options using binomial trees

The Black-Scholes-Merton Model

The “Greeks” b) Volatility: smiles and term structures c) Exotic options

FINA 674: Financial Risk Management I (to be created) a) The role of financial risk management b) Basic types of financial risk, measurement and management tools c) Creating value with financial risk management d) Modern portfolio theory e) CAPM - Standard and non-standard forms f) Singles and multi-index models and the Arbitrage Pricing Theory g) Risk-adjusted performance measurement h) Enterprise risk management i) Financial disasters and risk management failures j) Ethics in financial risk management

FINA 688: Financial Risk Management II (to be created) a) Calculating and applying risk-adjusted return on capital (RAROC) b) Estimating liquidity risk, sources of model risk c) Evaluating the performance of risk management systems d) Validating VaR models e) Enterprise risk management (ERM) f) Economic capital g) Operational loss data

Frequency and severity distributions

Modeling and fitting distributions

Data sufficiency

Extrapolating beyond the data h) Failure mechanics of dealer banks i) Regulation and the Basel Accords

Minimum capital requirements

Methods for calculating credit, market, and operational risk

Liquidity risk management

Modeling risk aggregation

Stress testing

Revisions to the Basel II Accord

The Basel III framework

10. Learning Outcomes:

Graduates will be able to calculate the value at risk (VaR) in various scenarios.

Graduates will compare derivative markets and the use and pricing of various derivatives.

Graduates will assess various risk mitigation techniques and be able to analyze situations and make recommendations regarding risk mitigation.

Graduates will estimate econometric models and make predictions based on those models.

Graduates will explain regulatory requirements for risk mitigation in various situations.

11: Expected methods for course delivery: Lecture and Seminar

12. Criteria for admission to the program:

In addition to the College of Business standards listed under “Graduate Study in Business,” an applicant is required to have a baccalaureate degree from an accredited institution with at least

15 semester hours in finance or department approval.

Phase One

See Phase One Requirements listed under “Graduate Study in Business.”

AND

The Phase One foundation courses will be included in a student’s program of study unless she or he has earned a C or better in corresponding undergraduate courses or a B or better in equivalent graduate courses elsewhere, or has passed the first and only attempt of the Phase One exemption examination.

In addition, those students who do not have 15 undergraduate semester hours in finance must complete FINA 607, FINA 620 and FINA 650 (or their equivalent) with a grade of B or better in each course.

13. Credit hour requirements to complete degree: 30 credit hours

14. Explain expected credit hours, enrollment, and degree completions within the first three years of implementation:

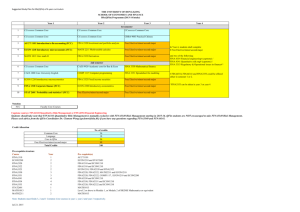

Student Enrollment Projections 1 st Year 2

Number of Program Majors (Fall headcount) 30 nd Year 3 rd Year

30 30

Annual Full-Time-Equivalent Majors

Annual Credit Hours in EXISTING Courses

Annual Credit Hours in NEW Courses

Annual Number of Degrees Awarded

30

720

180

30

30

720

180

30

30

720

180

30

15. Explain the adequacy of existing library and other resources to support program delivery:

Currently resources are adequate; however, should student fees be sufficient, it would be advantageous to enhance current resources with additional databases appropriate for research in the field of financial risk management.

16. Explain staffing needs (current and future) as well as funding and source of funds:

The courses will be staffed by current faculty, teaching on and off load, and new part-time instructors, with all stipends to be funded by the delivery fee.

Resources

Total Requirements

1 st Year 2 nd Year 3 rd

Amount in Dollars

136,000 136,000

Year

136,000

Federal Sources

Other Non-State Sources

Existing State Sources

Internal Reallocation

0,000

104,000

*

22,000

10,000

0,000

104,000

*

22,000

10,000

0,000

104,000

*

22,000

10,000

Expenditures

Faculty

Personal Services/Staff

Equipment and Instructional Needs

Amount in Dollars

88,000 88,000 88,000

22,000 22,000 22,000

10,000 10,000 10,000

Library

Other Support Services

1,000 1,000 1,000

15,000 15,000 15,000

Faculty

Staff

Student/GA

Personnel

2.67

0.50

0.00

FTE

2.67

0.50

0.00

2.67

0.50

0.00

* Funding from student delivery fee. Minimum number of students required to meet this funding requirement at current level of the fee is: 10.80 students.

†

Attach catalog copy including course descriptions

U\Planning\Forms\NewDegreeRequest

Revised September 2009

APPENDIX A : Ad Hoc Board of Executive Advisors for Risk Management

Name

Arpan Patel

Position

Risk Examiner

Organization

Federal Depository Insurance

Corporation (F.D.I.C.)

Credit Risk Associate CME Group Bryan McBlaine

Dan Onak

Daniel Carmody

James O’Brien

Risk Manager

Managing Partner

Harely-Davidson Financial

TreaSolutions, Inc.

Credit Risk Specialist Federal Reserve Bank of

Chicago

James Maitland Citigroup, Inc

Jeff Rodgers

Director of Operations

Risk Management

VP-Services

Operational Risk

Manager for the

Americas

Royal Bank of Scotland

Michael Campagna Treasury Risk Analyst

/ Asset-Liability

Management

Michael Syzmanski Principal Partner

The Northern Trust Company

Location

Chicago, IL

Chicago, IL

Chicago, IL

Chicago, IL

Chicago, IL

New York, NY

Chicago, IL

Chicago, IL

Chicago, IL

Timothy Levandoski VP-Derivatives

Market Business

Development

ValueKnowledge LLC

Eurex (Parent company of the

Swiss and German Stock

Exchanges, in addition to other financial exchanges)

Chicago, IL

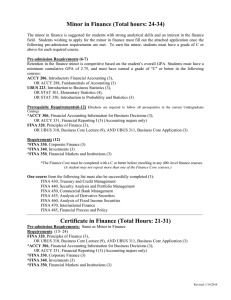

APPENDIX B : Catalog Description of the Program

Master of Science in Financial Risk Management

Department of Finance

The MS FRM program provides advanced study in financial risk management to prepare students for careers in risk management in banks, investment firms, and in corporate treasury departments. The program is designed for fulltime students. The program focuses on the latest advances in hedging and risk mitigation techniques incorporating the use of complex financial instruments, including swaps, futures, forwards, and options.

Admission

In addition to the College of Business standards listed under “Graduate Study in Business,” an applicant is required to have a baccalaureate degree from an accredited institution with at least

15 semester hours in finance or department approval.

Phase One

See Phase One Requirements listed under “Graduate Study in Business.”

AND

The Phase One foundation courses will be included in a student’s program of study unless she or he has earned a C or better in corresponding undergraduate courses or a B or better in equivalent graduate courses elsewhere, or has passed the first and only attempt of the Phase One exemption examination.

In addition, those students who do not have 15 undergraduate semester hours in finance must complete FINA 607, FINA 620 and FINA 650 (or their equivalent) with a grade of B or better in each course.

Requirements

The following courses are required for the MS FRM Degree.

FINA 555: Analysis of Derivative Securities

FINA 560: Financial Markets and Investments

FINA 575: Financial Data Analysis

FINA 603: Seminar in Financial Research

FINA 622: Security Analysis

FINA 623: Investment Management

FINA 630: Analysis of Fixed Income Securities

FINA 662: Financial Management Strategies

FINA 674: Financial Risk Management I

FINA 688: Financial Risk Management II

APPENDIX C : Admission to Graduate Programs in Business

Admission to Graduate Programs in Business

Admission to the various graduate programs in business is competitive and limited to those candidates who can demonstrate high promise of success in a graduate business degree program.

In addition to compliance with the policies of the Graduate School, the College of Business considers several indicators of potential for success in graduate business studies including, but not limited to, the following.

A minimum cumulative GPA of 2.75 (based on a 4.00 system) at the baccalaureate institution, or a minimum cumulative GPA of 2.75 in the last 60 hours of the baccalaureate program, or the completion of 15 or more semester hours of graduate work at an accredited institution with a minimum GPA of 3.20.

The total score and verbal and quantitative percentiles, and where available the analytical writing assessment (AWA) score, on the GMAT standards set by the individual graduate programs in business.

Work experience at the post-baccalaureate level, where applicable.

Leadership and communication skills as documented in a goals statement and resume.

A minimum of two letters of recommendation.

Submission of results on the Test of English as a Foreign Language (TOEFL) for all applicants whose native language is not English.

At the discretion of the respective program directors, candidates may be required to come in for an interview or to submit additional materials deemed important in assessing potential for success in graduate business studies.