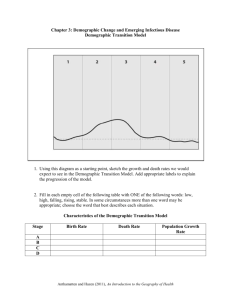

On the Consequences of Demographic Change Distribution of Wealth and Welfare

advertisement