Document 11278370

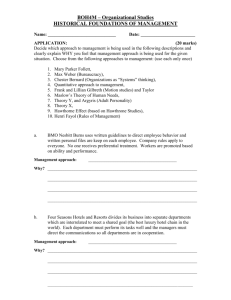

advertisement