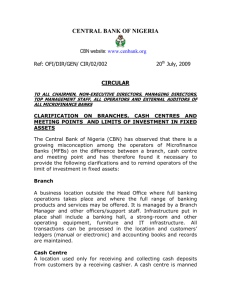

CDC

advertisement