Document 11267106

advertisement

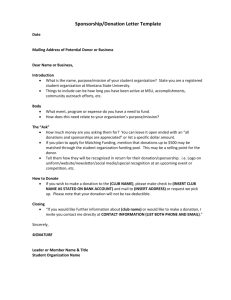

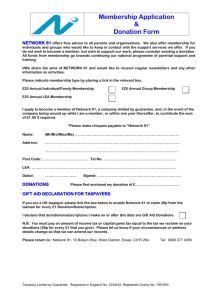

Accounting Transactions (A)Creating New Funds and Organization (B) Changing Financial Manager Expenditure transfers New funds & org Organization Code & Fund Code The College maintains and prepares its financial statements in accordance with Financial Accounting and Reporting Manual (FARM) and Natinoal Association of College and University Business Officers NACUBO. Organization Code Describes/Identifies Fund Code Describes/Identifies Program categories Functional categories Purpose Purpose Revenue/Expenditures Revenue/Expenditures Hierarchy-Chart of accounts Hierarchy-Chart of accounts Division/Department Division/Department Financial Manager/Approvals Financial Manager/Approvals South Texas College Request to Set Up a New Organization ORGANIZATION NAME :_______________________________________ ORG CODE: ______________ EFFECTIVE DATE:___________ (BUSINESS OFFICE USE ONLY) ORGANIZATION PURPOSE:_________________________________________________________________________________________________________ FINANCIAL MANAGER:_______________________________________ JOB TITLE:__________________________________________ DIVISION/DEPARTMENT:______________________________________ TELEPHONE:___________________ E-MAIL:______________ VICE PRESIDENT:_____________________________________________ Purpose: (Please check one) 1005 Agriculture ____ 1015 Bio. Physical Science, & Sci. Tech _____ 1025 Career Pilot_____ 1035 Computer & Information Sciences _____ 1045 Consumer & Homemaking Education _____ 1055 Engineering Related _____ 1065 Foreign Languages _____ 1075 Health Occup-Dental Hygiene _____ 1085 Health Occup-Respiratory Therapy _____ 1095 Mathematics _____ 1105 Mechanics & Repairers-Diesel _____ 1115 Physical Education and Fitness _____ 1125 Psychology, Social Sci. and History _____ 1135 Non-state funded _____ 1150 Instruction – Other _____ 4100 Library _____ 4300 Faculty Development Leave _____ 6100 Govt. of the Institution _____ 6300 Bus & Fiscal Management _____ 6500 Campus Security _____ 6900 Other Institutional Support _____ 7100 Plant Support Services _____ 7300 Custodial Services _____ 7500 Utilities _____ 7700 Physical Plant – Construction _____ 2000 Research _____ 5000 Student Services _____ 9000 Auxiliary Services _____ INSTRUCTION 1010 Arch & Precision Production Trades _____ 1020 Bus. Mgt., Marketing, & Adm. Svcs. _____ 1030 Communications _____ 1040 Construction Trades _____ 1050 Engineering _____ 1060 Eng. Lang. Liter. Phil. & Interdisc _____ 1070 Health Occup-Associate Degree Nurs _____ 1080 Health Occup-Other _____ 1090 Health Occup-Vocational Nursing _____ 1100 Mechanics & Repairers-Automotive _____ 1110 Mechanics & Repairers-Electronics _____ 1120 Protective Svcs and Public Admin _____ 1130 Visual & Performing Arts _____ 1140 Instruction Allocated _____ ACADEMIC SUPPORT 4200 Instructional Administration _____ 4400 Academic Support – Other _____ INSTITUTIONAL SUPPORT 6200 Executive Direction & Contr _____ 6400 Admin Data Processing _____ 6600 Human Resources _____ PHYSICAL PLANT 7200 Building Maintenance _____ 7400 Grounds Maintenance _____ 7600 Physical Plant – Other _____ OTHER 3000 Public Service _____ 8000 Scholarships _____ 9850 Agency Accounts _____ _____________________________________________ _____________________ Requested by (Print Name) Date _____________________________________________ _____________________ Financial Manager (Signature) Date _____________________________________________ _____________________ Vice President (Signature) Date =========================================================================================== Business Office Use Only Fund Code: ______ Fund Type _____ Predecessor Fund Code_______________ Program Code ____________ Processed by Business Office:________________________________________ Business Office 03/2010 BO-4910 Date:_______________ South Texas College ` Request to Set Up a Fund Code Fund Name:____________________________________ *Fund Code:________________ Effective Date:____________ (Business Office Use Only) Fund Purpose:____________________________________________________________________________________________ Financial Manager:__________________________________________ Division/Department:___________________ Telephone:____________________ E-mail:______________________ Vice President:___________________________ Please check one. Restricted Fund: _____ Agency Fund:_____ Investment in Plant Fund:_____ Purpose: Auxiliary Fund:_____ Loan Fund:_____ Unexpended Fund:_____ Renewal and Replacement Fund:_____ Retirement of Indebtedness Fund:_____ 1000 Instruction ______ 2000 Research ______ 3000 Public Service______ 4000 Academic Support_____ 5000 Student Services______ 6000 Institutional Support______ 7000 8000 9000 9994 9995 Operation & Maint – Plant _____ Scholarships ______ Auxiliary Enterprises ______ Non Mandatory Transfers______ Mandatory Transfers_______ Comments:______________________________________________________________________ ______________________________________________________________________________ Contact Person:______________________________ Telephone: _______________ _________________________________________ Requested by (Print Name) __________________________ Date _________________________________________ Fund Financial Manager (Signature) code __________________________ Date _________________________________________ Vice President (Signature) __________________________ Date +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ Business Office Use Only Responsible Person:_______________________________________________ Fund Type:_____ Predecessor Fund:_________ Organization Code:____________ Program Code_______ _________________________________________ _________________________________ Processed by Business Office Date Business Office Rev. 03/2010 BO-4900 Request to Change Financial Managers South Texas College REQUEST TO CHANGE FINANCIAL MANAGERS FUND / ORGANIZATION NAME FUND/ORG CODE PRIOR FINANCIAL MANAGER NEW FINANCIAL MANAGER JUSTIFICATION: ****Information required from New Financial Manager**** Employee ID Number:___________________________________________ Title:__________________________________________________ Division/Department:____________________________________________ Vice President:___________________________________________ Telephone Number:_____________________________________________ E-mail address:___________________________________________ Requested by (Print Name) form Date New Financial Manager (Signature) Date President (Signature) Date Processed by Business Office Date Acceptance of Gifts and Bequests Policy #5910 The Acceptance of Gifts and Bequest Policy was: Enacted on November 9, 1995. Amended on November 19, 1998 A copy is available at the South Texas College website under the Policy Manual on the Office of the President site. http://admin.southtexascollege.edu/president/policies/i ndex.html Policy applies to items of value which may aid in the accomplishment of the mission of the College. Acceptance of Gifts and Bequests Policy #5910 The College may accept gifts and bequests of: land, facilities, items of personal property such as books, equipment, training aids, money, stocks and bonds which may be converted into money, materials, or other items of value which may aid in the accomplishments of the mission of the College. Items received must have a current or foreseeable future use. The operation and maintenance cost for the gifts must be within current budgeted funds. Acceptance of Gifts and Bequests Policy #5910 (continued) The donor of gifts or bequests must specify the use for which the gift or bequest is intended. If the gift or bequest may be used at the discretion of the College for general purposes the donor should so state. Gifts or bequests of personal property such as books, equipment, training aids and livestock with unusual long term restrictions on their future use and ultimate disposition should not be accepted. The validity of donor restrictions will be determined at the lowest level of acceptance authority. Acceptance of Gifts and Bequests Policy #5910 (continued) The President may accept money or negotiable instruments for the establishment of endowment, agency, loan or scholarship funds. A letter of conveyance from the donor must be obtained stating the purpose for which the donation is to be used and in the case of money or negotiable instruments state how the principal and or income from the funds will be used. If unrestricted, it should be so stated. A copy of the donation agreement or letter will be forwarded to and be retained on file by the comptroller. Where money or negotiable instruments are donated, notification of such funds will be forwarded to the comptroller for investments and administration. A permanent reference file of all such agreements and conveyances will be maintained in the designated office. Procedures for Accepting Donations 1. The following forms must be completed by the department accepting the donation(s) : Departmental Accounting Report of Donation Form (BO-1500). Donation Disclosure Statement Form (BO-3900). Acknowledgment Letter (Thank-You letter to donor, prepared by department receiving donation). 2. All forms must be forwarded to the Office of the President. 3. The President will sign Departmental Accounting Report of Donations form (BO-1500) and 4. Acknowledgement letter, and send forms back to the department. Procedures for Accepting Donations (continued) 5. The department receiving donation(s) disclosure statement form (BO-3900). mails out original 6. The Office of the President mails out the acknowledgement letter (thank-you letter) to the donor. 7. The original Report of Donations form (BO-1500) and copies of Disclosure Statement and acknowledgment letter are sent to the business office for recording. 8. Copies are to be maintained by department accepting donation and the Office of the President. Procedures for Tagging A Donated Item 1. The Business Office receives the Report of Donations Form (BO1500) signed by both the Financial Manager and President, along with backup documentation of the donated item. 2. Once the donation is reviewed and recorded in Banner, the Business Office will submit a copy of the signed form (BO1500) with backup to Shipping and Receiving. 3. Shipping and Receiving will then schedule accordingly to tag the donated item. Note: All capital items (value over $5,000 will be tagged by Shipping & Receiving. • • • • Examples of Donated Items Tagged: Furniture Computers & Computer Equipment Artwork Vehicles & Related Equipment Donation Forms The two donation forms (BO-1500, BO-3900) are located in the business office website under business office forms: BO-1500 - Departmental Accounting Report of Donations http://finance.southtexascollege.edu/businessoffice/forms/bo1500.xls BO-3900 - Donation Disclosure Statement http://finance.southtexascollege.edu/businessoffice/forms/bo3900.doc Form BO-1500 Departmental Accounting Report of Donations Form BO-3900 Donation Disclosure Statement L T e h Y t a o t n u e k r End of Year Request Please submit completed documentation no later than Friday, September 18, 2015. Contacts Alma Church, Accounting Group Manager Email: Phone: (956) 872-4616 Anabel Garza, Accounting Assistant Email: Phone: (956) 872-4662 Donations to Student Organizations Any type of Donations to Student Organizations (SO) need to contact the Student Activities Department for guidance. The disclosure of the College’s Federal Identification Number (FID) is limited to the College’s mission. Student Organizations are recognized as an Agency Fund. With the assistance and approval of the Student Activities Department, the SO may acquire a FID by contacting the State Comptroller’s Office and the Internal Revenue Service (IRS) to acquire an exempt status. Questions?