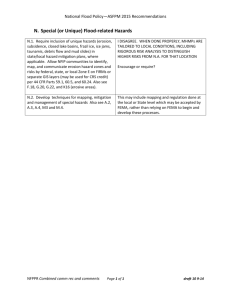

GAO NATIONAL FLOOD INSURANCE PROGRAM

advertisement