CTICE ESSAYS IN LOCAL

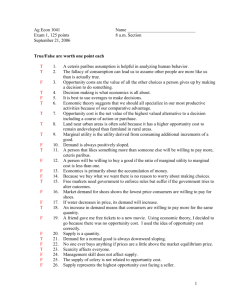

advertisement