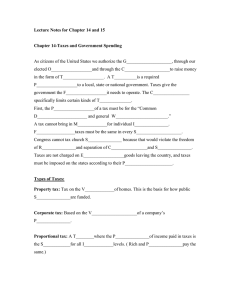

The Government and Fiscal Policy

advertisement

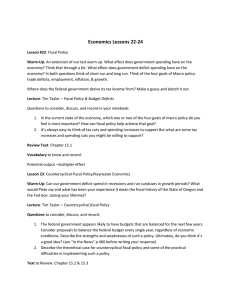

The Government and Fiscal Policy How does the government affect us? Mixed economies = government + private sector What is the best mix??? Private firms more efficient. Can best decide on: What? How? and For Whom? Free markets cannot function properly without gov. enforcement of the rules. Markets sometimes fail and need government intervention. Market systems do not produce equitable distribution of income and wealth. Market systems tend to experience business cycles. Governments need to make decisions on… • how much to spend • what to spend it on • how to finance its expenditure This is called fiscal policy. Budget speech outlines government’s spending plans for the financial year (1 April - 31 March) Excerpt from Budget speech 2014 http://www.enca.com/south-africa/livegordhan-boosts-small-business-helps-poor With regards to the 2014/15 budget… 1. What is the biggest source of tax revenue forecast to be in 2014/15? 2. What is the biggest expense that the government will face in 2014/15? 3. Which 3 taxes have increased? 4. What are 3 aims of the major aims of the government’s 2014/15 budget? Government spending effects… • aggregate production • income • employment • the price level (inflation) • the distribution of income. The government uses the budget to… • stimulate economic growth and employment • redistribute income • control inflation • address balance of payments problems. Expansionary fiscal policies stimulate economic activity • Government spending raised and taxes reduced • Budget deficit will tend to increase. Contractionary fiscal policies restrict economic activity • Government spending reduced and taxes increased • Budget deficit reduced, or surplus budgeted for • Helps curb inflationary pressures Government spending financed by… Income from property • interest and dividend income • Eskom, Telkom and Transnet, sale of agricultural, forestry and fishing products, mining rights Taxation • deficit is financed by borrowing. Borrowing • Domestic/international capital markets & central bank • increases quantity of money - potentially inflationary. Neutrality Should have minimum effect on relative prices – signalling function. Equity Ability to pay principle • pay according to their ability Benefit principle • Pay for benefits derived Administrative simplicity Compliance and administration costs as low as possible. What would your tax policy look like??? http://www.taxpolicy.com/ If you had the ability to introduce a new tax and scrap an existing tax, what would it be and why? Think about… 1. Who would it benefit? 2. Who would pay/save? 3. How would it affect the macroeconomic objectives of a SA? Please research and get definitions for the following… Direct taxes Indirect taxes Progressive taxes Proportional taxes Regressive taxes General taxes Selective taxes Pg 84, 85 in text book The three main taxes in South Africa are… 1. Personal income tax 2. Company tax 3. VAT Most important single source of tax revenue. Taxable income = total income - personal and other allowances. Marginal tax rate: the rate at which each additional rand of income is taxed. Average tax rate: the ratio between the amount of tax paid and taxable income - also called the effective tax rate. Personal Income Tax is a progressive tax. Average tax rate increases as income increases because marginal tax rate increases. Capital gains tax: a tax levied on the gains resulting from the sale of assets such as shares and fixed property. Introduced in 2001 to ensure horizontal equity. Profits are taxed at a uniform rate A proportional tax rate Average tax rate = marginal tax rate. 2nd most valuable source of tax revenue in SA Regressive tax Ratio between tax paid & income greater for low-income than high-income households. Tax burden increases as income decreases Fiscal policy is an instrument used by government to influence the economy. • Discuss in detail the effects of fiscal policy. (26 marks) • To what extent was the South African government successful in the implementation of its fiscal policy? (10 marks)