DHS FINANCIAL MANAGEMENT Additional Efforts Needed to Resolve

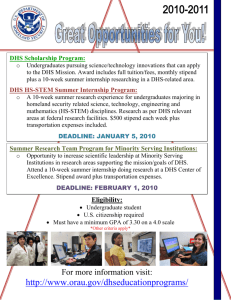

advertisement